Maximizing your performance requires a focused strategy on improving efficiency, maintaining consistent effort, and leveraging the right tools to track progress. Understanding key performance indicators and regularly analyzing results help pinpoint areas for growth and optimize outcomes. Discover practical tips and techniques to elevate your performance throughout this article.

Table of Comparison

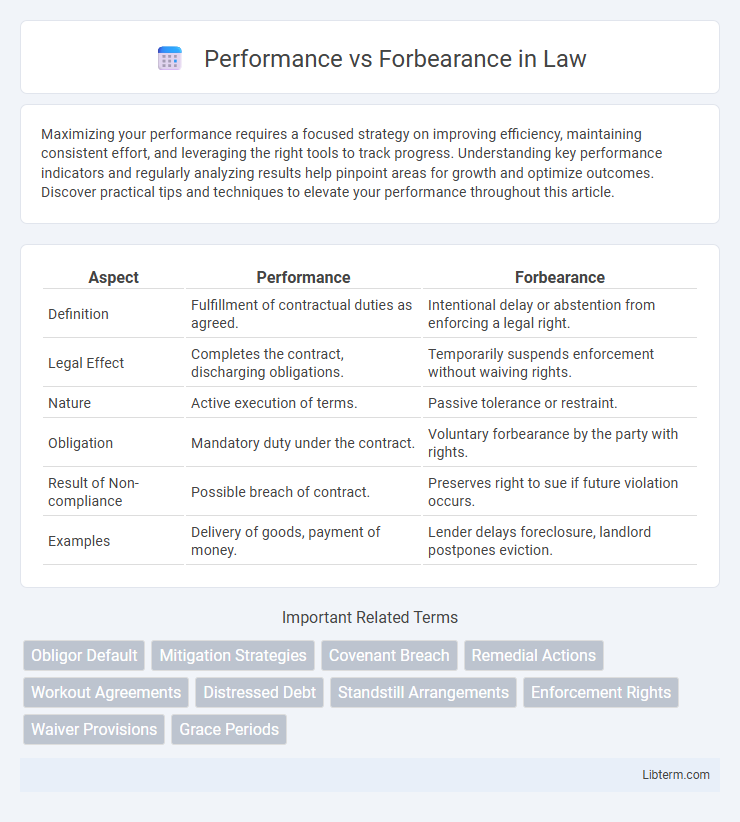

| Aspect | Performance | Forbearance |

|---|---|---|

| Definition | Fulfillment of contractual duties as agreed. | Intentional delay or abstention from enforcing a legal right. |

| Legal Effect | Completes the contract, discharging obligations. | Temporarily suspends enforcement without waiving rights. |

| Nature | Active execution of terms. | Passive tolerance or restraint. |

| Obligation | Mandatory duty under the contract. | Voluntary forbearance by the party with rights. |

| Result of Non-compliance | Possible breach of contract. | Preserves right to sue if future violation occurs. |

| Examples | Delivery of goods, payment of money. | Lender delays foreclosure, landlord postpones eviction. |

Understanding Performance and Forbearance

Performance refers to the fulfillment of contractual obligations exactly as agreed, ensuring timely and complete execution of duties. Forbearance involves a deliberate, temporary postponement or reduction of enforcement rights by a creditor, often to accommodate a debtor's financial hardship without constituting a breach. Understanding the distinction helps clarify legal consequences and financial strategies in loan agreements and debt management.

Key Differences Between Performance and Forbearance

Performance involves fulfilling contractual obligations as agreed, ensuring both parties meet their duties punctually and accurately. Forbearance, on the other hand, is a legal or contractual provision allowing a party to temporarily delay or refrain from enforcing rights or claims, often to accommodate difficulties faced by the other party. Key differences include that performance requires active compliance, while forbearance represents a strategic pause or leniency, often conditional and time-bound.

The Role of Performance in Achieving Goals

Performance serves as a critical measure in achieving goals by directly reflecting the effectiveness of actions taken toward desired outcomes. Consistent high performance accelerates goal attainment through improved productivity, skill application, and timely execution. Evaluating performance helps identify strengths and gaps, enabling focused adjustments that drive continuous progress.

Forbearance: A Strategic Pause or a Risk?

Forbearance in financial contexts serves as a strategic pause, allowing borrowers temporary relief from loan obligations during hardships, which can prevent immediate defaults and preserve creditworthiness. This approach balances short-term relief with potential long-term risks, such as accumulating interest and extended loan terms that may strain future repayment capacity. Lenders use forbearance as a risk management tool to avoid costly loan foreclosures while monitoring borrowers' ability to recover and resume payments.

Measuring Success: Performance Metrics vs Forbearance Outcomes

Performance metrics quantify success using precise indicators such as revenue growth, customer retention rates, and productivity levels to provide measurable business outcomes. Forbearance outcomes focus on temporary relief measures, tracking indicators like deferred payments, reduced default rates, and borrower recovery timelines to assess financial stability during hardship. Comparing these approaches highlights that performance metrics emphasize ongoing efficiency, whereas forbearance outcomes prioritize resilience and recovery in adverse conditions.

Situational Analysis: When to Prioritize Performance

Situational analysis for prioritizing performance over forbearance centers on contexts demanding immediate results and high efficiency, such as critical project deadlines or competitive market environments. When organizational goals require measurable outputs and quick decision-making, performance metrics and accountability take precedence to drive productivity. In contrast, forbearance may be deprioritized in scenarios where delay or leniency could jeopardize overall success or stakeholder trust.

Benefits and Drawbacks of Forbearance

Forbearance allows borrowers to temporarily pause or reduce mortgage payments, providing immediate financial relief during hardship such as job loss or medical emergencies. Benefits include avoiding foreclosure, maintaining credit standing, and enabling borrowers to regain financial stability without penalty during the forbearance period. Drawbacks involve accrued interest, potential extension of loan term, and the risk of increased total repayment amount, which may result in higher future financial obligations.

Case Studies: Successful Performance Strategies vs Forbearance Approaches

Case studies highlight that performance-driven strategies, such as aggressive debt restructuring and operational turnaround, deliver faster recovery and sustained growth compared to forbearance approaches that primarily aim to delay defaults. For example, companies like General Motors successfully leveraged performance strategies by swiftly cutting costs and innovating product lines, whereas prolonged forbearance in the eurozone banking crisis resulted in accumulated non-performing loans and slower economic revival. Data from the International Monetary Fund (IMF) underscores that timely performance-based interventions reduce credit risk and increase investor confidence more effectively than extended toleration of financial distress.

Long-term Implications: Performance vs Forbearance

Performance-based approaches prioritize meeting debt obligations promptly, which can enhance credit ratings and investor confidence over time. Forbearance, while offering temporary relief by delaying payments, may lead to increased long-term costs due to accrued interest and damaged creditworthiness. Evaluating long-term implications reveals that sustained performance fosters financial stability and growth, whereas reliance on forbearance can hinder recovery and elevate default risks.

Choosing the Right Path: Factors to Consider

Choosing the right path between performance and forbearance involves evaluating financial stability, repayment capacity, and long-term business goals. Key factors include current cash flow, creditworthiness, and the potential impact on credit ratings and stakeholder confidence. Assessing risk tolerance and future market conditions ensures informed decisions align with sustainable growth.

Performance Infographic

libterm.com

libterm.com