Insurance protects you from financial loss by transferring risk to an insurer in exchange for premium payments. It covers various areas such as health, auto, home, and life, ensuring peace of mind and financial security. Discover more about how the right insurance plans can safeguard your future in the rest of the article.

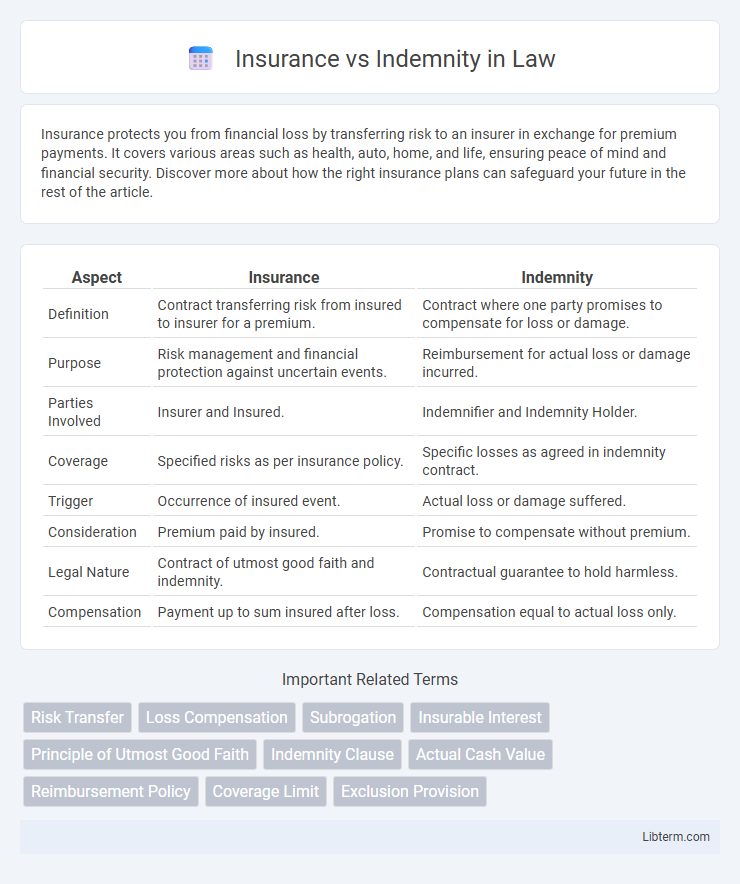

Table of Comparison

| Aspect | Insurance | Indemnity |

|---|---|---|

| Definition | Contract transferring risk from insured to insurer for a premium. | Contract where one party promises to compensate for loss or damage. |

| Purpose | Risk management and financial protection against uncertain events. | Reimbursement for actual loss or damage incurred. |

| Parties Involved | Insurer and Insured. | Indemnifier and Indemnity Holder. |

| Coverage | Specified risks as per insurance policy. | Specific losses as agreed in indemnity contract. |

| Trigger | Occurrence of insured event. | Actual loss or damage suffered. |

| Consideration | Premium paid by insured. | Promise to compensate without premium. |

| Legal Nature | Contract of utmost good faith and indemnity. | Contractual guarantee to hold harmless. |

| Compensation | Payment up to sum insured after loss. | Compensation equal to actual loss only. |

Understanding Insurance and Indemnity: Key Definitions

Insurance involves a contractual agreement where an insurer guarantees compensation for specific losses or damages in exchange for premium payments, transferring financial risk from the insured to the insurer. Indemnity refers to a legal obligation or contractual promise to compensate for actual loss or damage incurred, aiming to restore the injured party to their original financial position. Understanding these key definitions highlights insurance as a risk management tool and indemnity as the principle ensuring compensation aligns precisely with the loss suffered.

