A co-guarantor shares equal responsibility with the primary borrower for repaying a loan or debt, providing lenders with added security. This mutual obligation can improve your chances of loan approval and potentially secure better terms. Discover how a co-guarantor can impact your financial commitments by reading the full article.

Table of Comparison

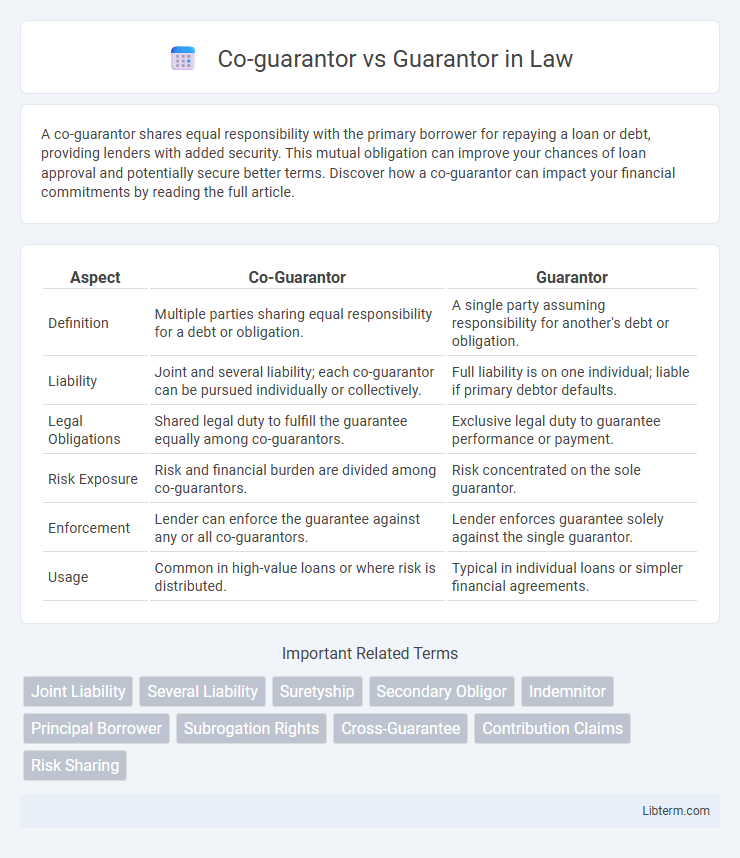

| Aspect | Co-Guarantor | Guarantor |

|---|---|---|

| Definition | Multiple parties sharing equal responsibility for a debt or obligation. | A single party assuming responsibility for another's debt or obligation. |

| Liability | Joint and several liability; each co-guarantor can be pursued individually or collectively. | Full liability is on one individual; liable if primary debtor defaults. |

| Legal Obligations | Shared legal duty to fulfill the guarantee equally among co-guarantors. | Exclusive legal duty to guarantee performance or payment. |

| Risk Exposure | Risk and financial burden are divided among co-guarantors. | Risk concentrated on the sole guarantor. |

| Enforcement | Lender can enforce the guarantee against any or all co-guarantors. | Lender enforces guarantee solely against the single guarantor. |

| Usage | Common in high-value loans or where risk is distributed. | Typical in individual loans or simpler financial agreements. |

Understanding the Role of a Guarantor

A guarantor provides a financial guarantee ensuring a borrower's debt repayment if the primary borrower defaults, while a co-guarantor shares equal responsibility alongside other guarantors for the loan obligation. Understanding the role of a guarantor involves recognizing the legal commitment to cover debts and potential impacts on credit scores and financial liability. Lenders often require guarantors to reduce lending risk, making the distinctions between co-guarantors and sole guarantors crucial for risk management and borrower qualifications.

Defining a Co-Guarantor: Who Are They?

