A constructive trust arises when a court imposes an equitable remedy to address unjust enrichment or wrongful conduct, ensuring that property is held for the rightful owner. This legal mechanism prevents individuals from profiting at the expense of another, particularly in situations involving fraud, breach of fiduciary duty, or mistake. Explore the article to understand how constructive trusts protect your interests and apply in various legal contexts.

Table of Comparison

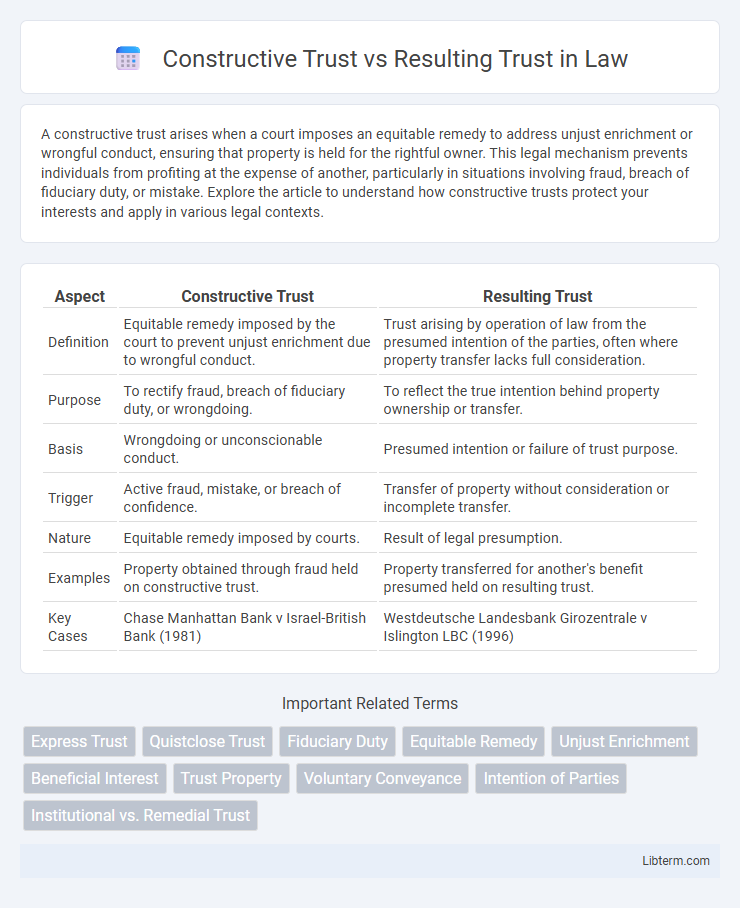

| Aspect | Constructive Trust | Resulting Trust |

|---|---|---|

| Definition | Equitable remedy imposed by the court to prevent unjust enrichment due to wrongful conduct. | Trust arising by operation of law from the presumed intention of the parties, often where property transfer lacks full consideration. |

| Purpose | To rectify fraud, breach of fiduciary duty, or wrongdoing. | To reflect the true intention behind property ownership or transfer. |

| Basis | Wrongdoing or unconscionable conduct. | Presumed intention or failure of trust purpose. |

| Trigger | Active fraud, mistake, or breach of confidence. | Transfer of property without consideration or incomplete transfer. |

| Nature | Equitable remedy imposed by courts. | Result of legal presumption. |

| Examples | Property obtained through fraud held on constructive trust. | Property transferred for another's benefit presumed held on resulting trust. |

| Key Cases | Chase Manhattan Bank v Israel-British Bank (1981) | Westdeutsche Landesbank Girozentrale v Islington LBC (1996) |

Understanding Constructive Trusts

Constructive trusts arise by operation of law to prevent unjust enrichment when one party wrongfully holds property that rightfully belongs to another. These trusts do not require explicit intent but are imposed by courts to rectify fraud, breach of fiduciary duty, or other inequitable conduct. Understanding constructive trusts involves recognizing their role in equitable remedies designed to restore property or its value to the rightful owner.

Defining Resulting Trusts

Resulting trusts arise when property is transferred under circumstances implying the transferor did not intend to grant full beneficial ownership to the transferee, often to prevent unjust enrichment. This equitable remedy typically occurs when contributions to purchase price are made by one party but legal title is held by another, reflecting the parties' presumed intention. Unlike constructive trusts, which are imposed primarily to address wrongdoing, resulting trusts focus on preserving the transferor's beneficial interest absent express or implied transfer of ownership.

