A bare trust is a simple legal arrangement where the trustee holds assets on behalf of the beneficiary, who has absolute rights to the trust property and income. This structure is commonly used for holding assets for minors or managing investments, offering straightforward control and transparency. Discover how a bare trust can benefit your financial planning and asset protection by reading the rest of the article.

Table of Comparison

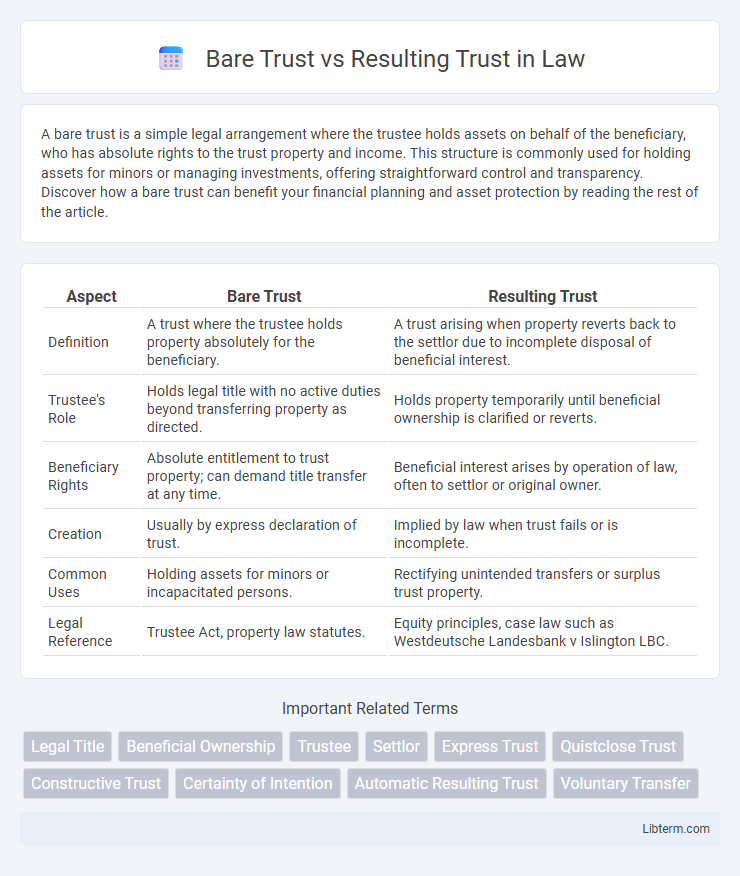

| Aspect | Bare Trust | Resulting Trust |

|---|---|---|

| Definition | A trust where the trustee holds property absolutely for the beneficiary. | A trust arising when property reverts back to the settlor due to incomplete disposal of beneficial interest. |

| Trustee's Role | Holds legal title with no active duties beyond transferring property as directed. | Holds property temporarily until beneficial ownership is clarified or reverts. |

| Beneficiary Rights | Absolute entitlement to trust property; can demand title transfer at any time. | Beneficial interest arises by operation of law, often to settlor or original owner. |

| Creation | Usually by express declaration of trust. | Implied by law when trust fails or is incomplete. |

| Common Uses | Holding assets for minors or incapacitated persons. | Rectifying unintended transfers or surplus trust property. |

| Legal Reference | Trustee Act, property law statutes. | Equity principles, case law such as Westdeutsche Landesbank v Islington LBC. |

Introduction to Bare Trusts and Resulting Trusts

Bare trusts involve a straightforward arrangement where the trustee holds assets solely for the benefit of the beneficiary, who has an immediate and absolute right to both the trust capital and income. Resulting trusts arise when the trust fails or does not fully dispose of the property, causing the assets to revert to the settlor or their estate by operation of law. Both trust types play distinct roles in property law, with bare trusts ensuring direct beneficiary control and resulting trusts addressing gaps in trust intentions.

Defining Bare Trusts: Key Characteristics

Bare trusts involve a trustee holding assets solely for the beneficiary's absolute benefit, with beneficiaries having immediate and absolute rights to both income and capital. The trustee's role is purely administrative, lacking any discretionary powers over the trust assets or their distribution. Unlike resulting trusts, bare trusts do not arise from implied intentions but are explicitly established arrangements reflecting clear ownership rights.

