A lessee is an individual or entity who holds the right to use and occupy property under a lease agreement, typically paying rent to the lessor. Understanding your rights and responsibilities as a lessee is crucial for maintaining a smooth leasing experience and avoiding potential disputes. Explore the rest of the article to learn key insights about lessee obligations and protections.

Table of Comparison

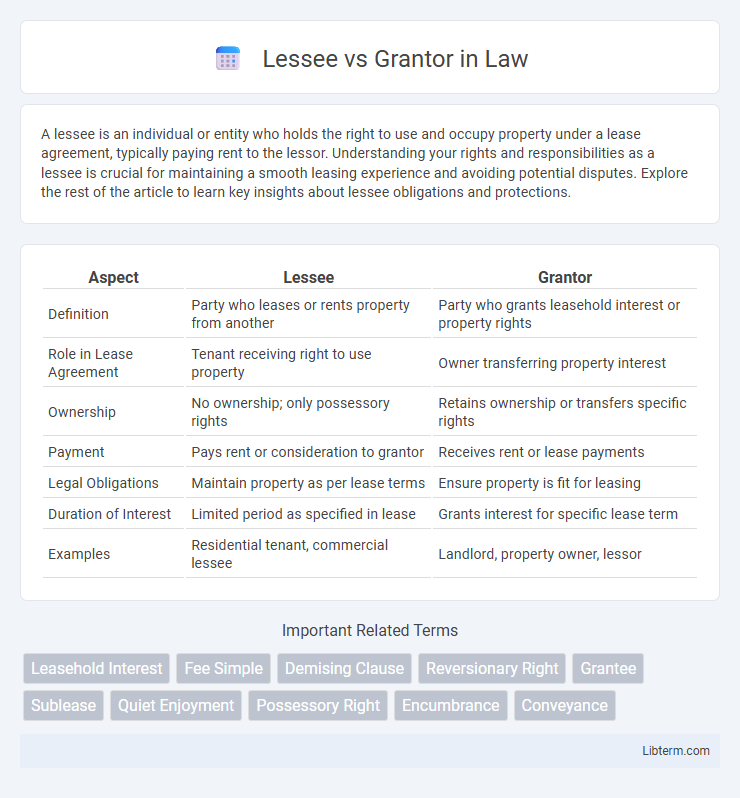

| Aspect | Lessee | Grantor |

|---|---|---|

| Definition | Party who leases or rents property from another | Party who grants leasehold interest or property rights |

| Role in Lease Agreement | Tenant receiving right to use property | Owner transferring property interest |

| Ownership | No ownership; only possessory rights | Retains ownership or transfers specific rights |

| Payment | Pays rent or consideration to grantor | Receives rent or lease payments |

| Legal Obligations | Maintain property as per lease terms | Ensure property is fit for leasing |

| Duration of Interest | Limited period as specified in lease | Grants interest for specific lease term |

| Examples | Residential tenant, commercial lessee | Landlord, property owner, lessor |

Understanding the Roles: Lessee vs Grantor

The lessee is the party who obtains the right to use and occupy a property under a lease agreement, while the grantor is the party who transfers an interest in real property, such as in a deed or easement. Understanding these roles is critical in real estate transactions, as the lessee holds a temporary right to possession without ownership, whereas the grantor relinquishes certain ownership rights or interests permanently or for a specified period. Clarifying these distinctions helps prevent legal disputes over property use, rights, and obligations.

Core Definitions: Who is a Lessee? Who is a Grantor?

A Lessee is an individual or entity that obtains the right to use and occupy property or assets under a lease agreement in exchange for regular payments to the property owner. A Grantor is the party that conveys or transfers property rights, interests, or privileges to another party through legal instruments such as deeds, leases, or trusts. Understanding these core definitions clarifies roles in property transactions, with the Lessee as the user or tenant and the Grantor as the original owner or transferor of rights.

Key Differences Between Lessee and Grantor

A lessee obtains the right to use and occupy property under a lease agreement, while a grantor transfers ownership or an interest in property through a deed, such as in a sale or conveyance. The lessee's rights are limited and temporary, typically for a fixed lease term, whereas the grantor's interest involves transferring title or ownership rights permanently or until conditions are met. Key differences include the nature of rights granted, duration of interest, and the legal relationship with the property, where lessee holds possession without ownership and grantor relinquishes ownership rights.

Legal Rights and Responsibilities

Lessees hold the right to possess and use leased property for an agreed period while obligated to pay rent and maintain the property according to the lease terms. Grantors retain ownership rights and must ensure the lessee's peaceful possession but are responsible for delivering the property free of encumbrances. Lease agreements define the boundaries of both parties' legal responsibilities, balancing possession rights for lessees with ownership privileges and duties for grantors.

Financial Implications for Lessee and Grantor

Lessees face ongoing financial obligations such as regular lease payments, potential maintenance costs, and limited control over asset ownership, impacting cash flow and balance sheet liabilities. Grantors benefit from steady income streams through lease payments, but bear risks related to asset depreciation, maintenance expenses, and potential default by lessees, influencing long-term return on investment. Both parties must evaluate tax implications, with lessees potentially deducting lease expenses and grantors recognizing rental income, affecting their respective financial statements.

Types of Agreements Involving Lessee and Grantor

Types of agreements involving a lessee primarily include lease agreements such as operating leases, finance leases, and sublease agreements, which define the terms for using or occupying property or assets without transferring ownership. Grantor agreements commonly encompass grant deeds, easements, and licenses that establish rights or interests transferred from the grantor to another party, often pertaining to property ownership or usage rights. These contracts specify obligations, duration, and rights, reflecting the distinct legal roles and interests of lessees and grantors in property or asset transactions.

Common Scenarios: Leasing vs Granting

In common leasing scenarios, a lessee acquires the right to use a property or asset for a specified period while the grantor retains ownership and control, such as in residential or commercial lease agreements. Granting typically involves the transfer of ownership or an interest in real property through deeds, often seen in transactions like easements, right-of-way grants, or land conveyances. Understanding the distinction between lessee and grantor is essential for clarifying legal rights and obligations in real estate and asset use agreements.

Benefits and Drawbacks for Lessee and Grantor

Lessees gain the benefit of property use without ownership risks, paying predictable lease payments but face limitations on property modifications and no equity accumulation. Grantors benefit from steady income streams, retaining ownership and control while bearing risks like property maintenance costs and potential lessee default. Both parties must assess lease terms to balance financial advantages against obligations and risks inherent in property leasing agreements.

Common Challenges and Solutions

Lessees often face challenges such as ambiguous lease terms and unexpected maintenance costs, while grantors struggle with enforcing lease compliance and managing property rights. Clear, detailed contracts and proactive communication help lessees avoid disputes and financial surprises. For grantors, implementing regular property inspections and legal consultations ensures adherence to agreements and protects ownership interests.

Choosing the Right Role: Factors to Consider

When choosing between lessee and grantor roles, consider the scope of rights and obligations each entails, such as lease term length, control over the property, and financial responsibilities including rent payments or mortgage commitments. Assess how each role impacts liability exposure, asset management, and potential tax implications like depreciation benefits for the grantor or expense deductions for the lessee. Evaluating these factors in the context of your business or personal goals ensures an informed decision aligning with legal, financial, and operational priorities.

Lessee Infographic

libterm.com

libterm.com