Ownership grants you control over assets, allowing you to make decisions that impact their value and use. It involves legal rights and responsibilities to protect and manage property effectively. Explore the article to understand how ownership shapes financial security and personal freedom.

Table of Comparison

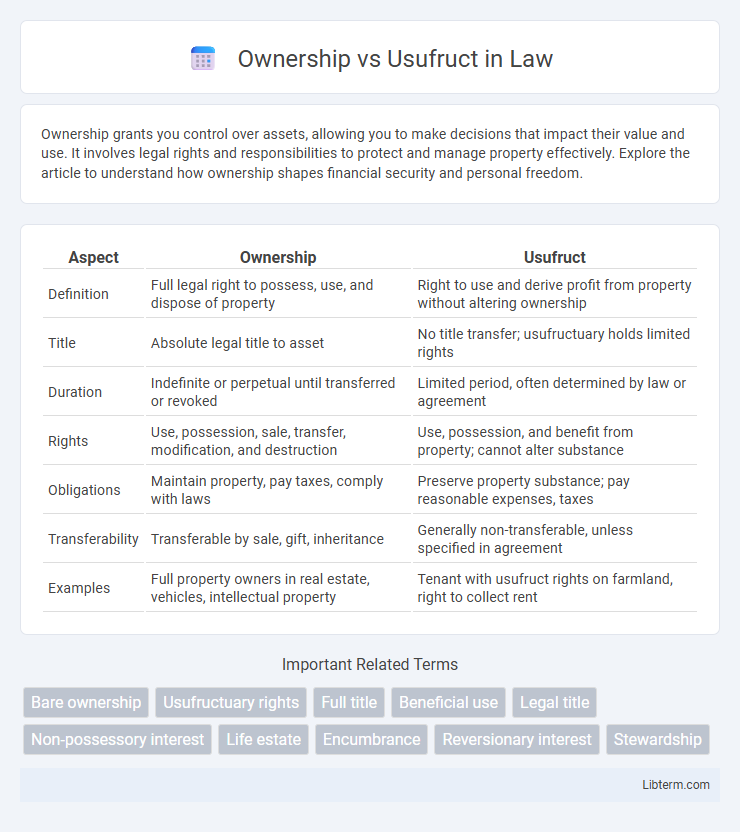

| Aspect | Ownership | Usufruct |

|---|---|---|

| Definition | Full legal right to possess, use, and dispose of property | Right to use and derive profit from property without altering ownership |

| Title | Absolute legal title to asset | No title transfer; usufructuary holds limited rights |

| Duration | Indefinite or perpetual until transferred or revoked | Limited period, often determined by law or agreement |

| Rights | Use, possession, sale, transfer, modification, and destruction | Use, possession, and benefit from property; cannot alter substance |

| Obligations | Maintain property, pay taxes, comply with laws | Preserve property substance; pay reasonable expenses, taxes |

| Transferability | Transferable by sale, gift, inheritance | Generally non-transferable, unless specified in agreement |

| Examples | Full property owners in real estate, vehicles, intellectual property | Tenant with usufruct rights on farmland, right to collect rent |

Understanding Ownership: Definition and Key Features

Ownership refers to the full legal right to possess, use, and dispose of property or assets, encompassing exclusive control and transferability. Key features include the rights of enjoyment, control, exclusion, and the ability to sell, lease, or bequeath the property. Ownership establishes a comprehensive bundle of rights that distinguishes it from limited interests such as usufruct, which grants temporary use without full ownership.

Usufruct Explained: Rights Without Full Ownership

Usufruct grants the right to use and enjoy property, including earning income from it, without transferring full ownership. This limited real right allows the usufructuary to possess, benefit from, and maintain the asset, while the bare owner retains the title. Usufruct typically applies to movable and immovable property, balancing the economic benefits with protection of the owner's interest.

Legal Distinctions: Ownership vs Usufruct

Ownership grants full legal rights to possess, use, and dispose of property permanently, including the right to transfer or sell. Usufruct provides the legal right to use and enjoy the benefits of property owned by another, without altering its substance, typically for a specified period or the usufructuary's lifetime. Legal distinctions pivot on the extent of control, with ownership conferring absolute rights, while usufruct limits rights to usage and profit, preserving the owner's fundamental ownership rights.

Key Responsibilities of Owners

Owners hold full legal title to property, granting them rights to use, sell, lease, or transfer ownership at their discretion. They bear responsibility for property taxes, maintenance, insurance, and compliance with local laws and regulations. Owners must also manage risks related to property value fluctuations and ensure proper documentation for all transactions.

Usufructuary Rights and Limitations

Usufructuary rights grant the individual (usufructuary) the legal authority to use and derive benefits from a property owned by another person, without altering its substance or ownership. The usufructuary must preserve the property's condition, ensuring no waste or damage occurs, and is responsible for ordinary maintenance and upkeep costs. Limitations include the inability to sell or mortgage the property, and the rights typically terminate after a specified period or upon the usufructuary's death.

Transferability: Can You Sell Ownership or Usufruct?

Ownership grants full rights to transfer, sell, or mortgage the property, including both the legal title and possession. Usufruct allows the holder to use and enjoy the property but limits transferability to the rights of use only, typically prohibiting sale since ownership remains with another party. Transfer of usufruct rights usually requires adherence to specific legal conditions and does not include transferring the underlying ownership title.

Impact on Inheritance and Succession

Ownership grants full rights to transfer property through inheritance, allowing heirs to assume complete control and disposal of the asset. Usufruct confers a temporary right to use and enjoy the property, but the substance remains with the owner, limiting heirs' claims to full ownership upon succession. This distinction affects estate planning, as usufruct rights expire upon death or term, while ownership passes indefinitely to successors.

Tax Implications: Ownership vs Usufruct

Ownership entails full legal title and responsibility for property taxes, while usufruct grants temporary rights to use and benefit from an asset without transferring title, often resulting in different tax obligations. Usufructuary typically pays income tax on benefits derived from the property, whereas the owner remains liable for property tax and potential capital gains tax upon sale. Understanding these distinctions is crucial for optimizing tax strategy in estate planning and asset management.

Duration and Termination of Usufruct

Usufruct grants a limited right to use and benefit from a property without transferring ownership, typically lasting for the usufructuary's lifetime or a fixed term set by agreement or law. Duration of usufruct often depends on specific conditions, such as the existence of the usufructuary or expiration of a contractual period. Termination occurs upon expiration of the term, death of the usufructuary, destruction of the property, or mutual agreement, at which point full ownership rights revert to the bare owner.

Practical Scenarios: Choosing Between Ownership and Usufruct

In real estate, ownership grants full control and rights over a property, allowing the owner to sell, modify, or lease it freely, making it ideal for those seeking long-term investment or complete authority. Usufruct, however, provides the right to use and benefit from a property without transferring ownership, often used in inheritance planning or when one party wishes to retain ownership while another enjoys property use. Choosing between ownership and usufruct depends on the need for control, duration of use, and financial goals, with usufruct serving practical purposes in scenarios involving temporary use or shared rights.

Ownership Infographic

libterm.com

libterm.com