Indorsee is an innovative platform designed to streamline the endorsement process by leveraging blockchain technology to ensure authenticity and transparency. It simplifies verification for both individuals and businesses, enhancing trust and reducing fraud in endorsements. Explore the article to discover how Indorsee can transform your endorsement experience and boost credibility.

Table of Comparison

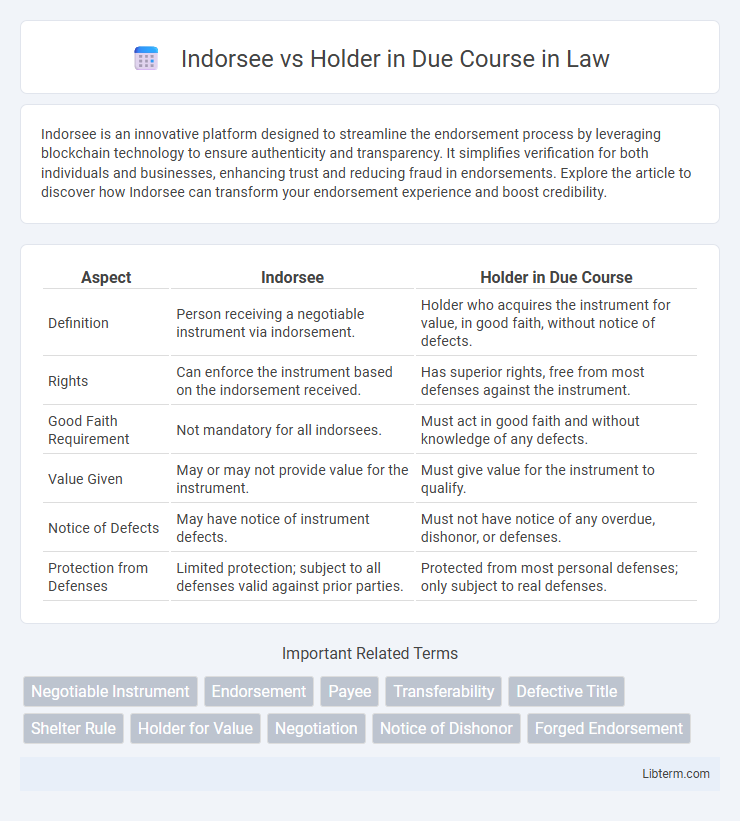

| Aspect | Indorsee | Holder in Due Course |

|---|---|---|

| Definition | Person receiving a negotiable instrument via indorsement. | Holder who acquires the instrument for value, in good faith, without notice of defects. |

| Rights | Can enforce the instrument based on the indorsement received. | Has superior rights, free from most defenses against the instrument. |

| Good Faith Requirement | Not mandatory for all indorsees. | Must act in good faith and without knowledge of any defects. |

| Value Given | May or may not provide value for the instrument. | Must give value for the instrument to qualify. |

| Notice of Defects | May have notice of instrument defects. | Must not have notice of any overdue, dishonor, or defenses. |

| Protection from Defenses | Limited protection; subject to all defenses valid against prior parties. | Protected from most personal defenses; only subject to real defenses. |

Introduction to Negotiable Instruments

Indorsee and Holder in Due Course are key parties in the framework of negotiable instruments, which are written documents guaranteeing the payment of a specific amount of money either on demand or at a set time. The Indorsee is a party to whom a negotiable instrument is endorsed, transferring the title and the right to collect the payment, while the Holder in Due Course is a holder who has acquired the instrument for value, in good faith, and without notice of defects, thereby enjoying enhanced protection against claims and defenses. Understanding the distinction between the Indorsee's mere transfer of entitlement and the Holder in Due Course's superior legal status is essential for the effective use and negotiation of bills of exchange, promissory notes, and checks.

Who is an Indorsee?

