Distribution in stock refers to the payment of dividends to shareholders, representing a portion of a company's earnings returned as income. Understanding how distribution works can help you evaluate the sustainability and attractiveness of your investments. Explore the rest of the article to learn how distribution impacts stock value and shareholder wealth.

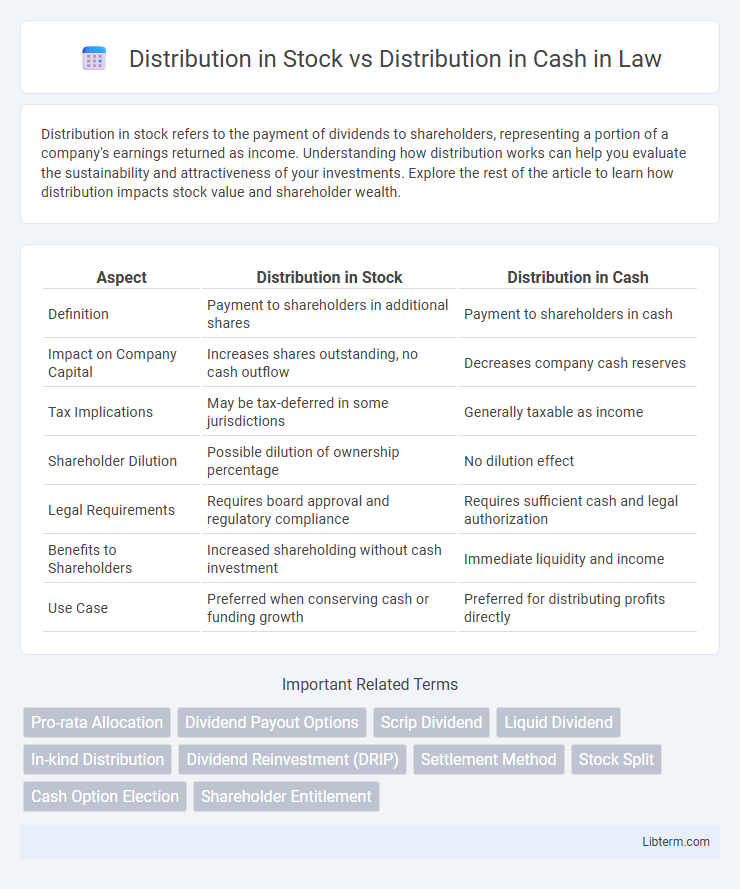

Table of Comparison

| Aspect | Distribution in Stock | Distribution in Cash |

|---|---|---|

| Definition | Payment to shareholders in additional shares | Payment to shareholders in cash |

| Impact on Company Capital | Increases shares outstanding, no cash outflow | Decreases company cash reserves |

| Tax Implications | May be tax-deferred in some jurisdictions | Generally taxable as income |

| Shareholder Dilution | Possible dilution of ownership percentage | No dilution effect |

| Legal Requirements | Requires board approval and regulatory compliance | Requires sufficient cash and legal authorization |

| Benefits to Shareholders | Increased shareholding without cash investment | Immediate liquidity and income |

| Use Case | Preferred when conserving cash or funding growth | Preferred for distributing profits directly |

Understanding Distribution in Stock

Distribution in stock involves a company issuing additional shares to existing shareholders instead of paying cash dividends, allowing investors to increase their equity stake without immediate tax consequences. This form of distribution can signal a company's intent to conserve cash while rewarding shareholders, often impacting stock liquidity and market perception. Understanding stock distributions requires examining the shares' impact on ownership percentage, market value, and potential dilution effects compared to traditional cash distributions.

What is Distribution in Cash?

Distribution in cash refers to the payment made by a corporation to its shareholders in the form of cash, representing a portion of the company's earnings or profits. This cash payout can come as dividends, return of capital, or proceeds from the liquidation of assets, providing shareholders with immediate liquidity. Unlike stock distributions, which issue additional shares, cash distributions reduce the company's retained earnings and directly impact shareholder wealth by increasing their cash holdings.

Key Differences Between Stock and Cash Distributions

Stock distributions increase the number of shares held by investors, diluting the share price without impacting company cash reserves, while cash distributions provide direct income to shareholders by reducing company cash assets. Stock distributions do not incur immediate tax liabilities for shareholders, whereas cash distributions are generally taxable as income upon receipt. The choice between stock and cash distributions depends on company liquidity, shareholder preference for income versus capital growth, and strategic financial management.

Advantages of Receiving Distributions in Stock

Receiving distributions in stock allows investors to increase their shareholding without incurring immediate tax liabilities, offering potential for long-term capital appreciation. Stock distributions help maintain cash flow flexibility, enabling shareholders to reinvest dividends automatically, thereby compounding growth over time. This method also reduces cash outflow for companies, preserving liquidity and supporting continued business expansion.

Pros and Cons of Cash Distributions

Cash distributions provide immediate liquidity to investors, allowing for flexible reinvestment or personal use without market risk. However, they can trigger taxable events regardless of whether shares are sold, potentially leading to unintended tax liabilities. Unlike stock distributions, cash payouts reduce the company's available capital, which may limit growth opportunities over time.

Tax Implications: Stock vs Cash Distributions

Distribution in stock allows shareholders to receive additional shares, which are generally not taxable until sold, deferring capital gains tax. Cash distributions are typically taxed as ordinary income or dividends in the year received, leading to immediate tax liability for investors. Choosing stock distributions can offer tax deferral advantages, while cash distributions provide immediate income but increased current tax obligations.

Impact on Shareholder Value and Ownership

Distribution in stock increases the total number of shares outstanding, potentially diluting existing shareholders' ownership percentage but preserving company cash reserves for growth or debt repayment. Distribution in cash directly reduces company liquidity but provides immediate tangible value to shareholders, often reflecting strong financial health and potentially increasing investor confidence. The choice between stock and cash distributions directly influences shareholder value by balancing dilution risk against cash flow benefits and signaling corporate financial strategy.

Company Perspective: Why Choose Stock or Cash Distributions?

Companies choose stock distributions to conserve cash flow and reinvest earnings into business growth, preserving liquidity for operational needs or debt reduction. Cash distributions attract investors seeking immediate income and provide a straightforward reward without diluting shareholder value. The decision hinges on balancing shareholder preferences, company financial health, and strategic growth objectives.

Investor Considerations: Which Distribution is Better?

Investors often weigh the benefits of stock distributions against cash distributions based on their financial goals and tax implications; stock distributions allow for potential capital appreciation without immediate tax liability, while cash distributions provide instant liquidity and income. The choice depends on individual preferences for reinvestment opportunities and current income needs, as stock dividends increase share ownership whereas cash dividends contribute directly to personal cash flow. Understanding the company's dividend policy, market conditions, and personal tax situation is essential for determining which distribution aligns better with investment strategies.

Real-World Examples of Stock and Cash Distributions

Stock distributions, such as Apple's 2020 stock split, increase shares outstanding without changing total shareholder equity, providing investors with additional shares at no immediate tax cost. Cash distributions, exemplified by Microsoft's quarterly dividends, involve direct payments to shareholders, typically taxed as income, which offer immediate income but reduce the company's cash reserves. Companies like Coca-Cola balance both methods by issuing dividends for steady income and occasional stock dividends to reward long-term investors without depleting cash.

Distribution in Stock Infographic

libterm.com

libterm.com