Enforcement action involves the implementation of legal or regulatory measures to ensure compliance with laws, rules, or standards. These actions can include penalties, fines, or corrective directives aimed at deterring violations and protecting public interests. Discover how enforcement action can impact your rights and responsibilities by reading the rest of this article.

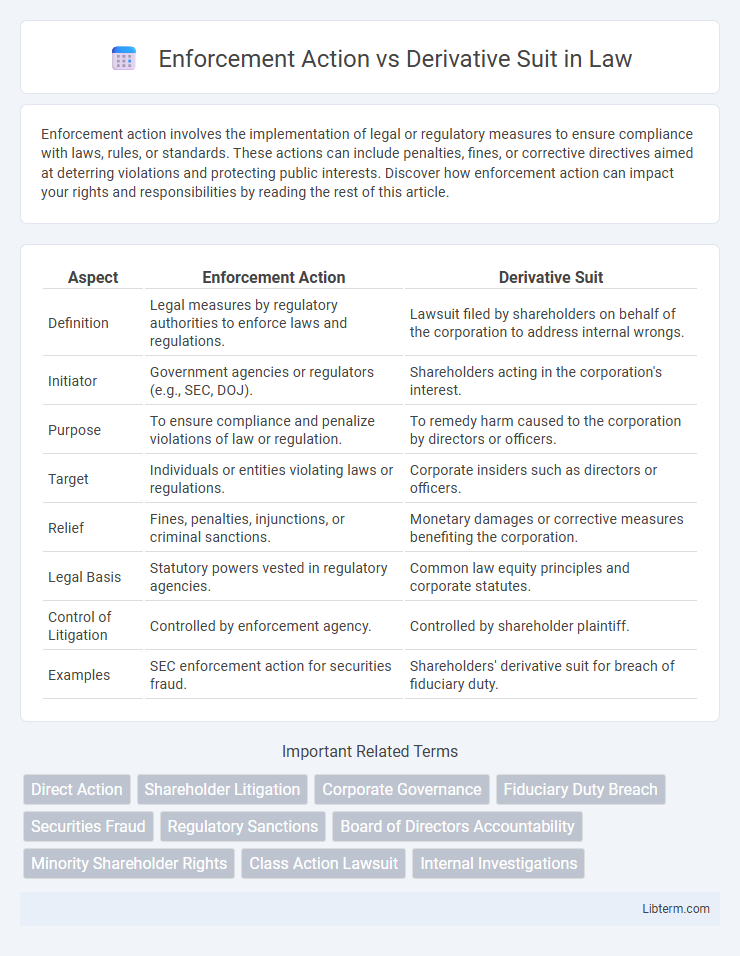

Table of Comparison

| Aspect | Enforcement Action | Derivative Suit |

|---|---|---|

| Definition | Legal measures by regulatory authorities to enforce laws and regulations. | Lawsuit filed by shareholders on behalf of the corporation to address internal wrongs. |

| Initiator | Government agencies or regulators (e.g., SEC, DOJ). | Shareholders acting in the corporation's interest. |

| Purpose | To ensure compliance and penalize violations of law or regulation. | To remedy harm caused to the corporation by directors or officers. |

| Target | Individuals or entities violating laws or regulations. | Corporate insiders such as directors or officers. |

| Relief | Fines, penalties, injunctions, or criminal sanctions. | Monetary damages or corrective measures benefiting the corporation. |

| Legal Basis | Statutory powers vested in regulatory agencies. | Common law equity principles and corporate statutes. |

| Control of Litigation | Controlled by enforcement agency. | Controlled by shareholder plaintiff. |

| Examples | SEC enforcement action for securities fraud. | Shareholders' derivative suit for breach of fiduciary duty. |

Understanding Enforcement Actions: Definition and Scope

Enforcement actions involve legal proceedings initiated by regulatory authorities to address violations of laws or regulations, aiming to ensure compliance and impose penalties on offenders. These actions typically cover areas such as securities fraud, environmental breaches, and consumer protection violations, with the scope defined by statutory mandates and regulatory frameworks. Understanding enforcement actions requires recognizing their role in maintaining market integrity and protecting public interests through government-backed intervention.

What is a Derivative Suit? Key Concepts Explained

A derivative suit is a legal action brought by a shareholder on behalf of the corporation against third parties, often insiders like executives or directors, for breaches of fiduciary duty or misconduct that harm the company. Unlike enforcement actions initiated by regulatory bodies to address violations of laws or regulations, derivative suits aim to hold management accountable and recover damages for the corporation itself. Key concepts include the shareholder's standing to sue, the requirement to demand action from the board before filing, and the suit's focus on protecting corporate interests rather than individual shareholder claims.

