A pledge serves as a binding promise or commitment to fulfill a specific duty or goal, often demonstrating trustworthiness and responsibility. It is commonly used in legal, social, and financial contexts to assure parties of a guaranteed action or repayment. Discover how understanding the nuances of a pledge can protect Your interests and ensure clarity in obligations throughout the rest of this article.

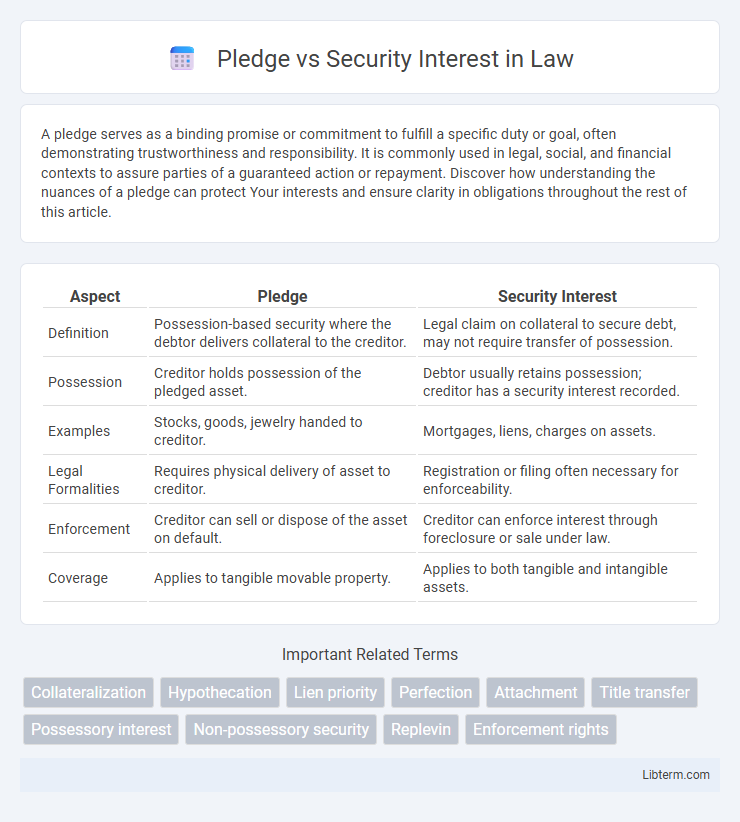

Table of Comparison

| Aspect | Pledge | Security Interest |

|---|---|---|

| Definition | Possession-based security where the debtor delivers collateral to the creditor. | Legal claim on collateral to secure debt, may not require transfer of possession. |

| Possession | Creditor holds possession of the pledged asset. | Debtor usually retains possession; creditor has a security interest recorded. |

| Examples | Stocks, goods, jewelry handed to creditor. | Mortgages, liens, charges on assets. |

| Legal Formalities | Requires physical delivery of asset to creditor. | Registration or filing often necessary for enforceability. |

| Enforcement | Creditor can sell or dispose of the asset on default. | Creditor can enforce interest through foreclosure or sale under law. |

| Coverage | Applies to tangible movable property. | Applies to both tangible and intangible assets. |

Introduction to Pledge vs Security Interest

A pledge involves the delivery of goods or assets by a debtor to a creditor as collateral to secure a debt, where possession is transferred but ownership remains with the debtor. Security interest, by contrast, is a broader legal concept encompassing any interest in personal property or fixtures that secures payment or performance of an obligation, often without transferring possession. Understanding the distinctions helps clarify the rights and obligations of parties in secured transactions under laws such as the Uniform Commercial Code (UCC) and relevant common law principles.

Definitions: What is a Pledge?

A pledge is a form of security interest where the debtor delivers possession of personal property to the creditor to secure a debt or obligation. It involves transferring possession, but not ownership, of tangible assets such as stocks, bonds, or goods until the debt is satisfied. The creditor holds the pledged property as collateral, ensuring the performance of the debtor's obligation.

