A lien is a legal claim or right against a property, typically used as security for a debt or obligation. It ensures that creditors have a way to recover what is owed before the property can be sold or transferred. Discover how understanding liens can protect your interests and what steps to take next by reading the full article.

Table of Comparison

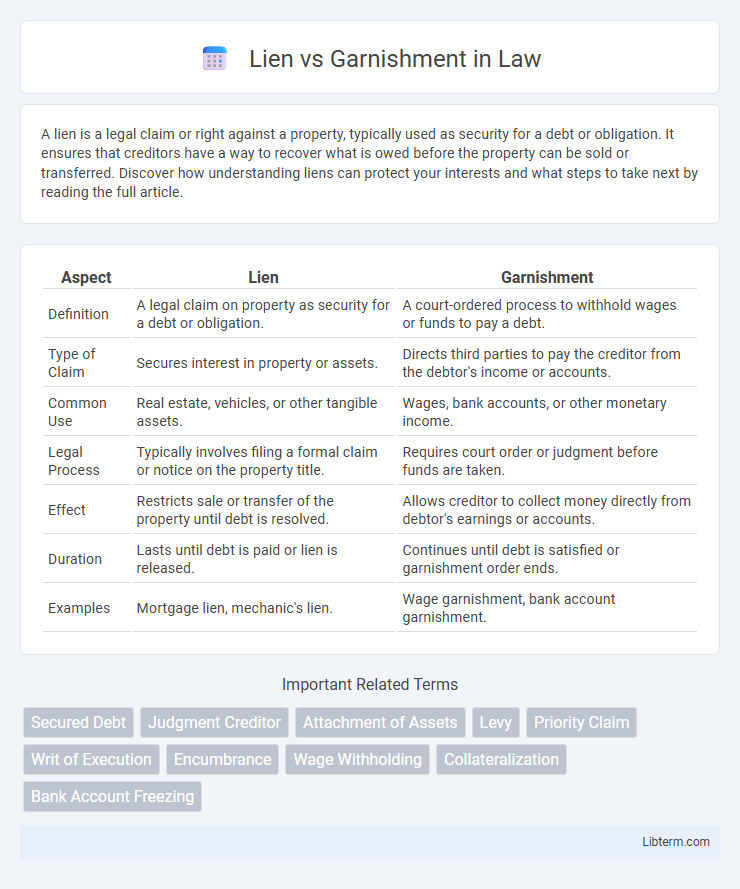

| Aspect | Lien | Garnishment |

|---|---|---|

| Definition | A legal claim on property as security for a debt or obligation. | A court-ordered process to withhold wages or funds to pay a debt. |

| Type of Claim | Secures interest in property or assets. | Directs third parties to pay the creditor from the debtor's income or accounts. |

| Common Use | Real estate, vehicles, or other tangible assets. | Wages, bank accounts, or other monetary income. |

| Legal Process | Typically involves filing a formal claim or notice on the property title. | Requires court order or judgment before funds are taken. |

| Effect | Restricts sale or transfer of the property until debt is resolved. | Allows creditor to collect money directly from debtor's earnings or accounts. |

| Duration | Lasts until debt is paid or lien is released. | Continues until debt is satisfied or garnishment order ends. |

| Examples | Mortgage lien, mechanic's lien. | Wage garnishment, bank account garnishment. |

Introduction to Lien and Garnishment

A lien is a legal claim or hold on a property as security for a debt owed, allowing creditors to ensure repayment before the property can be sold or transferred. Garnishment involves a court-ordered process where a portion of a debtor's wages or bank accounts is withheld to satisfy outstanding debts directly from their income or assets. Both tools serve as mechanisms for creditors to recover debts, but liens target property interests while garnishments target income or financial accounts.

Definition of Lien

A lien is a legal claim or hold on an asset granted to a creditor to secure the payment of a debt or obligation, providing the creditor with a right to retain possession or control over the property until the debt is satisfied. Liens can be voluntary, such as mortgage liens, or involuntary, like tax liens imposed by government authorities. Unlike garnishment, which involves the direct seizure of wages or bank accounts to satisfy debts, a lien creates a security interest that must generally be resolved before the asset can be sold or transferred.

Definition of Garnishment

Garnishment is a legal process through which a creditor collects a debt by seizing a portion of a debtor's wages or bank accounts directly from a third party, typically an employer or financial institution. This enforcement mechanism is used after a court judgment confirms the debtor owes the creditor money. Unlike a lien, which places a claim or hold on property to secure payment, garnishment actively redirects funds to satisfy the debt.

Key Differences Between Lien and Garnishment

A lien is a legal claim or hold on an asset to secure the payment of a debt, typically attaching to property such as real estate or vehicles, and remains until the debt is paid or resolved. Garnishment involves a court-ordered procedure where a portion of a debtor's wages or bank accounts is withheld by a third party, usually an employer or bank, to satisfy a creditor's claim. The key difference lies in the lien creating a security interest in property, while garnishment directly intercepts funds owed to the debtor before they receive them.

Types of Liens

Types of liens include consensual liens like mortgages and car loans, and non-consensual liens such as tax liens, judgment liens, and mechanic's liens, each securing a creditor's interest in property until a debt is satisfied. Tax liens arise from unpaid federal or state taxes, granting governments legal claims on assets, while judgment liens result from court decisions requiring debt repayment through property seizure. Mechanic's liens protect contractors and suppliers by allowing claims on real estate when contractors' payments are overdue, differentiating liens from garnishments, which directly seize debtor's wages or bank accounts.

Types of Garnishments

Types of garnishments include wage garnishment, bank account garnishment, and tax refund garnishment, each targeting different sources of debtor's funds. Wage garnishment involves deducting a portion of the debtor's paycheck to satisfy a debt, commonly used for unpaid child support or federal student loans. Bank account garnishment freezes and withdraws funds directly from the debtor's bank accounts, while tax refund garnishment intercepts government refunds to pay outstanding debts.

Legal Process for Obtaining a Lien

The legal process for obtaining a lien involves filing a claim with the appropriate government office, often requiring documentation proving the debt or obligation. Property owners must be properly notified, and the lien must comply with state-specific statutes, including deadlines and exact filing procedures. Once recorded, the lien attaches to the property, creating a legal encumbrance that secures the creditor's interest until the debt is satisfied or the lien is released.

Legal Process for Obtaining Garnishment

The legal process for obtaining garnishment begins with a creditor securing a judgment against a debtor through the court system. After the judgment, the creditor files a motion for garnishment, requesting the court to allow wages or bank accounts to be garnished to satisfy the debt. Courts typically require notification to the debtor and may impose limits on the amount garnished to protect the debtor's basic living expenses.

Impact on Debtors and Creditors

Liens create a legal claim on a debtor's property, limiting their ability to sell or refinance until the debt is satisfied, which often pressures debtors to resolve outstanding balances promptly. Creditors benefit from liens by securing priority to recover funds from the sale or refinancing of the property, enhancing their chances of debt repayment. Garnishments directly impact a debtor's income or bank accounts by legally redirecting funds to creditors, providing creditors with a more immediate means of debt collection but potentially straining the debtor's financial stability.

Choosing Between Lien and Garnishment

Choosing between a lien and garnishment depends on the creditor's goal and the debtor's financial situation. A lien places a legal claim on a debtor's property, affecting its sale or refinancing, while garnishment directly withholds wages or bank funds to satisfy the debt. Creditors seeking long-term security may prefer liens, whereas garnishment ensures quicker access to funds through wage or asset seizure.

Lien Infographic

libterm.com

libterm.com