An indorsee is the person to whom a negotiable instrument, such as a check or promissory note, is transferred through endorsement by the holder. This individual obtains the rights to demand payment from the maker or drawer of the instrument but may have limited protection compared to a holder in due course. Unlike a holder in due course, an indorsee's claim is subject to defenses that may be valid against the original payee or holder.

Defining Holder in Due Course

A Holder in Due Course refers to a person who has obtained a negotiable instrument in good faith, for value, and without notice of any defects or claims against it, granting them superior rights over prior parties. Unlike a mere indorsee, who simply receives the instrument through endorsement, a Holder in Due Course enjoys protection from many defenses that could be raised against previous holders. This status ensures the Holder in Due Course can enforce the instrument free from certain disputes affecting the instrument's validity.

Legal Rights of an Indorsee

An indorsee acquires the legal right to enforce a negotiable instrument by receiving it through endorsement, subject to any defenses applicable against the transferor. Unlike a holder in due course who takes the instrument free from most defenses, an indorsee's rights depend on the validity of the endorsement and may be limited by claims or defenses against the previous holders. The indorsee can sue on the instrument only if the endorsement is genuine and the instrument is otherwise enforceable under commercial law.

Privileges Granted to a Holder in Due Course

A Holder in Due Course (HDC) enjoys significant privileges such as the right to enforce the instrument free from many defenses that could be raised against the original payee, including claims of fraud or failure of consideration. Unlike an indorsee, an HDC takes the instrument for value, in good faith, and without notice of defects, which grants superior protection against personal defenses but not against real defenses like forgery or incapacity. These privileges ensure that the HDC can collect payment even when prior parties have disputes, enhancing the negotiability and reliability of commercial paper.

Key Differences Between Indorsee and Holder in Due Course

An indorsee is a party to whom a negotiable instrument is transferred through endorsement, while a holder in due course (HDC) is a recipient who acquires the instrument for value, in good faith, and without notice of defects. Unlike an indorsee, an HDC enjoys superior rights, including protection against certain defenses and claims that could be raised against the original payee. The key difference lies in the HDC's ability to enforce the instrument free from many personal defenses, enhancing security in commercial transactions.

Liabilities Associated with Indorsee

The indorsee assumes liability only after endorsing the negotiable instrument, thereby becoming responsible for payment if prior parties default. Unlike a holder in due course, who typically holds the instrument free from most defenses and liabilities, the indorsee's liability is secondary and contingent upon the endorsement and transfer process. This distinction is crucial in determining which parties bear financial responsibility during disputes or non-payment scenarios involving negotiable instruments.

Protection Under Law: Holder in Due Course

A Holder in Due Course (HDC) enjoys enhanced legal protection, allowing them to enforce payment free from many defenses that could be raised against the original payee or prior parties. This status shields the HDC from claims such as fraud, duress, or breach of contract related to the instrument, ensuring stronger security in negotiations. Unlike an indorsee without HDC status, the Holder in Due Course's rights are safeguarded by Article 3 of the Uniform Commercial Code or equivalent laws globally, promoting confidence in commercial transactions.

Real-Life Examples: Indorsee vs Holder in Due Course

An indorsee receives a negotiable instrument by endorsement and acquires rights subject to any defenses against the transferor, as seen when a person inherits a check but faces obstacles if the original payee defaulted. A holder in due course, exemplified by a bank that buys a promissory note for value in good faith without notice of defects, gains superior rights, free from most defenses that could be raised against previous holders. For instance, when a retailer accepts a transferred promissory note and qualifies as a holder in due course, they can enforce payment even if the maker claims fraud against the original payee.

Conclusion: Significance in Commercial Transactions

Indorsee and Holder in Due Course play crucial roles in commercial transactions by ensuring the free transferability and negotiability of instruments like checks and promissory notes. The Indorsee's legitimacy stems from the transfer of endorsement, while the Holder in Due Course possesses enhanced protection against defenses, promoting trust and fluidity in commerce. Understanding these distinctions safeguards parties' rights and fosters efficient financial operations.

Indorsee Infographic

libterm.com

libterm.com