Parties Involved: Enforcement Actions vs. Derivative Suits

Enforcement actions typically involve regulatory agencies or government authorities as plaintiffs aiming to rectify violations of law or public harm, while derivative suits are initiated by shareholders on behalf of the corporation to address wrongs committed against the company by insiders such as directors or officers. In enforcement actions, the government seeks penalties or corrective measures, whereas in derivative suits, the relief sought benefits the corporation and its shareholders. Parties in derivative suits include the individual shareholder plaintiff and the corporation as the nominal defendant, contrasting with enforcement actions where the state or regulatory body acts as the plaintiff directly against the offending party.

Legal Standing: Who Can Initiate Each Action?

Enforcement actions are typically initiated by regulatory agencies or government authorities with legal standing to enforce laws and regulations on behalf of the public. Derivative suits, on the other hand, are brought by shareholders representing the corporation's interests against insiders such as directors or officers accused of harming the company. Legal standing in enforcement actions is vested in public entities to protect societal interests, whereas derivative suits require shareholders to demonstrate a direct connection to the corporation and a prior demand to the board in most jurisdictions.

Grounds for Filing: Typical Causes in Enforcement Actions and Derivative Suits

Enforcement actions are typically filed due to violations of securities laws, regulatory breaches, fraud, or insider trading activities identified by regulatory bodies such as the SEC. Derivative suits arise mainly from corporate governance issues, including breaches of fiduciary duty by directors or officers, mismanagement, or harm to the corporation's interests that shareholders seek to address on behalf of the company. While enforcement actions focus on public law violations and regulatory compliance, derivative suits focus on internal corporate wrongdoings impacting shareholders and company value.

Procedural Differences and Legal Frameworks

Enforcement actions are typically initiated by regulatory authorities under administrative or statutory frameworks, following specific procedural rules that emphasize public interest and compliance with regulatory standards. Derivative suits are brought by shareholders on behalf of the corporation, governed primarily by corporate law and requiring plaintiffs to meet procedural prerequisites like demand futility or board approval. The procedural distinctions include differing burdens of proof, standing requirements, and judicial oversight, with enforcement actions often expedited through administrative agencies, while derivative suits follow civil litigation protocols within courts.

Outcomes and Remedies: Comparing Potential Results

Enforcement actions typically result in regulatory penalties, fines, or injunctions aimed at correcting wrongful behavior and deterring future violations. Derivative suits primarily seek remedies on behalf of the corporation, such as monetary damages recovered from fiduciaries, removal of directors, or reforms in corporate governance. While enforcement actions emphasize public interest and compliance, derivative suits focus on protecting shareholder rights and corporate assets.

Noteworthy Case Examples: Enforcement Action vs. Derivative Suit

Enforcement actions often involve regulatory agencies pursuing companies or individuals for violations of securities laws, as seen in the SEC's case against Elon Musk for the 2018 Tesla tweets, resulting in hefty fines and mandatory compliance measures. Derivative suits, exemplified by the Disney shareholder litigation over the Michael Ovitz hiring debacle, empower shareholders to sue on behalf of the corporation for breaches of fiduciary duty by executives or directors. These cases highlight enforcement actions targeting regulatory compliance versus derivative suits focusing on internal corporate governance and shareholder rights.

Strategic Considerations for Stakeholders

Enforcement actions prioritize regulatory compliance and public interest, often initiated by government agencies to address legal violations, affecting a company's reputation and operational license. Derivative suits empower shareholders to enforce corporate rights on behalf of the company, targeting management misconduct and mismanagement to protect shareholder value. Stakeholders must weigh risk exposure, potential financial recoveries, and governance impact when choosing between these legal strategies.

Choosing the Right Path: Factors Influencing Legal Recourse

Enforcement actions typically involve regulatory or governmental bodies initiating proceedings to uphold compliance and protect public interests, whereas derivative suits are shareholder-initiated lawsuits addressing corporate mismanagement or fiduciary breaches within a company. Choosing the right path depends on factors such as the source of the alleged wrongdoing, potential remedies, stakeholder interests, and jurisdictional nuances. Understanding the distinction between public enforcement priorities and private shareholder rights is crucial for effective legal strategy and maximizing remedial outcomes.

Enforcement Action Infographic

libterm.com

libterm.com