Understanding Resulting Trusts: Fundamental Features

Resulting trusts arise when property is transferred without the intention to benefit the recipient, reflecting the presumption that the property should revert to the original owner. These trusts highlight the fundamental feature of equitable ownership, where legal title is held by one party but the beneficial interest returns to the transferor. Unlike bare trusts, resulting trusts are often implied by law to prevent unjust enrichment and ensure fairness in property dealings.

Legal Principles Governing Bare Trusts

Bare trusts operate under the principle that the trustee holds property solely for the benefit of the beneficiary who has an immediate and absolute right to both the capital and income. Legal principles governing bare trusts emphasize the beneficiary's full control, allowing them to direct the trustee to manage or transfer trust assets at any time. Unlike resulting trusts, bare trusts do not arise from presumed intentions but are explicitly established arrangements where the trustee's obligations are clearly defined.

How Resulting Trusts Arise in Practice

Resulting trusts arise in practice when property is transferred under circumstances suggesting an implied intention that the property will revert to the transferor, such as in failed gift transactions or incomplete trusts. Courts impose resulting trusts to reflect the parties' presumed intentions where no express trust exists, typically seen in contributions to purchase price or where trust purposes fail. These trusts serve to prevent unjust enrichment by returning property to the original owner or contributor when legal title does not align with equitable ownership.

Beneficiary Rights in Bare Trusts vs Resulting Trusts

Beneficiary rights in bare trusts confer absolute entitlement to trust assets, allowing beneficiaries to demand transfer of legal title and enjoy full control upon reaching legal age. In contrast, resulting trusts arise by operation of law to reflect inferred intentions, where beneficiaries' rights are contingent and often limited to equitable interests without automatic entitlement to legal title. Courts recognize bare trust beneficiaries as principal owners, while resulting trust beneficiaries hold beneficial interests subject to return or redistribution based on the trust's purpose.

Trustee Duties and Responsibilities

In a Bare Trust, the trustee holds legal title solely to manage property on behalf of the beneficiary, who retains absolute entitlement, requiring the trustee to act according to the beneficiary's instructions without discretionary power. In contrast, a Resulting Trust arises when property is transferred but not intended to benefit the recipient, obligating the trustee to hold the property for the settlor or another party, often implicating duties of preservation and proper administration. Trustees in both trusts must maintain fiduciary duties, ensuring that assets are managed prudently, avoiding conflicts of interest, and adhering strictly to the terms that define the trust's purpose and beneficial interests.

Tax Implications of Bare Trusts and Resulting Trusts

Bare trusts offer clear tax advantages as the beneficiary is considered the absolute owner for tax purposes, leading to straightforward income and capital gains tax assessments. Resulting trusts, however, can trigger complex tax consequences since the beneficial ownership often reverts to the settlor, potentially causing unexpected income distribution and inheritance tax liabilities. Understanding the distinction between these trusts is crucial for effective tax planning, ensuring compliance with HMRC regulations and minimizing tax burdens.

Common Uses and Scenarios for Each Trust Type

Bare trusts are commonly used in scenarios involving the holding of assets on behalf of minors or beneficiaries who are entitled to immediate ownership, allowing them full control once they reach maturity. Resulting trusts typically arise in situations where property is transferred without a clear intention to benefit the recipient, often serving to return equitable interest to the original contributor when a trust fails or is incomplete. Bare trusts suit straightforward asset management needs, while resulting trusts address complex equity issues in property disputes and failed trust settlements.

Choosing Between Bare Trusts and Resulting Trusts: Factors to Consider

Choosing between bare trusts and resulting trusts depends on control, purpose, and tax implications; bare trusts offer beneficiaries absolute control and direct ownership, ideal for simplicity and transparency in asset management. Resulting trusts arise when the legal title holder holds assets on behalf of another due to contribution or intention, often used to prevent unintended ownership transfers or to reflect equitable interests. Key considerations include the level of control desired by beneficiaries, the intent behind asset transfer, and tax consequences that differ notably between bare trust income attribution and resulting trust equity interests.

Bare Trust Infographic

libterm.com

libterm.com