Equity financing involves raising capital by selling shares of your company to investors, allowing you to fund growth without incurring debt. This strategy can dilute ownership but provides access to valuable resources and expertise from shareholders. Discover how equity financing can transform your business by exploring the full article.

Table of Comparison

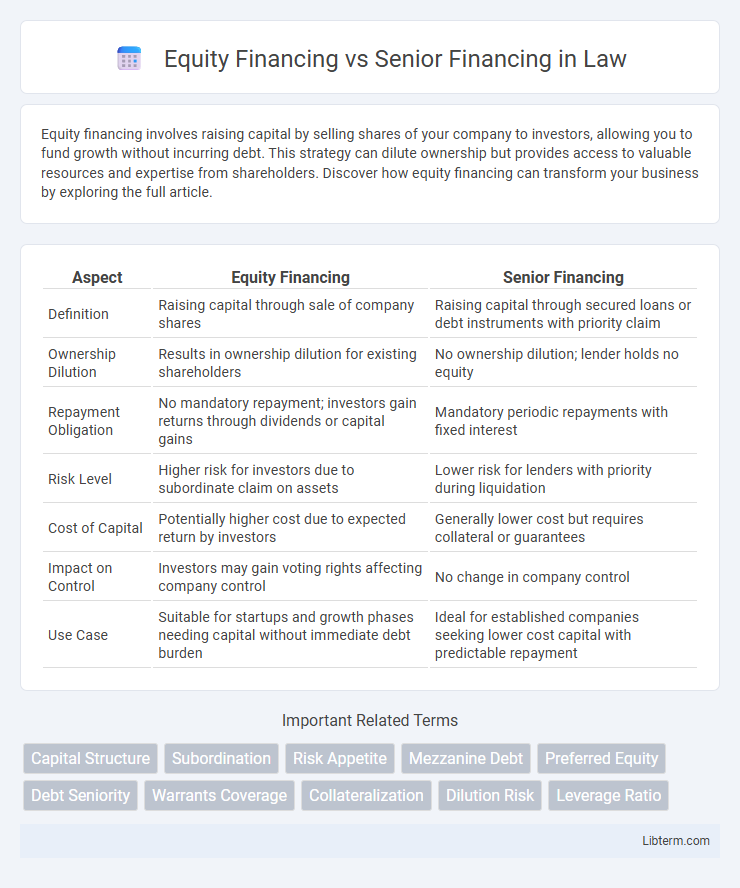

| Aspect | Equity Financing | Senior Financing |

|---|---|---|

| Definition | Raising capital through sale of company shares | Raising capital through secured loans or debt instruments with priority claim |

| Ownership Dilution | Results in ownership dilution for existing shareholders | No ownership dilution; lender holds no equity |

| Repayment Obligation | No mandatory repayment; investors gain returns through dividends or capital gains | Mandatory periodic repayments with fixed interest |

| Risk Level | Higher risk for investors due to subordinate claim on assets | Lower risk for lenders with priority during liquidation |

| Cost of Capital | Potentially higher cost due to expected return by investors | Generally lower cost but requires collateral or guarantees |

| Impact on Control | Investors may gain voting rights affecting company control | No change in company control |

| Use Case | Suitable for startups and growth phases needing capital without immediate debt burden | Ideal for established companies seeking lower cost capital with predictable repayment |

Introduction to Equity Financing and Senior Financing

Equity financing involves raising capital by selling shares of ownership in a company, allowing investors to gain partial control and share in future profits, making it a strategic choice for startups and growth-stage businesses seeking long-term funding without immediate repayment obligations. Senior financing refers to loans or debt instruments that hold priority over other types of financing, meaning senior lenders receive repayment first in the event of liquidation, often secured by company assets and carrying lower risk but fixed repayment terms. Understanding the differences between equity and senior financing is essential for businesses to balance control, risk, and capital structure effectively.

