Defense and cost containment expenses are critical factors in managing legal and operational risks while controlling overall financial impact. Effective strategies in these areas help your business allocate resources efficiently and avoid excessive liabilities. Explore the rest of the article to learn practical approaches to optimizing defense costs and achieving cost containment.

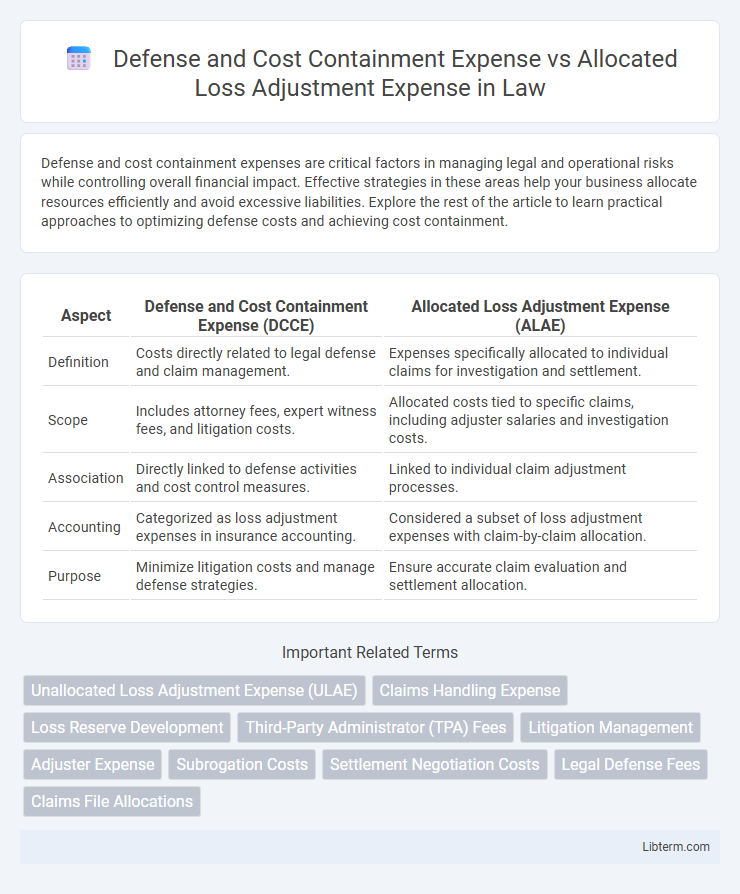

Table of Comparison

| Aspect | Defense and Cost Containment Expense (DCCE) | Allocated Loss Adjustment Expense (ALAE) |

|---|---|---|

| Definition | Costs directly related to legal defense and claim management. | Expenses specifically allocated to individual claims for investigation and settlement. |

| Scope | Includes attorney fees, expert witness fees, and litigation costs. | Allocated costs tied to specific claims, including adjuster salaries and investigation costs. |

| Association | Directly linked to defense activities and cost control measures. | Linked to individual claim adjustment processes. |

| Accounting | Categorized as loss adjustment expenses in insurance accounting. | Considered a subset of loss adjustment expenses with claim-by-claim allocation. |

| Purpose | Minimize litigation costs and manage defense strategies. | Ensure accurate claim evaluation and settlement allocation. |

Understanding Defense and Cost Containment Expense (DCCE)

Defense and Cost Containment Expense (DCCE) represents the costs incurred by insurers to manage and control claims through legal defense, investigation, and settlement negotiations. DCCE directly impacts an insurer's profitability by reducing the overall claim payouts while maintaining claim reserves. Understanding DCCE is crucial for accurate loss forecasting and differentiation from Allocated Loss Adjustment Expense (ALAE), which specifically covers expenses directly tied to individual claims such as legal fees and expert witness costs.

Defining Allocated Loss Adjustment Expense (ALAE)

Allocated Loss Adjustment Expense (ALAE) refers to the costs directly associated with investigating, defending, and settling individual insurance claims, including legal fees, expert witness expenses, and claim adjuster costs. Defense and cost containment expenses fall under ALAE, representing specific expenditures aimed at minimizing claim losses through litigation and negotiated settlements. Precise allocation of ALAE is critical for accurate loss reserving and efficient claims management in insurance operations.