Definitions: What is a Security Interest?

A security interest is a legal claim or right granted by a debtor to a creditor over the debtor's property, known as collateral, to secure repayment of a debt or performance of an obligation. Unlike a pledge, which involves the debtor physically delivering the collateral to the creditor, a security interest can exist without immediate transfer of possession. This mechanism provides creditors with priority rights to the collateral in case of default.

Key Legal Differences Between Pledge and Security Interest

A pledge involves the physical delivery of an asset to the creditor as collateral, ensuring possession remains with the secured party, while a security interest typically allows the debtor to retain possession of the collateral. Pledges require actual or constructive delivery under common law, whereas security interests are created and perfected through attachment and public filing, such as Uniform Commercial Code (UCC) financing statements in the U.S. The enforcement of a pledge generally allows the pledgee to sell the pledged property outright upon default, whereas enforcing a security interest may involve judicial or non-judicial foreclosure processes depending on jurisdiction and the nature of the collateral.

Nature of Possession: Who Holds the Collateral?

In a pledge, the pledgee physically holds the collateral, maintaining possession to secure the debt, ensuring control and reducing risk of misuse. Conversely, in a security interest, the debtor typically retains possession of the collateral while the secured party has a legal interest recorded through a security agreement or financing statement. This distinction affects the enforcement rights and the level of control the secured party has over the collateral during the loan term.

Creation and Documentation Requirements

A pledge involves the delivery of physical possession of the collateral to the pledgee, requiring a written agreement specifying the pledged asset and the obligations secured, often supported by a security agreement or contract. Security interests are created through attachment and perfection processes, typically necessitating a signed security agreement and may require filings such as a UCC-1 financing statement to provide public notice. Precise documentation ensures enforceability and clarity of rights, with possession as critical in pledges and statutory filings playing a key role in security interests.

Enforcement and Remedies upon Default

Enforcement of a pledge involves the pledgee taking possession and selling the pledged asset to recover the debt, often without court intervention if agreed upon in the contract, while remedies typically include retention or sale of the asset with proceeds applied to the obligation. In contrast, enforcement of a security interest usually requires judicial or non-judicial foreclosure proceedings, depending on jurisdiction, allowing the secured party to repossess, sell, or otherwise dispose of collateral after debtor default. Remedies for security interests may include acceleration of the debt, deficiency judgments, or strict foreclosure, aiming to satisfy the underlying obligation through collateral liquidation or retention.

Rights and Obligations of Parties Involved

In a pledge, the pledgor transfers possession of the collateral to the pledgee, who gains the right to retain and, upon default, sell the asset to satisfy the debt, while the pledgor remains the owner with the obligation to repay. In contrast, a security interest allows the debtor to retain possession of the collateral, but grants the secured party a legal claim, enforceable through filing or perfection, to repossess or liquidate the collateral upon default. Both arrangements impose duties on the secured party to act in good faith and on the debtor to protect the collateral's value and fulfill repayment terms.

Practical Examples and Applications

Pledges commonly arise in pawnshops where borrowers provide personal property, such as jewelry, as collateral to secure short-term loans, allowing lenders to hold the items until repayment. Security interests are frequently used in commercial lending, exemplified by a business securing equipment or inventory as collateral under a UCC-1 financing statement, enabling creditors to claim the assets upon default. Both mechanisms protect creditors but differ in possession requirements and scope, with pledges involving direct possession of collateral and security interests often allowing borrowers to retain possession while granting lien rights.

Conclusion: Choosing Between Pledge and Security Interest

Choosing between a pledge and a security interest depends on the degree of control over the collateral and the formality required. Pledges provide the secured party with possession of the collateral and stronger protection against third-party claims but may limit the debtor's use of the asset. Security interests allow the debtor to retain possession while granting the secured party a legal claim, requiring proper filing to perfect the interest and ensure priority in case of default.

Pledge Infographic

libterm.com

libterm.com