Legal Foundations of Constructive Trusts

Constructive trusts arise from equitable principles aimed at preventing unjust enrichment when one party wrongfully holds property. Their legal foundation lies in judicial intervention to impose trust-like obligations despite no formal agreement, ensuring fairness in cases involving fraud, mistake, or breach of fiduciary duty. Resulting trusts, by contrast, are rooted in inferred intent, reflecting parties' presumed intentions regarding property ownership without wrongdoing.

Key Principles of Resulting Trusts

Resulting trusts arise when property is transferred under circumstances implying the transferor did not intend to benefit the transferee, preserving the original owner's equitable interest. Key principles include the presumption of resulting trust when contributions are made to purchase property or when a trust fails or is incomplete, signaling the property should revert to the transferor. Unlike constructive trusts, resulting trusts automatically arise based on intent or equity without the need to prove wrongdoing or unjust enrichment.

Circumstances Leading to Constructive Trusts

Constructive trusts arise primarily from situations involving fraud, unjust enrichment, or breach of fiduciary duty where equity imposes a trust to prevent wrongdoing. Courts often impose constructive trusts when one party wrongfully holds property that rightfully belongs to another, such as in cases of misappropriated funds, mistaken transfers, or confidential relationships broken by exploitation. These circumstances compel the equitable remedy of a constructive trust to restore the original owner's rights and ensure fair restitution.

Situations Giving Rise to Resulting Trusts

Resulting trusts commonly arise when a property transfer lacks clear intention to benefit the recipient, such as failed express trusts or contributions to purchase price by a non-legal owner. Courts impose resulting trusts to restore equitable ownership to the true contributor, especially in cases of incomplete gifts or unjust enrichment. These situations contrast with constructive trusts, which typically address wrongful conduct or fraud rather than purely equitable presumptions.

Distinctions Between Constructive and Resulting Trusts

Constructive trusts arise primarily to prevent unjust enrichment when one party wrongfully holds property, whereas resulting trusts occur when property is transferred under circumstances suggesting the original owner did not intend to gift it. Constructive trusts are imposed by courts irrespective of the parties' intentions, focusing on equitable remedies for wrongdoing, while resulting trusts depend on implied intentions or presumed contributions to the purchase price. The key distinction lies in their purpose: constructive trusts address wrongful conduct, whereas resulting trusts address gaps in ownership arising from the parties' presumed intent.

Remedies and Enforcement in Both Trusts

Constructive trusts arise to prevent unjust enrichment by imposing a trust on property obtained through wrongful conduct, with remedies focused on restitution and equitable relief. Resulting trusts occur when property is transferred without clear intent, and the courts enforce the trust to reflect the parties' presumed intentions, often restoring the property to the original contributor. Enforcement of constructive trusts involves equitable remedies like injunctions and tracing assets, while resulting trusts primarily rely on returning the property or its value to the rightful owner.

Case Law Illustrations: Constructive vs Resulting Trust

In Constructive Trust cases, courts impose a trust to prevent unjust enrichment, as seen in *Gissing v Gissing* [1971] AC 886, where equity recognized a beneficial interest despite no formal agreement. Resulting Trusts arise when property is transferred with the presumption that the transferor did not intend to gift, demonstrated in *Westdeutsche Landesbank Girozentrale v Islington LBC* [1996] AC 669, where money advanced to the council was presumed returned under a resulting trust. The distinction lies in the purpose; constructive trusts address wrongdoing or unconscionability, while resulting trusts reflect the parties' inferred intentions regarding property ownership.

Practical Implications in Estate and Property Law

Constructive trusts arise to prevent unjust enrichment when one party wrongfully holds property, often used in cases of fraud or breach of fiduciary duty, ensuring equitable remedies in estate disputes. Resulting trusts typically occur when property is transferred without the intent to gift, reflecting the grantor's presumed intention, crucial in resolving ownership conflicts in property transactions. Practical implications include the ability of courts to impose constructive trusts to rectify wrongful conduct, whereas resulting trusts help clarify beneficiary rights, impacting estate administration and property redistribution.

Constructive Trust Infographic

libterm.com

libterm.com