Key Differences Between Equity and Senior Financing

Equity financing involves raising capital by selling ownership shares, which dilutes control but does not require fixed repayments. Senior financing refers to debt that holds priority for repayment in case of liquidation, typically secured by assets and accompanied by fixed interest obligations. The key differences lie in risk allocation, repayment priority, and impact on company control--equity funding bears higher risk with profit participation, while senior debt offers lower risk with prioritized claims and no ownership dilution.

Types of Equity Financing

Equity financing primarily includes common stock issuance, preferred stock, and convertible securities, each offering varying degrees of ownership and control to investors. Common stock provides voting rights and potential dividends, preferred stock guarantees fixed dividends with priority over common stockholders, and convertible securities allow holders to convert debt into equity under predetermined conditions. These types enable companies to raise capital without incurring debt, contrasting with senior financing, which involves secured loans prioritized in claims during liquidation.

Types of Senior Financing

Senior financing primarily includes types such as term loans, revolving credit facilities, and secured bonds, each offering lenders priority claims on a company's assets in case of default. Term loans provide fixed amounts of capital with scheduled repayments, while revolving credit facilities allow for flexible borrowing up to a predefined limit. Secured bonds involve debt backed by specific collateral, reducing lender risk and often resulting in lower interest rates compared to unsecured debt.

Risk and Return Profiles

Equity financing involves raising capital by selling shares, exposing investors to higher risk due to potential market fluctuations but offering substantial returns through dividends and capital appreciation. Senior financing is characterized by lower risk as debt holders have priority claims on assets and cash flows, yet it generally provides fixed, limited returns through interest payments. The contrasting risk and return profiles make equity financing suitable for long-term growth investors, while senior financing appeals to risk-averse lenders seeking stable income.

Control and Ownership Implications

Equity financing involves selling ownership stakes, which dilutes control and decision-making power among shareholders, granting investors voting rights and influence over company strategy. Senior financing, typically structured as debt, preserves ownership and control for existing stakeholders since lenders do not hold equity or voting power, but it requires fixed repayments and priority claims over assets in case of liquidation. Companies must balance the trade-off between maintaining control through senior debt and raising capital via equity that shares ownership but reduces financial risk burden.

Impact on Company Balance Sheet

Equity financing increases shareholders' equity by issuing stock, enhancing the company's net worth and reducing financial leverage on the balance sheet. Senior financing introduces liabilities that appear as long-term debt, increasing debt ratios and potentially impacting credit ratings. The choice between equity and senior financing significantly affects the company's capital structure, risk profile, and balance sheet representation.

Cost of Capital Comparison

Equity financing typically involves higher cost of capital due to shareholder expectations for substantial returns and dilution risk, whereas senior financing incurs lower cost of capital as it is secured debt with priority claims in bankruptcy. Senior financing reduces lender risk through collateral and fixed interest rates, resulting in lower required returns compared to equity investors demanding compensation for ownership risk. The cost differential directly impacts capital structure decisions, influencing weighted average cost of capital (WACC) optimization and firm valuation.

Scenarios for Choosing Equity vs Senior Financing

Startups and high-growth companies often choose equity financing to access capital without immediate repayment obligations, particularly when cash flow is uncertain or business risk is high. Established firms with predictable revenues and assets may opt for senior financing to secure lower-cost debt with priority claims, especially when leveraging tax benefits and maintaining ownership control is important. In scenarios requiring rapid expansion or acquisition where preserving cash is critical, equity financing provides flexibility, whereas senior financing suits companies aiming to optimize capital structure with fixed repayment schedules.

Conclusion: Which Financing Option Suits Your Business?

Equity financing offers growth capital without immediate repayment obligations, ideal for startups seeking long-term expansion and risk-sharing with investors. Senior financing provides structured debt with priority claims, suitable for established businesses aiming to maintain ownership control and benefit from predictable repayment terms. Choosing between equity and senior financing depends on your company's stage, risk tolerance, and strategic goals for capital structure optimization.

Equity Financing Infographic

libterm.com

libterm.com