A Bargain and Sale Deed transfers property ownership without warranties against encumbrances, placing the risk of title issues on the buyer. This type of deed is common in transactions where the seller does not guarantee a clear title, such as foreclosures or tax sales. Explore the detailed insights in the rest of this article to understand how a Bargain and Sale Deed impacts your real estate investment.

Table of Comparison

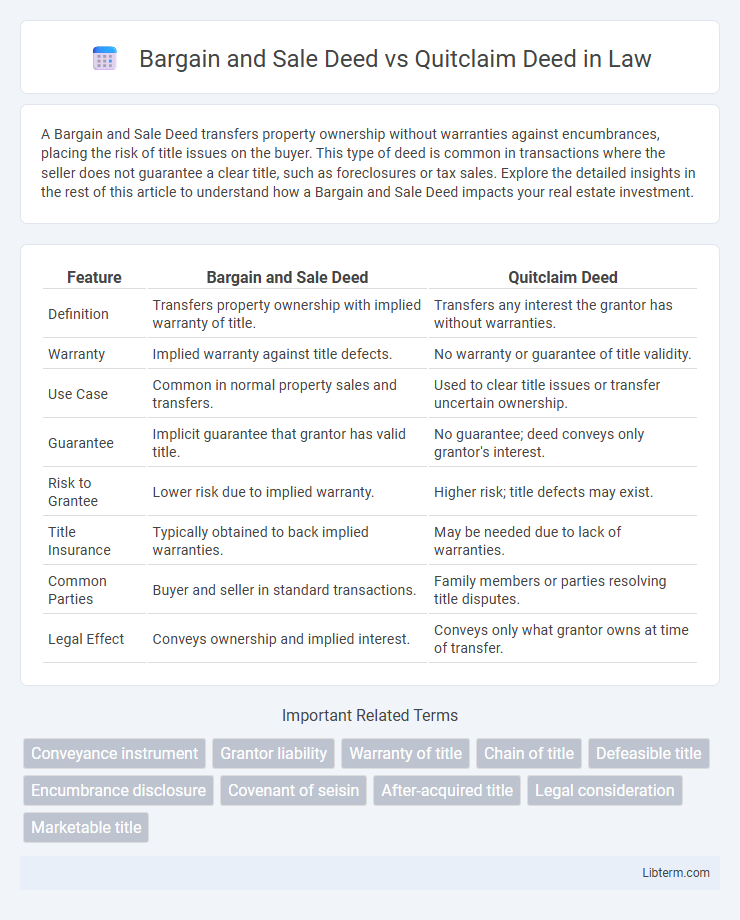

| Feature | Bargain and Sale Deed | Quitclaim Deed |

|---|---|---|

| Definition | Transfers property ownership with implied warranty of title. | Transfers any interest the grantor has without warranties. |

| Warranty | Implied warranty against title defects. | No warranty or guarantee of title validity. |

| Use Case | Common in normal property sales and transfers. | Used to clear title issues or transfer uncertain ownership. |

| Guarantee | Implicit guarantee that grantor has valid title. | No guarantee; deed conveys only grantor's interest. |

| Risk to Grantee | Lower risk due to implied warranty. | Higher risk; title defects may exist. |

| Title Insurance | Typically obtained to back implied warranties. | May be needed due to lack of warranties. |

| Common Parties | Buyer and seller in standard transactions. | Family members or parties resolving title disputes. |

| Legal Effect | Conveys ownership and implied interest. | Conveys only what grantor owns at time of transfer. |

Introduction to Property Deeds

Bargain and Sale Deed transfers property ownership with implied warranty that the grantor has the right to convey the title, offering some protection to the buyer against title defects. Quitclaim Deed transfers whatever interest the grantor has in the property without any warranties, making it less secure for the buyer. These deeds are essential legal instruments in real estate, defining the nature of the ownership rights being transferred.

What is a Bargain and Sale Deed?

A Bargain and Sale Deed transfers ownership of property without warranties against encumbrances, implying the grantor holds title but does not guarantee it is clear. This deed provides limited protection to the buyer compared to other deeds, as the grantor makes no promises about defects or liens. Commonly used in foreclosure sales or tax deed transfers, the Bargain and Sale Deed serves to convey interest in real estate efficiently while minimizing grantor liability.

