Apportionment involves the process of distributing something, such as legislative seats or resources, among various parties based on predetermined criteria like population or contribution. This method ensures fair representation and equitable allocation according to specific rules or formulas. Discover how apportionment affects governance and resource management throughout this article.

Table of Comparison

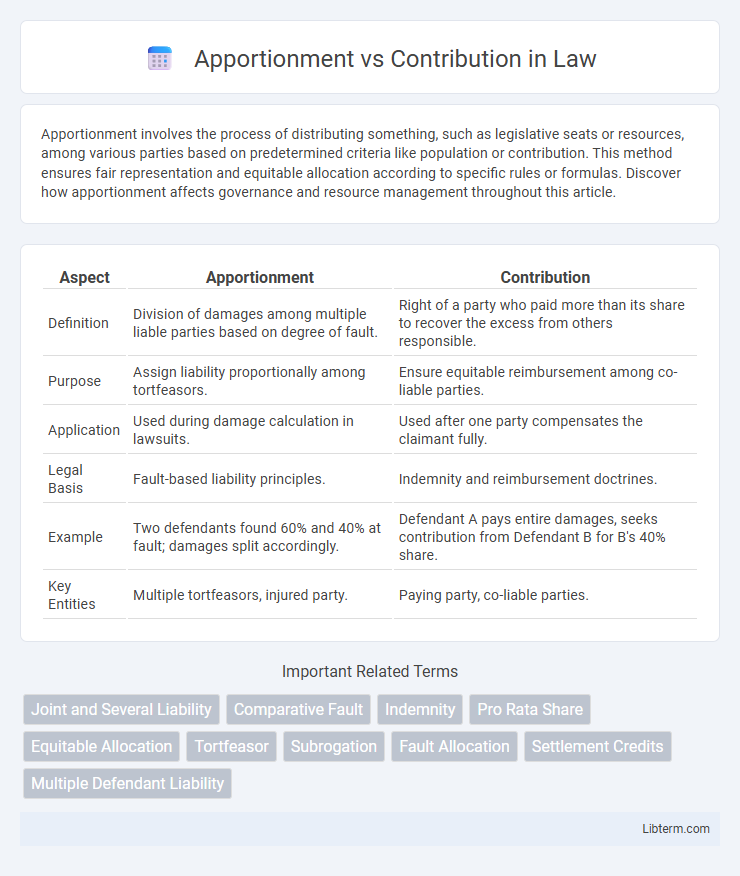

| Aspect | Apportionment | Contribution |

|---|---|---|

| Definition | Division of damages among multiple liable parties based on degree of fault. | Right of a party who paid more than its share to recover the excess from others responsible. |

| Purpose | Assign liability proportionally among tortfeasors. | Ensure equitable reimbursement among co-liable parties. |

| Application | Used during damage calculation in lawsuits. | Used after one party compensates the claimant fully. |

| Legal Basis | Fault-based liability principles. | Indemnity and reimbursement doctrines. |

| Example | Two defendants found 60% and 40% at fault; damages split accordingly. | Defendant A pays entire damages, seeks contribution from Defendant B for B's 40% share. |

| Key Entities | Multiple tortfeasors, injured party. | Paying party, co-liable parties. |

Introduction to Apportionment and Contribution

Apportionment divides liability or cost among multiple parties based on predetermined criteria such as usage, benefit, or responsibility, ensuring each party bears a fair share. Contribution involves one party paying more than their proportional share and seeking reimbursement from others who share the liability, balancing the financial burden. Both concepts play a critical role in legal, financial, and insurance contexts to allocate expenses or damages equitably.

Definition of Apportionment

Apportionment refers to the process of distributing liability or costs among multiple parties based on their respective share of responsibility or benefit. It is commonly used in legal and financial contexts to allocate damages, expenses, or resources proportionally. This allocation ensures fairness by correlating each party's involvement to their assigned portion of the overall obligation.

Definition of Contribution

Contribution refers to the payment made by one party to cover a portion of a loss or liability that another party has incurred, typically within insurance claims or legal settlements. It ensures that each responsible party pays their fair share based on the extent of their involvement or obligation, rather than the total loss amount. Contribution differs from apportionment, which divides liability or costs proportionally among parties but does not necessarily involve reimbursement between them.

Legal Basis for Apportionment and Contribution

Legal basis for apportionment is predominantly found in tort law, where liability is divided among multiple parties based on their degree of fault as established by statutes or case law precedents. Contribution arises from equitable principles allowing a party who pays more than their share of a common liability to seek reimbursement from others responsible, often governed by contracts or statutory provisions such as the Uniform Contribution Among Tortfeasors Act. Courts consistently reference these legal frameworks to determine proportionate financial responsibility and ensure fairness between jointly liable parties.

Key Differences Between Apportionment and Contribution

Apportionment allocates liability among multiple parties based on their respective degrees of fault or ownership, often used in property damage or insurance claims, while contribution involves one party seeking reimbursement from others for payments made on a shared obligation. Apportionment determines how much each liable party owes according to predefined legal or contractual rules, whereas contribution is the mechanism that enables a party who has overpaid to recover excess costs from co-obligors. The key difference lies in apportionment's role in assigning responsibility upfront versus contribution's function in balancing payments after one party has discharged more than their fair share.

Circumstances Requiring Apportionment

Circumstances requiring apportionment typically arise in insurance claims involving multiple liable parties or policies, where damages must be divided based on each party's proportionate responsibility. Apportionment ensures equitable distribution of costs according to factors like fault degree, coverage limits, or exposure periods, preventing overcompensation and duplicative payments. This contrasts with contribution, which involves one insurer seeking reimbursement from another after paying more than its fair share of a claim.

Circumstances Requiring Contribution

Circumstances requiring contribution arise when multiple parties share liability for a loss, necessitating fair distribution of damages among them based on their respective fault or benefit. In apportionment, liability is divided proportionally according to degree of responsibility, whereas contribution involves one party seeking reimbursement from others for costs already incurred. Legal frameworks typically mandate contribution when joint tortfeasors or co-obligors have paid more than their equitable share, ensuring balanced financial responsibility.

Practical Examples in Law

Apportionment in law involves dividing damages or liability among multiple parties based on their degree of fault, such as in a car accident where each driver's percentage of responsibility determines their payment. Contribution refers to a party who has paid more than their fair share seeking reimbursement from other liable parties, commonly seen in cases where one co-defendant pays the entire judgment and pursues others for their proportional share. Practical examples include tort liability disputes where states apply apportionment principles to allocate damages, while contribution claims arise when co-obligors seek equitable distribution of financial burdens.

Advantages and Limitations

Apportionment offers clear advantages in allocating shared expenses or liabilities based on fixed criteria such as time, use, or benefit, ensuring transparency and ease of calculation for parties involved. Its limitations include potential unfairness when contributions are not proportional to actual usage or responsibility, possibly leading to disputes. Contribution mechanisms promote equitable sharing of losses or costs according to individual fault or benefit, but they can be complex to determine and require detailed evidence, which may delay resolutions.

Conclusion and Best Practices

Apportionment allocates damages or liabilities based on each party's degree of fault, while contribution enables one party who pays more than their share to recover excess amounts from others responsible. Effective resolution relies on thorough liability assessment and clear legal frameworks governing apportionment and contribution rights. Best practices include maintaining detailed records, seeking early mediation, and ensuring compliance with jurisdiction-specific laws to optimize fair cost distribution.

Apportionment Infographic

libterm.com

libterm.com