A conflict of interest arises when personal interests potentially influence professional decisions, compromising objectivity and integrity. Identifying and managing these conflicts ensures transparency and maintains trust in any professional environment. Discover how to recognize and address conflicts of interest effectively in the rest of this article.

Table of Comparison

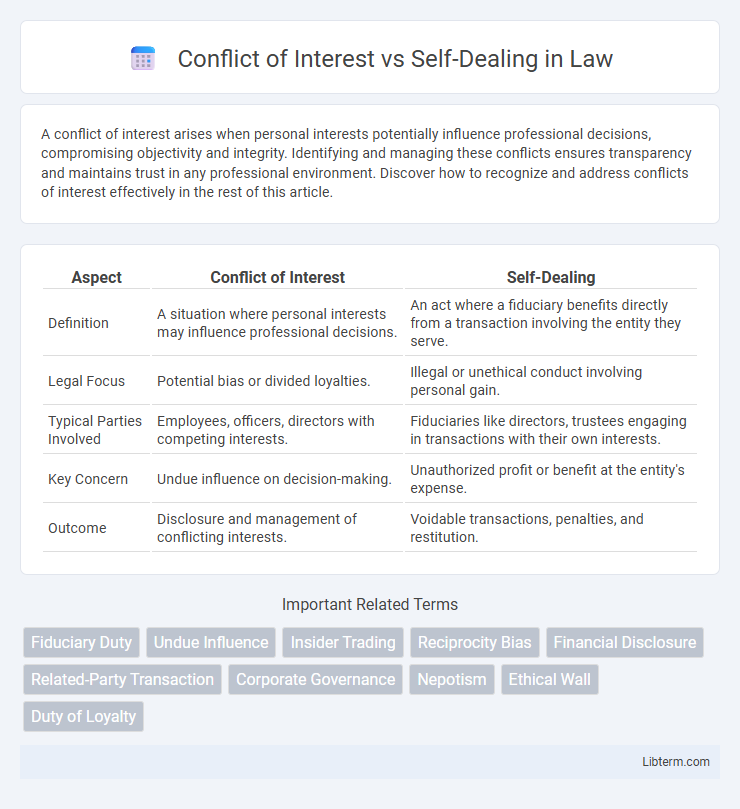

| Aspect | Conflict of Interest | Self-Dealing |

|---|---|---|

| Definition | A situation where personal interests may influence professional decisions. | An act where a fiduciary benefits directly from a transaction involving the entity they serve. |

| Legal Focus | Potential bias or divided loyalties. | Illegal or unethical conduct involving personal gain. |

| Typical Parties Involved | Employees, officers, directors with competing interests. | Fiduciaries like directors, trustees engaging in transactions with their own interests. |

| Key Concern | Undue influence on decision-making. | Unauthorized profit or benefit at the entity's expense. |

| Outcome | Disclosure and management of conflicting interests. | Voidable transactions, penalties, and restitution. |

Understanding Conflict of Interest

Conflict of interest arises when personal interests potentially influence professional decisions, creating a risk of biased judgment. It differs from self-dealing, which involves directly profiting from one's position, often illegally or unethically. Recognizing conflict of interest is vital for maintaining transparency and trust in corporate governance and regulatory compliance.

Defining Self-Dealing

Self-dealing occurs when an individual in a position of trust, such as a corporate officer or fiduciary, uses their authority to benefit personally at the expense of the entity they serve. This practice involves actions like awarding contracts, loans, or transactions where the individual's interests conflict with their duty to prioritize the organization's welfare. Unlike broader conflicts of interest, self-dealing specifically refers to concrete transactions that improperly enrich the decision-maker.

Key Differences Between Conflict of Interest and Self-Dealing

Conflict of interest occurs when an individual's personal interests potentially interfere with their professional duties, whereas self-dealing specifically involves an individual acting in their own financial interest within a fiduciary capacity. The key difference lies in self-dealing being a form of conflict of interest characterized by direct personal gain from decisions made in a position of trust. Understanding this distinction is crucial for maintaining ethical standards in corporate governance and legal compliance.

Common Examples in Business and Government

Common examples of conflict of interest in business and government include employees awarding contracts to family members or owning shares in a competing company, which may compromise impartial decision-making. Self-dealing occurs when executives or officials manipulate transactions for personal gain, such as approving loans to companies they personally control or using insider information to benefit their investments. Both practices undermine trust and legal compliance by prioritizing personal interests over organizational or public responsibilities.

Legal Implications and Consequences

Conflict of interest arises when an individual's personal interests potentially interfere with their professional duties, creating a risk of biased decision-making. Self-dealing involves a fiduciary exploiting their position to benefit personally, often breaching trust and violating corporate governance laws. Legal implications for both include civil penalties, rescission of transactions, and possible criminal charges, emphasizing the need for stringent compliance and transparent disclosures.

Recognizing Red Flags in Organizational Settings

Recognizing red flags in organizational settings involves identifying situations where personal interests may improperly influence professional decisions, signaling a conflict of interest or self-dealing. Indicators include undisclosed financial relationships, favoritism in awarding contracts, or misuse of organizational resources for personal gain. Vigilant monitoring of transactions and enforcing transparency policies help prevent ethical breaches and protect organizational integrity.

Best Practices for Prevention and Disclosure

Conflict of interest and self-dealing require robust prevention and disclosure protocols to ensure ethical governance and legal compliance. Establishing clear policies that define and differentiate conflicts from self-dealing, combined with mandatory disclosure forms and regular training sessions, enhances transparency and accountability. Implementing oversight mechanisms, such as independent audits and review boards, further mitigates risks by monitoring transactions and enforcing corrective actions.

The Role of Ethics Committees and Compliance

Ethics committees play a crucial role in identifying and managing conflicts of interest and self-dealing by enforcing strict compliance policies that maintain organizational integrity. These committees implement rigorous review processes to detect potential abuses of power where personal gain conflicts with fiduciary duties. Compliance programs ensure transparency and accountability, minimizing risks and safeguarding stakeholder trust in decision-making frameworks.

Case Studies: Real-World Scenarios

Case studies reveal that conflict of interest occurs when a decision-maker's personal interests potentially influence professional judgment, as seen in corporate board members voting on contracts benefiting relatives. Self-dealing involves more direct misuse of position for personal gain, demonstrated by executives channeling company funds into businesses they own. Real-world examples, such as the Enron scandal and recent government procurement frauds, illustrate the importance of strict governance and transparency to prevent ethical breaches.

Steps for Addressing and Resolving Violations

Steps for addressing and resolving conflict of interest and self-dealing violations include conducting a thorough investigation to identify the extent and impact of the misconduct. Implementing corrective actions such as recusal from decision-making, restitution of any financial losses, and disciplinary measures helps restore organizational integrity. Establishing clear policies, ongoing training, and transparent reporting mechanisms prevents recurrence and promotes accountability.

Conflict of Interest Infographic

libterm.com

libterm.com