Understanding Quitclaim Deeds

Quitclaim deeds transfer whatever ownership interest the grantor has in a property without guaranteeing clear title or protecting against liens or claims. These deeds are commonly used between family members, divorcing spouses, or to clear up title issues because they offer a quick, low-cost method to relinquish rights. Unlike bargain and sale deeds, quitclaim deeds do not provide any warranty of valid ownership, making them riskier for buyers seeking title assurance.

Key Differences Between Bargain and Sale Deed vs Quitclaim Deed

A Bargain and Sale Deed conveys property ownership with implied warranties, offering more protection to the buyer than a Quitclaim Deed, which transfers only the grantor's interest without any guarantees. The Quitclaim Deed is commonly used to clear title defects or transfer property between family members, whereas the Bargain and Sale Deed is preferred in standard real estate transactions to assure the buyer of a valid title. In terms of legal recourse, buyers have limited options with a Quitclaim Deed if title issues arise, while a Bargain and Sale Deed provides recourse for breaches of implied warranty.

Legal Implications of Each Deed Type

A Bargain and Sale Deed implies that the grantor holds title to the property and has the right to convey it, providing the grantee limited warranty against title defects that occurred during the grantor's ownership. In contrast, a Quitclaim Deed transfers whatever interest the grantor has without any warranties or guarantees, making it riskier for the grantee due to the absence of protection against potential title issues. Legal implications include higher due diligence requirements for Quitclaim Deeds, while Bargain and Sale Deeds offer moderate protection but less than warranty deeds.

Common Uses for Bargain and Sale Deeds

Bargain and Sale Deeds are commonly used in real estate transactions where the seller has ownership interest but does not provide warranties against encumbrances, often in tax sales, foreclosures, or transfers between family members. These deeds convey title with implied ownership but without guarantees, making them suitable for situations requiring quick transfer of property rights. Real estate investors and auction buyers frequently use Bargain and Sale Deeds due to their balance of title transfer and limited liability.

When to Use a Quitclaim Deed

A quitclaim deed is ideal for transferring property ownership quickly between family members or to clear up title issues without warranties of title protection. It is commonly used in cases of divorce settlements, gift transfers, or adding or removing a person's name from the property deed. Unlike a bargain and sale deed, a quitclaim deed offers no guarantees against liens or claims, making it best suited for low-risk transactions or where parties have a strong level of trust.

Pros and Cons: Bargain and Sale Deed vs Quitclaim Deed

A Bargain and Sale Deed offers the buyer limited warranties, implying the grantor holds title and possession but may not guarantee against encumbrances, making it more secure than a Quitclaim Deed, which transfers only the grantor's interest without any warranty, thus posing higher risk for title defects. The Bargain and Sale Deed is commonly used in tax sales or foreclosures, providing moderate protection, whereas the Quitclaim Deed is ideal for transferring property within family or between trusted parties due to its simplicity and lack of guarantees. Choosing between these deeds depends on the desired level of title assurance and the nature of the transaction, with Bargain and Sale Deeds offering more legal protection and Quitclaim Deeds prioritizing speed and ease of transfer.

State-Specific Considerations and Requirements

State-specific considerations for Bargain and Sale Deeds often include requirements for warranties or implied covenants, varying significantly across jurisdictions; some states mandate full warranty coverage while others limit liability to past ownership interests. Quitclaim Deeds, by contrast, typically transfer whatever interest the grantor has without warranties, and states may have distinct recording fees, disclosure obligations, or statutes addressing their valid use in property transfers or settlements. Understanding local real estate laws is crucial, as state courts interpret the deeds' implications differently, influencing title insurance, buyer protections, and potential liabilities.

Choosing the Right Deed for Your Real Estate Transaction

Choosing the right deed for your real estate transaction depends on the level of protection and warranty desired. A Bargain and Sale Deed implies the grantor holds title and promises to convey ownership but offers limited warranties against encumbrances. In contrast, a Quitclaim Deed transfers any interest the grantor may have without guarantees, making it suitable for transferring property among familiar parties or clearing title issues.

Bargain and Sale Deed Infographic

libterm.com

libterm.com