A co-guarantor is an individual who shares equal responsibility with another guarantor for repaying a loan or fulfilling a financial obligation if the primary borrower defaults. Unlike a single guarantor, co-guarantors jointly guarantee the debt, meaning lenders can hold either party accountable for the full amount owed. This arrangement enhances the security of the loan by spreading the risk among multiple parties.

Key Differences: Co-Guarantor vs Guarantor

A co-guarantor shares equal responsibility with other guarantors for the repayment of a loan, whereas a guarantor assumes full liability individually if the borrower defaults. Co-guarantors collectively guarantee the debt, making each liable for the entire amount until it's repaid, distributing risk among them. In contrast, a guarantor acts as a single, secondary debtor, stepping in only after the borrower fails to fulfill payment obligations.

Legal Obligations of Guarantors and Co-Guarantors

Guarantors and co-guarantors share legal obligations to fulfill the debt if the primary borrower defaults, but co-guarantors typically hold joint and several liabilities, meaning each can be held responsible for the entire debt independently. Guarantors may have individual or proportional responsibility depending on the loan agreement, whereas co-guarantors' liability is often collectively enforceable. Courts enforce these obligations strictly, requiring full repayment from any guarantor or co-guarantor if the borrower fails to meet the debt terms.

Financial Risks for Co-Guarantors vs Guarantors

Co-guarantors share joint and several liabilities, increasing their financial risks as each party can be held responsible for the entire debt if others default, unlike a sole guarantor who bears full responsibility alone. Co-guarantors face amplified risk exposure due to potential disputes over repayment contributions and joint credit impact in case of default. The shared obligation can complicate financial recovery and exacerbate credit damage, making risk management more challenging compared to single guarantor arrangements.

Scenarios Requiring Co-Guarantors

Scenarios requiring co-guarantors often arise when a single guarantor's financial capacity or creditworthiness is insufficient to secure a loan or lease, ensuring lenders receive adequate protection. Co-guarantors share joint responsibility for the debt, providing multiple sources of repayment and reducing the risk for creditors in high-value or high-risk financial agreements. This arrangement is common in real estate transactions, commercial lending, and business loans where borrower income or asset levels fall below lender thresholds.

How Lenders Assess Guarantors and Co-Guarantors

Lenders assess guarantors and co-guarantors by evaluating their creditworthiness, income stability, and debt-to-income ratio to ensure they can fulfill loan obligations if the primary borrower defaults. A guarantor typically assumes full responsibility for the loan, leading lenders to scrutinize their financial strength individually, whereas co-guarantors share joint liability, prompting lenders to consider the combined financial profiles of all parties. Risk assessment also includes reviewing assets, credit history, and employment status to determine the overall likelihood of repayment.

Advantages and Disadvantages of Being a Guarantor

Being a guarantor involves taking full responsibility for a loan or debt if the primary borrower defaults, which can impact personal credit and financial stability. A co-guarantor shares this responsibility equally with another guarantor, reducing individual risk but requiring mutual trust and coordination. Advantages of being a guarantor include enabling a borrower to access credit with less stringent requirements, while disadvantages encompass potential damage to credit scores and legal obligations to repay debts.

Impact on Credit Scores: Co-Guarantor vs Guarantor

A co-guarantor shares equal responsibility with the primary borrower, meaning both parties' credit scores can be equally affected by the loan's repayment history. In contrast, a guarantor's credit score is only impacted if the primary borrower defaults, as their obligation is secondary. Understanding the distinct roles helps manage credit risk and potential score fluctuations for individuals involved in loan agreements.

Choosing the Right Option: Co-Guarantor or Guarantor

Choosing between a co-guarantor and a guarantor depends on the specific financial obligation and risk distribution. A co-guarantor shares equal responsibility for the debt alongside the primary borrower, reducing individual liability, while a guarantor acts as a backup, responsible only if the borrower defaults. Evaluating the borrower's creditworthiness, debt amount, and willingness to assume joint liability helps determine the optimal option for securing a loan.

Co-guarantor Infographic

libterm.com

libterm.com