The Honda Accord combines reliability, fuel efficiency, and advanced safety features, making it a top choice for drivers seeking a dependable sedan. Its sleek design and modern technology enhance both comfort and driving experience, appealing to a wide range of buyers. Explore the rest of the article to discover why the Accord stands out as your next vehicle.

Table of Comparison

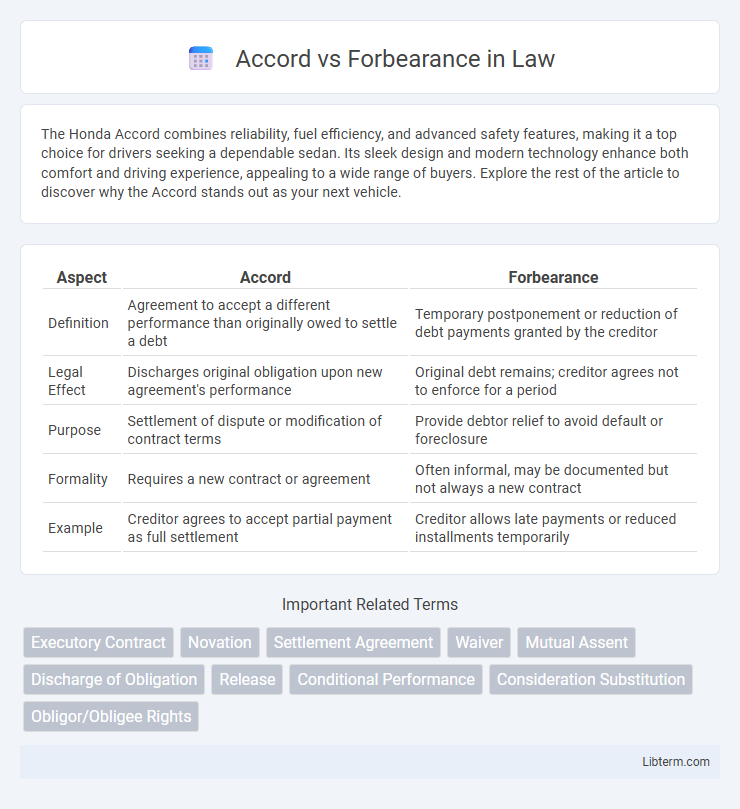

| Aspect | Accord | Forbearance |

|---|---|---|

| Definition | Agreement to accept a different performance than originally owed to settle a debt | Temporary postponement or reduction of debt payments granted by the creditor |

| Legal Effect | Discharges original obligation upon new agreement's performance | Original debt remains; creditor agrees not to enforce for a period |

| Purpose | Settlement of dispute or modification of contract terms | Provide debtor relief to avoid default or foreclosure |

| Formality | Requires a new contract or agreement | Often informal, may be documented but not always a new contract |

| Example | Creditor agrees to accept partial payment as full settlement | Creditor allows late payments or reduced installments temporarily |

Understanding Accord: Definition and Key Concepts

Accord refers to a legally binding agreement where one party agrees to accept a different performance than originally owed, often to settle a debt or dispute. It involves an offer, acceptance, and consideration, ensuring the new terms replace the prior obligation. Understanding accord is crucial in contract law as it signifies the resolution of obligations through mutual consent and modified duties.

What is Forbearance? Meaning and Essentials

Forbearance is a legally binding agreement in which a lender temporarily reduces or pauses a borrower's loan payments to avoid foreclosure, allowing time for financial recovery. Essential elements of forbearance include a clear agreement on the payment suspension or reduction period, specific repayment terms after the forbearance ends, and mutual consent between lender and borrower. This arrangement differs from an accord, which settles a debt dispute by substituting the original obligation with a new agreement.

Legal Basis: Accord vs Forbearance

Accord and forbearance are distinct legal concepts in contract law, where an accord involves a new agreement to discharge an existing obligation by substituting it with different terms, while forbearance refers to the creditor's voluntary agreement to temporarily refrain from enforcing a right or claim. The legal basis of accord centers on mutual consent to alter contractual obligations, thereby creating a binding new contract that extinguishes the original debt upon performance. Forbearance relies on the creditor's toleration of delay or non-performance without waiving the underlying right, often serving as consideration for a subsequent agreement or as a means to prevent breach or litigation.

Primary Differences Between Accord and Forbearance

Accord involves an agreement to accept a different performance than originally owed, effectively substituting the contract, while forbearance entails a promise to delay or refrain from enforcing a legal right or claim, without altering the original obligation. In an accord, the performance is substituted and discharges the original duty upon satisfaction, whereas forbearance does not discharge the debt but suspends the creditor's right to demand payment temporarily. The key difference lies in accord creating a new contract with a substituted obligation, while forbearance merely delays enforcement of the existing contract terms.

Practical Examples of Accord in Contracts

Accord in contracts occurs when parties agree to accept different performance than originally specified, such as settling a debt with partial payment or modifying delivery terms to resolve disputes. Practical examples include a creditor accepting a lower payment amount to discharge a debt or a contractor agreeing to complete additional work instead of demanding full contract price due to unforeseen delays. These agreements legally substitute original obligations, preventing breaches and costly litigation by providing mutually acceptable resolutions.

Real-world Scenarios Involving Forbearance

Forbearance agreements commonly arise in real-world scenarios where borrowers face temporary financial hardships, allowing them to pause or reduce loan payments without triggering default consequences. Unlike an accord, which is a compromise to settle a debt for less than owed, forbearance preserves the original loan terms while providing relief during crises such as job loss, medical emergencies, or economic downturns. Mortgage lenders often use forbearance as a strategic option to avoid foreclosure, facilitating recovery without immediate liquidation.

Impact on Debt Settlement: Accord vs Forbearance

Accord involves a formal agreement to settle a debt for less than the owed amount, significantly reducing the debtor's financial obligation and often leading to a quicker resolution. Forbearance temporarily suspends or reduces debt payments without forgiving the principal, providing short-term relief but maintaining the original debt terms. The impact on debt settlement differs as accord results in partial debt forgiveness, while forbearance merely defers payment without reducing the total amount owed.

Pros and Cons of Accord Arrangements

Accord arrangements provide a formal agreement where the debtor agrees to a new performance obligation, often reducing the original debt, which can expedite dispute resolution and avoid lengthy litigation. However, the debtor risks uncertain future obligations, and the creditor may receive less than the owed amount, potentially impacting financial recovery. These agreements offer flexibility but require clear terms to prevent misunderstandings and ensure enforceability.

Advantages and Disadvantages of Forbearance

Forbearance allows borrowers temporary relief by postponing or reducing loan payments, helping to avoid foreclosure and maintain credit standing during financial hardships. However, forbearance may increase the total loan cost due to accrued interest and can extend the repayment period, potentially leading to larger payments after the forbearance ends. This option provides flexibility but might impact credit scores if not managed properly, unlike an accord which typically involves a negotiated agreement to settle a debt for less than owed, often with more immediate credit implications.

Choosing Between Accord and Forbearance: Which is Right for You?

Choosing between accord and forbearance depends on your financial goals and the nature of the debt dispute. Accord involves creating a new agreement to settle a debt for less than owed, providing a clear resolution and updated terms, while forbearance temporarily pauses or reduces payments without altering the original agreement, ideal for short-term relief. Assess your ability to repay, the lender's flexibility, and long-term impact on credit before deciding the best option for debt management.

Accord Infographic

libterm.com

libterm.com