Uninsurable title refers to a property title with defects or legal issues that prevent insurance companies from providing coverage, which can include unresolved liens, ownership disputes, or fraudulent documentation. This risk poses significant challenges in real estate transactions, potentially delaying sales or affecting property value due to the buyer's inability to secure title insurance. Explore the full article to understand how uninsurable titles impact your property investments and options for resolving these issues.

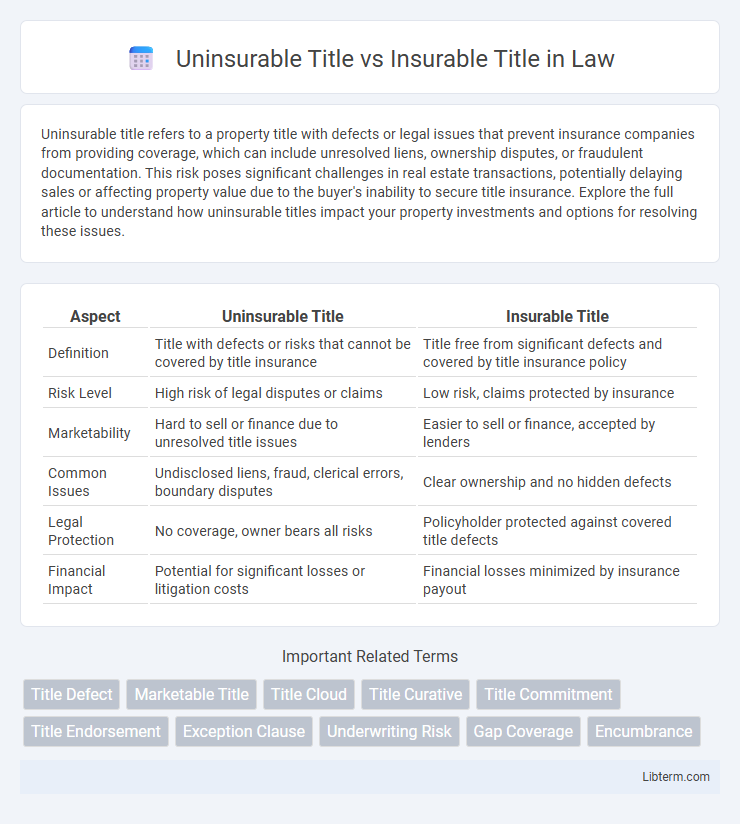

Table of Comparison

| Aspect | Uninsurable Title | Insurable Title |

|---|---|---|

| Definition | Title with defects or risks that cannot be covered by title insurance | Title free from significant defects and covered by title insurance policy |

| Risk Level | High risk of legal disputes or claims | Low risk, claims protected by insurance |

| Marketability | Hard to sell or finance due to unresolved title issues | Easier to sell or finance, accepted by lenders |

| Common Issues | Undisclosed liens, fraud, clerical errors, boundary disputes | Clear ownership and no hidden defects |

| Legal Protection | No coverage, owner bears all risks | Policyholder protected against covered title defects |

| Financial Impact | Potential for significant losses or litigation costs | Financial losses minimized by insurance payout |

Understanding Real Estate Title: Key Concepts

Uninsurable title refers to property ownership with defects or claims that title insurance companies refuse to cover due to unresolved legal issues, liens, or undisclosed heirs. Insurable title means the property's ownership is clear of significant disputes or encumbrances, allowing title insurers to provide coverage against potential financial loss. Understanding these distinctions is crucial when conducting real estate transactions to ensure secure property ownership and minimize risk.

What is an Uninsurable Title?

An uninsurable title refers to a property ownership record with defects or legal issues that prevent title insurance companies from providing coverage. Common problems may include unresolved liens, fraudulent transfers, boundary disputes, or missing heirs, which pose significant financial risks to buyers and lenders. Title insurance protects against future claims, but when a title is deemed uninsurable, these risks remain uncovered, making the property transaction potentially hazardous.

What is an Insurable Title?

An insurable title guarantees that a property has clear ownership without any hidden liens, claims, or legal defects that could jeopardize the owner's rights. Title insurance companies provide coverage to protect buyers and lenders from financial loss due to disputes or errors in the title. Unlike an uninsurable title, which presents unresolved issues or risks, an insurable title ensures marketable ownership and smooth property transactions.

Causes of an Uninsurable Title

Uninsurable title occurs primarily due to defects such as unresolved liens, fraud, errors in public records, or unclear ownership history that create significant risks for lenders and buyers. Common causes include boundary disputes, missing heirs, forged documents, and improper or missing legal descriptions of the property. These issues prevent title insurance companies from providing coverage, compelling a thorough title search and resolution before closing.

Risks Associated with Uninsurable Titles

Uninsurable titles present significant risks, including unresolved liens, ownership disputes, or undisclosed heirs, which can lead to costly legal battles and loss of property rights. Unlike insurable titles that have been thoroughly vetted and backed by title insurance policies covering potential defects, uninsurable titles lack this protection, exposing buyers to financial vulnerabilities. The absence of coverage for hidden title issues increases the likelihood of title claims, making transactions with uninsurable titles considerably riskier for property investors and homeowners.

Benefits of Having an Insurable Title

An insurable title provides legal protection by safeguarding property owners and lenders against potential title defects, liens, or claims that could arise after purchase. This assurance enhances property value and facilitates smoother real estate transactions by reducing financial risks and increasing buyer confidence. Access to title insurance mitigates costly disputes, ensuring clear ownership and peace of mind throughout property ownership.

Title Insurance: Protection for Homebuyers

Uninsurable title refers to property titles with significant legal defects or unresolved claims that prevent title insurance companies from providing coverage, posing a high risk to homebuyers. Insurable title means the title is free from major liens, disputes, or encumbrances, allowing title insurance policies to protect buyers against potential financial loss due to undiscovered title issues. Title insurance is essential for homebuyers as it safeguards ownership rights and investment by covering costs related to title defects, fraud, or clerical errors discovered after purchase.

How to Identify Title Issues Before Purchase

Uninsurable titles often exhibit defects such as unresolved liens, boundary disputes, or missing heirs, which can be identified through comprehensive title searches and professional title examinations before purchase. Insurable titles typically have clear ownership records verified by title insurance companies, reducing the risk of future legal claims. Conducting a thorough review of public records, historical ownership documents, and engaging a qualified title professional ensures accurate identification of title issues prior to property acquisition.

Resolving Title Defects: Steps and Solutions

Resolving title defects involves identifying issues such as liens, encumbrances, or ownership disputes that render a title uninsurable, then taking corrective actions like paying outstanding debts, obtaining releases, or initiating quiet title lawsuits to clear the record. Insurable titles have met underwriting standards after defects are addressed, allowing title insurance companies to provide coverage and protect against future claims. Effective resolution requires thorough title searches, legal intervention when necessary, and cooperation among parties to ensure marketable, insurable ownership rights.

Choosing a Reliable Title Company

Choosing a reliable title company is crucial when dealing with uninsurable title issues, as they have the expertise to identify, resolve, or mitigate defects that make titles uninsurable. Insurable titles guarantee protection against defects and claims, providing peace of mind through title insurance policies backed by reputable underwriters. A professional title company ensures thorough title searches, risk assessments, and clear communication, safeguarding property transactions from potential legal complications.

Uninsurable Title Infographic

libterm.com

libterm.com