Succession planning ensures a seamless transition of leadership within organizations, safeguarding business continuity and preserving institutional knowledge. Effective strategies identify and develop future leaders, aligning talent management with long-term organizational goals. Discover how succession can impact your company's future and learn the key steps to implement a successful plan in the rest of this article.

Table of Comparison

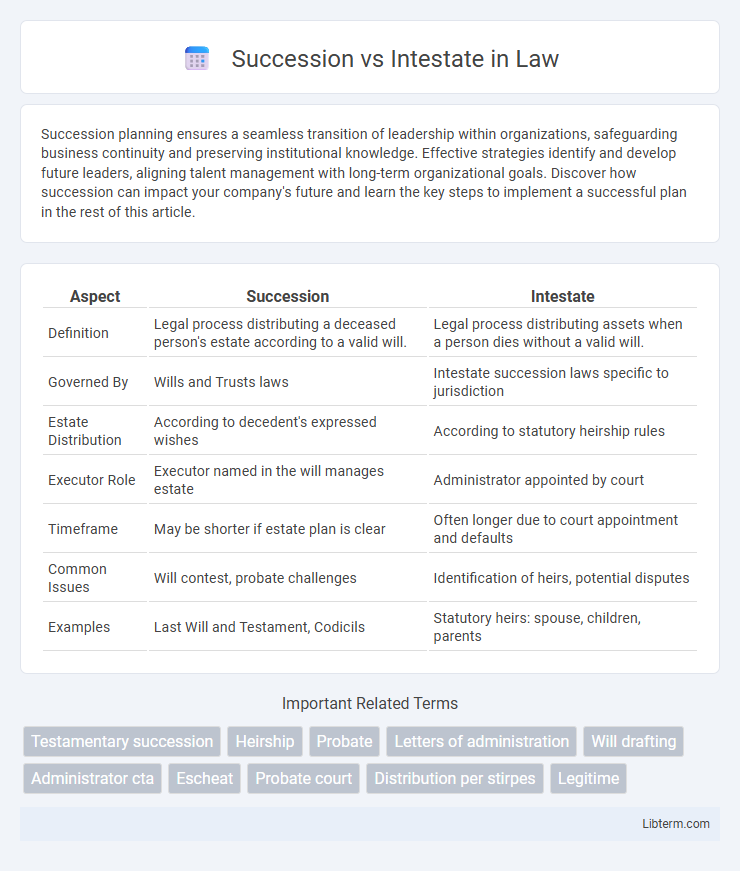

| Aspect | Succession | Intestate |

|---|---|---|

| Definition | Legal process distributing a deceased person's estate according to a valid will. | Legal process distributing assets when a person dies without a valid will. |

| Governed By | Wills and Trusts laws | Intestate succession laws specific to jurisdiction |

| Estate Distribution | According to decedent's expressed wishes | According to statutory heirship rules |

| Executor Role | Executor named in the will manages estate | Administrator appointed by court |

| Timeframe | May be shorter if estate plan is clear | Often longer due to court appointment and defaults |

| Common Issues | Will contest, probate challenges | Identification of heirs, potential disputes |

| Examples | Last Will and Testament, Codicils | Statutory heirs: spouse, children, parents |

Understanding Succession: Definition and Types

Succession refers to the legal process by which the estate of a deceased person is transferred to their heirs or beneficiaries, governed by either a valid will or by intestate succession laws in the absence of one. There are two primary types: testate succession, where the deceased leaves a valid will specifying asset distribution, and intestate succession, where distribution follows statutory guidelines due to the absence of a will. Understanding these distinctions is crucial for estate planning and resolving inheritance disputes efficiently.

What is Intestate Succession?

Intestate succession occurs when a person dies without a valid will, causing their estate to be distributed according to state or national laws. The distribution follows a legal hierarchy, typically prioritizing spouses, children, and close relatives, ensuring assets are allocated to eligible heirs. Understanding intestate succession is crucial for estate planning to avoid unintended distribution of property.

Key Differences Between Succession and Intestate

Succession refers to the legal process where property and assets are transferred according to a valid will, while intestate succession occurs when a person dies without a will, and state laws determine the distribution. Key differences include the method of asset allocation, with succession following the deceased's explicit wishes, and intestate succession relying on statutory guidelines which prioritize heirs such as spouses, children, and relatives. Succession often involves executor oversight, whereas intestate cases typically require court-appointed administrators to manage estate distribution.

Legal Framework Governing Succession

The legal framework governing succession is primarily established by statutory laws and jurisdictional regulations that dictate how an estate is distributed upon an individual's death. Succession refers to the orderly transfer of assets according to a valid will, whereas intestate succession occurs when a person dies without a will, triggering default inheritance rules outlined in probate law. These frameworks ensure asset distribution aligns with legal standards, protecting heirs' rights and clarifying fiduciary responsibilities.

Consequences of Dying Intestate

Dying intestate means a person passes away without leaving a valid will, causing the estate to be distributed according to state intestacy laws. This often results in assets being allocated to legal heirs such as spouses, children, or relatives, which may not align with the deceased's wishes. Intestate succession can lead to longer probate processes, potential family disputes, and unintended beneficiaries receiving portions of the estate.

Importance of Having a Valid Will

Having a valid will ensures that your assets are distributed according to your wishes, avoiding the default state laws that govern intestate succession. Intestate succession often leads to delays, increased legal costs, and potential family disputes due to the lack of clear instructions. A properly drafted will provides clarity, reduces conflict, and facilitates a smoother transfer of wealth to designated beneficiaries.

Succession Planning: Best Practices

Effective succession planning involves identifying and developing internal talent to ensure a smooth leadership transition, minimizing business disruptions and preserving organizational knowledge. Key best practices include creating a detailed succession roadmap, engaging stakeholders in the process, and regularly updating plans to reflect changing business needs and employee capabilities. Utilizing tools like talent assessments and mentorship programs supports continuous development and aligns successor readiness with long-term corporate goals.

Heirs and Beneficiaries: Succession vs Intestate

Succession law dictates the orderly transfer of property to heirs or beneficiaries according to a valid will, clearly specifying individual shares and conditions. In intestate cases, state laws govern inheritance distribution, prioritizing spouses, children, and closest relatives as statutory heirs without testamentary instructions. Understanding the distinction ensures rightful claims and prevents disputes among potential beneficiaries in estate settlements.

Role of Courts in Intestate Proceedings

In intestate proceedings, courts play a crucial role in determining the rightful heirs by interpreting and applying state succession laws when a person dies without a valid will. They oversee the appointment of administrators to manage the decedent's estate, ensuring debts are paid and assets are distributed according to intestate succession statutes. Court involvement guarantees legal compliance, resolves disputes among potential heirs, and protects the interests of creditors and beneficiaries.

Avoiding Intestate: Practical Tips for Estate Planning

To avoid intestate succession, drafting a comprehensive and legally valid will is essential, clearly specifying asset distribution and executor appointments. Regularly updating estate planning documents ensures alignment with life changes such as marriages, births, or acquisitions of significant assets. Utilizing trusts and beneficiary designations on financial accounts further safeguards against intestacy, providing precise control over asset transfer and minimizing probate delays.

Succession Infographic

libterm.com

libterm.com