Understanding reimbursement processes is crucial for managing healthcare expenses and ensuring timely payments from insurance providers. Accurate documentation and adherence to policy guidelines can streamline your claims, avoiding delays and denials. Dive into the rest of the article to learn effective strategies for maximizing reimbursement success.

Table of Comparison

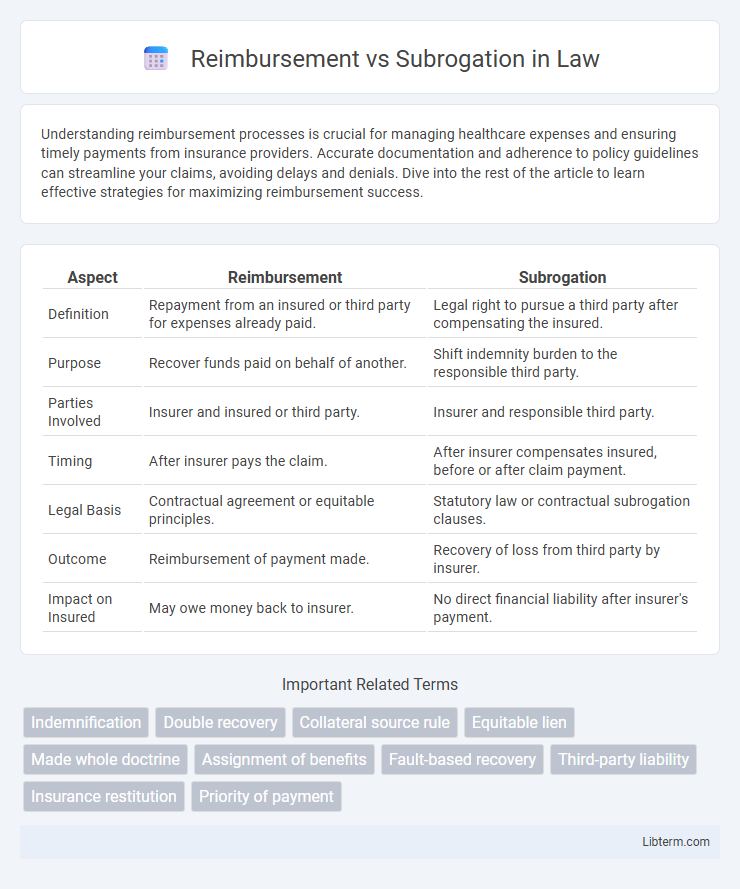

| Aspect | Reimbursement | Subrogation |

|---|---|---|

| Definition | Repayment from an insured or third party for expenses already paid. | Legal right to pursue a third party after compensating the insured. |

| Purpose | Recover funds paid on behalf of another. | Shift indemnity burden to the responsible third party. |

| Parties Involved | Insurer and insured or third party. | Insurer and responsible third party. |

| Timing | After insurer pays the claim. | After insurer compensates insured, before or after claim payment. |

| Legal Basis | Contractual agreement or equitable principles. | Statutory law or contractual subrogation clauses. |

| Outcome | Reimbursement of payment made. | Recovery of loss from third party by insurer. |

| Impact on Insured | May owe money back to insurer. | No direct financial liability after insurer's payment. |

Understanding Reimbursement and Subrogation

Reimbursement and subrogation are distinct legal concepts in claims and insurance management. Reimbursement refers to the recovery of expenses paid for a loss or service from the responsible party, while subrogation involves an insurer stepping into the insured's shoes to pursue a third party for compensation. Both processes ensure that the party ultimately responsible for the loss bears the financial burden, optimizing claims resolution and cost recovery.

Definitions: What is Reimbursement? What is Subrogation?

Reimbursement is the process by which an insured party is compensated for expenses or losses initially paid out-of-pocket, usually by their insurer after a claim. Subrogation occurs when an insurance company seeks to recover the amount it has paid to the insured by pursuing a third party responsible for the loss. Both reimbursement and subrogation involve payment recovery but differ in who initiates the recovery and the legal rights transferred.

Key Differences Between Reimbursement and Subrogation

Reimbursement involves compensation paid directly to an individual or entity that initially covered a loss, while subrogation allows an insurer to assume the insured's rights to recover costs from a third party responsible for the loss. The key difference lies in reimbursement being a repayment process between parties involved, whereas subrogation is a legal mechanism enabling insurers to pursue recovery from liable third parties. Understanding these distinctions is crucial for accurately managing claims and financial responsibilities in insurance and legal contexts.

Legal Framework Governing Both Concepts

Reimbursement and subrogation operate within distinct legal frameworks centered on indemnity and the transfer of rights, respectively. Reimbursement allows an insured party to recover costs from a liable third party after compensation from an insurer, governed by contract law and insurance statutes. Subrogation enables the insurer to step into the insured's shoes to pursue third parties for losses, relying on equitable principles and statutory provisions to prevent unjust enrichment.

Common Scenarios Involving Reimbursement

Common scenarios involving reimbursement include medical expenses paid by an insurance company on behalf of an insured individual, where the insurer seeks repayment from a liable third party. Auto insurance claims often involve reimbursement when insurers pay for vehicle damages and then recover costs from at-fault drivers. Workers' compensation cases regularly feature reimbursement as employers or insurers seek to recoup expenses from parties responsible for employee injuries.

Typical Cases Where Subrogation Applies

Subrogation typically applies in insurance claims where the insurer seeks to recover costs paid to the insured from a third party responsible for the loss, such as in auto accidents, property damage, or medical malpractice cases. It allows the insurer to step into the insured's shoes to pursue compensation, preventing the insured from receiving double reimbursement. Common scenarios include vehicle collisions caused by another driver, property damage due to negligence, and workers' compensation claims involving a third party's liability.

Impact on Insurance Policyholders

Reimbursement and subrogation significantly influence insurance policyholders by determining how claims are resolved and costs recovered. Reimbursement requires the insured to repay the insurer for claims paid when a third party is responsible, while subrogation allows the insurer to pursue recovery directly from that third party. Understanding these processes helps policyholders anticipate potential financial obligations and impacts on premiums.

Rights and Obligations: Insurer vs. Insured

Reimbursement grants the insurer the right to recover payments made to the insured for covered losses, establishing an obligation for the insured to repay the insurer when a third party is responsible. Subrogation transfers the insured's legal rights to pursue recovery from third parties to the insurer, obligating the insurer to pursue those rights on behalf of the insured. Both mechanisms protect the insurer's financial interests while balancing the insured's obligation to cooperate in recovery efforts and prevent double recovery.

Real-World Examples of Reimbursement and Subrogation

Reimbursement occurs when an insured party recovers costs directly from the insurance company after paying for a loss, such as a homeowner paying for repairs and then seeking repayment from their insurer. Subrogation involves the insurance company stepping into the insured's shoes to pursue recovery from a third party responsible for the loss, like a car insurer suing a negligent driver who caused an accident. Real-world examples include health insurance companies reimbursing patients for medical bills and property insurers subrogating against contractors responsible for faulty work.

Choosing the Best Approach: Reimbursement or Subrogation

Choosing the best approach between reimbursement and subrogation depends on factors such as the extent of recovery goals, legal rights, and the complexity of the claim. Reimbursement allows insurers to recover costs directly from the insured or third parties without pursuing legal action, making it faster and less adversarial. Subrogation involves stepping into the insured's shoes to initiate legal claims against responsible third parties, potentially resulting in higher recoveries but requiring more time and resources.

Reimbursement Infographic

libterm.com

libterm.com