Distinguishing between similar concepts or items requires careful attention to specific characteristics and context. Recognizing subtle differences enhances your understanding and ensures accurate communication or decision-making. Explore the rest of the article to master the art of distinguishing effectively.

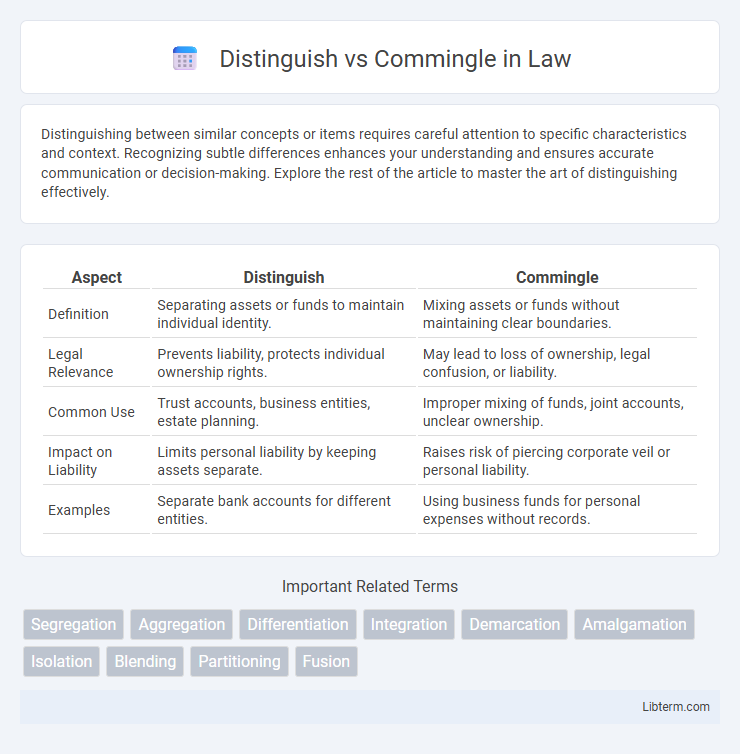

Table of Comparison

| Aspect | Distinguish | Commingle |

|---|---|---|

| Definition | Separating assets or funds to maintain individual identity. | Mixing assets or funds without maintaining clear boundaries. |

| Legal Relevance | Prevents liability, protects individual ownership rights. | May lead to loss of ownership, legal confusion, or liability. |

| Common Use | Trust accounts, business entities, estate planning. | Improper mixing of funds, joint accounts, unclear ownership. |

| Impact on Liability | Limits personal liability by keeping assets separate. | Raises risk of piercing corporate veil or personal liability. |

| Examples | Separate bank accounts for different entities. | Using business funds for personal expenses without records. |

Understanding the Concepts: Distinguish vs Commingle

Distinguish refers to recognizing and maintaining the separate identities of entities or elements, ensuring clarity and individual accountability in legal, financial, or conceptual contexts. Commingle involves mixing or blending distinct assets, funds, or ideas, often leading to challenges in tracing origins or ownership. Understanding these concepts is crucial for managing asset protection, legal disputes, and clear record-keeping.

Definitions: What Does It Mean to Distinguish?

To distinguish means to recognize or point out the differences between two or more entities based on their unique characteristics or qualities. It involves identifying and categorizing distinct features that set one item apart from another, ensuring clarity in classification or understanding. This process is fundamental in fields like law, finance, and ethics, where separating assets or concepts accurately impacts decision-making and compliance.

Commingle Explained: A Comprehensive Overview

Commingle refers to the process of mixing or blending different materials, substances, or assets together, making it challenging to separate individual components afterward. This concept is widely used in finance, waste management, and supply chain logistics, where commingling assets can impact traceability and accountability. Understanding commingling's effects helps ensure compliance with regulatory standards and enhances transparency in handling mixed resources.

Key Differences Between Distinguishing and Commingling

Distinguishing involves clearly separating assets, accounts, or funds to maintain their unique identities, crucial in legal and financial contexts to protect ownership rights. Commingling, by contrast, occurs when separate assets or funds are mixed together, obscuring individual ownership and complicating accountability in fiduciary, business, or trust scenarios. The key difference centers on asset segregation versus mixing, impacting transparency, legal clarity, and potential liability.

Practical Examples of Distinguishing vs Commingling

Distinguishing involves keeping assets or funds separate, such as a real estate investor maintaining distinct accounts for personal and business expenditures to avoid legal complications. Commingling occurs when these assets or funds are mixed together, like a business owner depositing personal money into the company's account, which can lead to issues in tracing ownership and potential legal disputes. Practical examples highlight that distinguishing ensures clarity and protection of assets, while commingling often results in blurred boundaries and increased risk of financial mismanagement.

Legal Implications: Distinguishing Assets vs Commingling Funds

Distinguishing assets ensures that legal ownership is clearly defined, preventing disputes and protecting individual property rights in cases like divorce or bankruptcy. Commingling funds, however, can lead to loss of separate ownership status, making it difficult to trace individual contributions and potentially exposing all funds to legal claims. Courts often scrutinize commingling to determine intent and may penalize parties by treating combined assets as jointly owned, increasing liability risks.

Advantages of Distinguishing in Business and Finance

Distinguishing assets and funds in business and finance enhances transparency and accountability, enabling precise tracking of financial performance and reducing the risk of fraud or legal complications. Clear separation of accounts facilitates accurate reporting to stakeholders and compliance with regulatory requirements, fostering trust and credibility. This practice supports effective risk management by isolating liabilities and protecting core business resources.

Risks and Challenges of Commingling

Commingling in finance or business occurs when separate funds or assets are mixed, leading to challenges in tracking individual ownership and complicating audits. The risks include potential legal liabilities, difficulties in verifying financial integrity, increased risk of fraud, and complications in regulatory compliance due to lack of clear asset segregation. Distinguishing assets or funds effectively mitigates these risks by maintaining clear records, ensuring transparency, and protecting stakeholders' interests.

Best Practices for Keeping Assets Separate

Maintaining clear records and using separate accounts are essential best practices for distinguishing assets and avoiding commingling, especially in business and legal contexts. Implementing rigorous documentation protocols and segregating funds or property ensures asset protection and compliance with regulatory standards. Consistently monitoring asset transactions strengthens the integrity of separation and prevents potential disputes or liabilities.

Choosing the Right Approach: Distinguish or Commingle?

Choosing between distinguish and commingle hinges on the clarity and efficiency required in managing resources or data. Distinguishing ensures precise identification and segregation, minimizing errors and enhancing accountability in complex systems. Commingle offers flexibility and simplicity by combining elements, which can streamline processes but may reduce specificity and traceability.

Distinguish Infographic

libterm.com

libterm.com