Core Principles: How Insurance Differs from Indemnity

Insurance involves transferring risk to an insurer who compensates for losses under a policy, while indemnity is a contractual obligation to restore a party to their original financial position after a loss. Core principles of insurance include risk pooling, premium payments, and coverage limits, whereas indemnity focuses on financial reimbursement without profit. Unlike indemnity, insurance spreads potential losses across many policyholders, providing broader financial protection.

Types of Insurance Policies vs Indemnity Agreements

Types of insurance policies include life, health, auto, property, and liability insurance, each providing financial protection against specific risks through contractual agreements with insurers. Indemnity agreements, typically contractual clauses or standalone contracts, obligate one party to compensate another for losses or damages, often used in commercial transactions and service contracts. While insurance policies transfer risk to an insurer with coverage limits and premiums, indemnity agreements directly allocate financial responsibility between parties without involving an insurance provider.

Scope of Coverage: Insurance vs Indemnity

Insurance coverage involves a contractual agreement where the insurer assumes financial risk for specified losses, typically covering a broad range of potential damages defined in the policy terms. Indemnity, by contrast, generally refers to a contractual obligation where one party agrees to compensate another for specific losses or damages arising from particular liabilities or claims. The scope of insurance is typically more comprehensive, transferring risk to the insurer, while indemnity covers direct reimbursement for losses without transferring the underlying risk.

Legal Framework Governing Insurance and Indemnity

The legal framework governing insurance is primarily based on contract law and regulatory statutes designed to protect policyholders and ensure the insurer's solvency. Indemnity, rooted in tort law and contractual principles, involves compensating a party for actual losses incurred, emphasizing restoration rather than profit. Insurance contracts typically include specific clauses such as insurable interest and utmost good faith, distinguishing them from indemnity agreements that focus on restoring the indemnified party to their pre-loss position.

Claim Procedures: Insurance Claims vs Indemnity Claims

Insurance claims involve submitting a formal request to the insurer with required documentation such as policy details, proof of loss, and damage assessment, followed by a claims adjuster's evaluation and approval for compensation. Indemnity claims typically require demonstrating actual financial loss or damage and may involve direct negotiations between the indemnitor and the claimant without the formalized process found in insurance claims. Both claim procedures demand accurate evidence and timely submission, but insurance claims often follow standardized protocols regulated by insurance companies and authorities.

Financial Implications and Risk Allocation

Insurance transfers financial risk from the insured to the insurer through premium payments, providing compensation for covered losses up to policy limits. Indemnity clauses allocate risk between parties by requiring one party to compensate the other for specific damages or losses, often related to negligence or contract breaches. Financial implications differ as insurance spreads risk across many policyholders, while indemnity places direct financial responsibility on the party assuming the risk.

Common Examples of Insurance and Indemnity in Practice

Common examples of insurance include health insurance, auto insurance, and property insurance, where policyholders pay premiums for coverage against potential losses. Indemnity typically appears in contractor agreements, where one party agrees to compensate the other for damages or losses arising from specific liabilities. In practice, insurance transfers risk to an insurer for financial protection, while indemnity ensures direct reimbursement between involved parties for losses incurred.

Pros and Cons: Choosing Between Insurance and Indemnity

Insurance provides financial protection against specified risks by transferring risk to an insurer, offering predictability and peace of mind but often involving premium costs and policy limitations. Indemnity agreements create a contractual obligation to compensate losses, allowing for tailored risk allocation without upfront costs but exposing parties to potentially unlimited liabilities. Choosing between insurance and indemnity requires weighing the certainty and coverage scope of insurance against the flexibility and risk exposure inherent in indemnity arrangements.

Which is Right for You: Insurance or Indemnity?

Choosing between insurance and indemnity depends on your risk management needs and financial protection goals. Insurance offers a policy with premiums to cover potential losses across various risks, ideal for individuals and businesses seeking broad, predictable coverage. Indemnity focuses on compensating for specific damages or losses after they occur, suitable for situations requiring tailored, contract-based protection.

Insurance Infographic

libterm.com

libterm.com