Key Differences Between DCCE and ALAE

Defense and Cost Containment Expense (DCCE) primarily covers costs directly associated with managing and controlling claims, such as legal fees and investigative expenses, while Allocated Loss Adjustment Expense (ALAE) specifically refers to claim-related costs that can be directly attributed to a particular claim. DCCE tends to emphasize proactive cost management strategies to minimize overall claim expenses, whereas ALAE focuses on the allocation of expenses tied to individual claims. Understanding the distinction aids insurers in accurately categorizing expenses for financial reporting and reserving purposes.

The Role of DCCE in Insurance Claims

Defense and Cost Containment Expense (DCCE) plays a crucial role in managing overall claim costs by directly covering legal fees and other expenses related to defending claims, distinct from Allocated Loss Adjustment Expense (ALAE) which includes both defense costs and other allocated expenses such as expert witness fees. Effective management of DCCE helps insurers control litigation expenses, thereby reducing the total loss adjustment expense and improving claim expense predictability. Insurance companies leverage detailed DCCE tracking to optimize legal strategies and enhance cost containment, ultimately preserving underwriting profitability.

Impact of ALAE on Claims Settlement

Allocated Loss Adjustment Expense (ALAE) significantly influences claims settlement by directly affecting the total cost insurers incur in resolving claims. Unlike Defense and Cost Containment Expense, which covers defense-related costs, ALAE includes expenses such as legal fees and investigation costs specifically tied to individual claims, increasing the financial burden during settlement processes. Efficient management of ALAE is crucial for insurers to minimize impact on loss reserves and maintain profitability while ensuring timely and fair claim resolutions.

How Insurers Track DCCE and ALAE

Insurers track Defense and Cost Containment Expense (DCCE) and Allocated Loss Adjustment Expense (ALAE) using detailed case-level accounting systems that allocate expenses directly to individual claims, ensuring precise cost monitoring. DCCE includes expenses related to managing and defending claims, such as legal fees and claims handling costs, while ALAE encompasses all loss adjustment expenses that can be allocated to specific claims. Advanced claims management software integrates real-time data analytics to provide transparency and accurate forecasting of reserve requirements for both DCCE and ALAE categories.

Examples of DCCE in Practice

Defense and Cost Containment Expense (DCCE) includes legal fees, expert witness charges, and investigation costs incurred to defend and manage claims effectively, while Allocated Loss Adjustment Expense (ALAE) specifically refers to costs directly linked to individual claims. Examples of DCCE in practice involve payments to external legal counsel handling complex liability claims, fees for medical expert consultations, and expenses for accident scene investigations. These targeted expenditures help insurers control overall claim costs by focusing resources on claim-specific defense strategies.

Typical Items Included in ALAE

Allocated Loss Adjustment Expense (ALAE) typically includes legal fees, expert witness charges, investigation costs, and other expenses directly related to adjusting and settling claims. Defense and Cost Containment Expenses cover strategies to minimize claim costs through negotiated settlements, loss prevention, and dispute resolution services. These expenses are integral to managing overall claim costs and maintaining insurer profitability by efficiently addressing and controlling losses.

Influence on Loss Reserving and Pricing

Defense and Cost Containment Expense (DCCE) directly affects loss reserving by influencing the timing and amount of claim payments, leading to more accurate reserve estimates. Allocated Loss Adjustment Expense (ALAE) impacts pricing models by incorporating the specific costs associated with individual claims adjustments, enabling insurers to set premiums that reflect the true cost of claims handling. Both DCCE and ALAE refine loss reserving and pricing strategies by providing granular data on claim management expenses, improving financial forecasting and risk assessment.

Managing and Controlling DCCE vs ALAE

Managing Defense and Cost Containment Expense (DCCE) requires strategic oversight to minimize unnecessary legal and investigative costs, directly impacting an insurer's overall loss ratio. Allocated Loss Adjustment Expense (ALAE), encompassing DCCE, demands precise allocation and monitoring to ensure expenses are appropriately matched to specific claims, promoting accurate financial reporting. Effective control of DCCE versus ALAE involves leveraging claims data analytics and implementing robust vendor management to identify cost-saving opportunities without compromising claim outcomes.

Defense and Cost Containment Expense Infographic

libterm.com

libterm.com