A donee is an individual or entity who receives a gift, donation, or transfer of assets from a donor without any expectation of payment. Understanding the legal rights and responsibilities associated with donees is crucial for ensuring proper acceptance and management of the gifted property. Explore the rest of the article to learn more about how being a donee can impact your financial and legal situation.

Table of Comparison

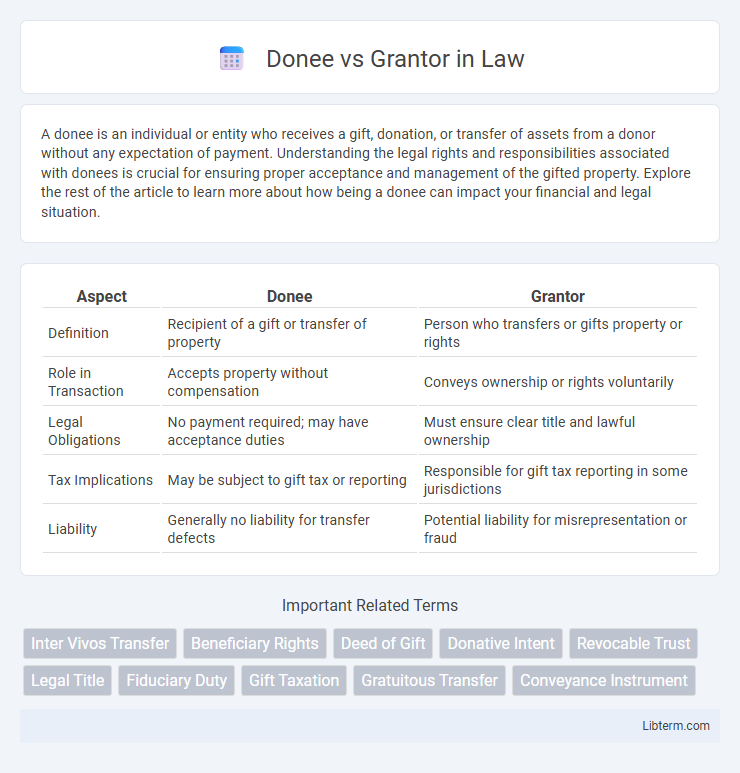

| Aspect | Donee | Grantor |

|---|---|---|

| Definition | Recipient of a gift or transfer of property | Person who transfers or gifts property or rights |

| Role in Transaction | Accepts property without compensation | Conveys ownership or rights voluntarily |

| Legal Obligations | No payment required; may have acceptance duties | Must ensure clear title and lawful ownership |

| Tax Implications | May be subject to gift tax or reporting | Responsible for gift tax reporting in some jurisdictions |

| Liability | Generally no liability for transfer defects | Potential liability for misrepresentation or fraud |

Introduction to Donee and Grantor

A donee is an individual or entity that receives a gift or property transfer without payment, typically through a legal instrument such as a deed or trust. A grantor, also known as a donor, is the person or party who transfers ownership or rights of assets to the donee. Understanding the roles of donee and grantor is essential in property law, estate planning, and charitable giving, as these terms define the transferor and recipient relationship in legal transactions.

Defining Donee: Rights and Roles

A donee is an individual or entity receiving a gift or transfer of property without monetary compensation, holding specific legal rights to accept and use the gifted asset. Donees possess the authority to manage, control, or dispose of the property consistent with the terms of the gift, distinguishing their role from that of the grantor, who initiates the transfer. Understanding the donee's rights is essential in property law, as these rights establish the foundation for ownership and responsibility post-transfer.

Defining Grantor: Responsibilities and Roles

The grantor is the individual or entity who transfers legal ownership of property or assets to another party, commonly known as the donee or grantee. Responsibilities of the grantor include ensuring clear title, preparing and executing all necessary legal documents, and often retaining certain rights or conditions based on the terms of the transfer. Roles of the grantor also encompass compliance with statutory requirements and providing warranties or guarantees regarding the property's authenticity and authority to transfer ownership.

Key Differences Between Donee and Grantor

A donee is an individual or entity that receives a gift or property, while a grantor is the person who transfers or grants the gift or property. Key differences revolve around ownership transfer: the grantor initiates the transaction by conveying rights or assets, and the donee assumes ownership without providing consideration. Legal responsibilities and tax implications vary, with the grantor often bearing potential gift tax obligations and the donee obtaining the benefits and title to the property.

Legal Implications of Being a Donee

A donee holds legal ownership of a gift upon its transfer, assuming full rights and responsibilities associated with the property or asset. Accepting a gift as a donee may involve tax liabilities such as gift tax, depending on jurisdictional thresholds and reporting requirements. Legal disputes can arise if the gift's validity is challenged, requiring the donee to prove legitimate transfer and absence of coercion or fraud.

Legal Obligations of a Grantor

The grantor holds significant legal obligations, including ensuring clear title transfer and providing accurate information about the property or asset, free from encumbrances or liens. They must also comply with all statutory requirements and contractual terms to validate the grant, preventing future disputes or claims from the donee or third parties. Failure to meet these obligations can result in legal liability, rescission of the transfer, or damages awarded to the donee.

Tax Considerations: Donee vs Grantor

Tax considerations for donees and grantors differ significantly, with grantors typically facing potential gift tax liabilities when transferring assets, while donees may benefit from receiving property without immediate tax consequences. The grantor must evaluate the annual gift tax exclusion limits and lifetime exemption thresholds to minimize taxable events. Donees should be aware of the basis in the gifted property, as it affects future capital gains tax upon sale.

Common Scenarios Involving Donees and Grantors

Common scenarios involving donees and grantors often include gift transfers where the grantor voluntarily transfers ownership of property or assets to the donee without receiving payment. In estate planning, grantors frequently establish trusts, appointing donees as beneficiaries to receive assets upon the grantor's death or under certain conditions. Another typical example is in real estate transactions, where the grantor conveys title to the donee through a deed to facilitate ownership changes or donations.

How to Transfer Ownership: Step-by-Step Guide

To transfer ownership from the grantor to the donee, start by preparing a valid deed, such as a warranty deed or quitclaim deed, that clearly identifies both parties and the property. The grantor must sign the deed in presence of a notary public to ensure legal authenticity and compliance with state laws. Finally, record the deed with the local county recorder's office to officially document the ownership transfer and protect the donee's property rights.

Frequently Asked Questions About Donee vs Grantor

A donee is the individual or entity receiving a gift or property, while a grantor is the person transferring ownership or rights. Frequently asked questions about donee vs grantor often address legal responsibilities, tax implications, and the nature of ownership transfer. Understanding distinctions between donee and grantor is essential for estate planning, gift taxation, and property law compliance.

Donee Infographic

libterm.com

libterm.com