A holder is a device or component designed to securely support or contain an object, ensuring stability and accessibility. Common types include phone holders, cup holders, and document holders, each tailored to specific uses and environments. Explore the rest of the article to discover the various holders available and how they can enhance your daily organization and convenience.

Table of Comparison

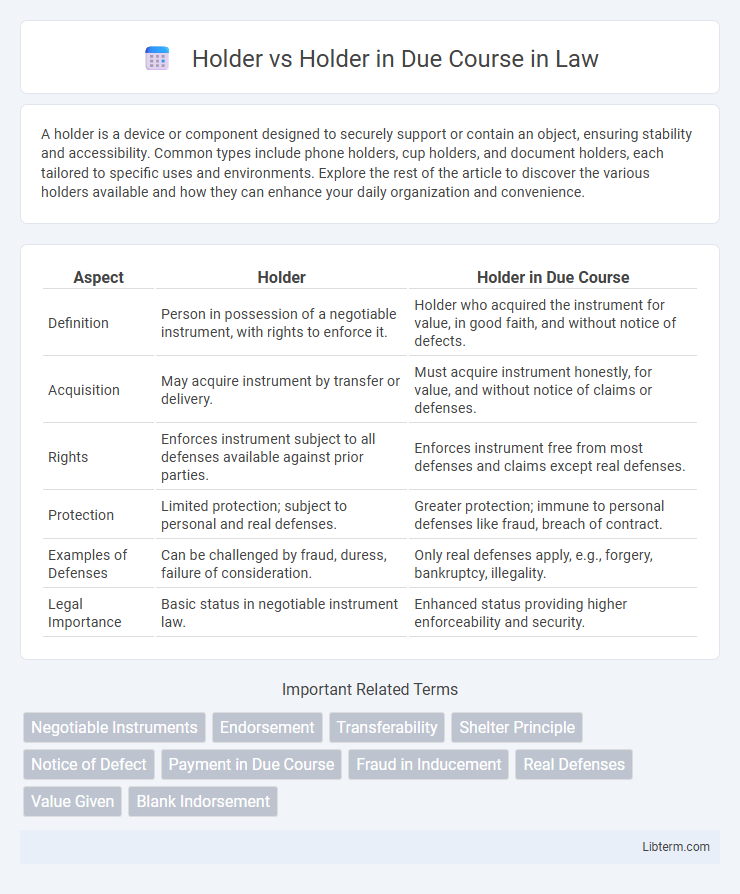

| Aspect | Holder | Holder in Due Course |

|---|---|---|

| Definition | Person in possession of a negotiable instrument, with rights to enforce it. | Holder who acquired the instrument for value, in good faith, and without notice of defects. |

| Acquisition | May acquire instrument by transfer or delivery. | Must acquire instrument honestly, for value, and without notice of claims or defenses. |

| Rights | Enforces instrument subject to all defenses available against prior parties. | Enforces instrument free from most defenses and claims except real defenses. |

| Protection | Limited protection; subject to personal and real defenses. | Greater protection; immune to personal defenses like fraud, breach of contract. |

| Examples of Defenses | Can be challenged by fraud, duress, failure of consideration. | Only real defenses apply, e.g., forgery, bankruptcy, illegality. |

| Legal Importance | Basic status in negotiable instrument law. | Enhanced status providing higher enforceability and security. |

Introduction to Holder and Holder in Due Course

A Holder is an individual or entity in possession of a negotiable instrument, like a check or promissory note, issued either to them or endorsed to them, giving them the legal right to enforce the instrument. A Holder in Due Course (HDC) acquires the instrument for value, in good faith, and without notice of any defects or claims against it, providing them with enhanced legal protections against certain defenses that may be asserted by prior parties. The distinction between Holder and Holder in Due Course is crucial in commercial law, as HDC status ensures more secure and reliable transferability of negotiable instruments in financial transactions.

Legal Definition of a Holder

A holder is defined legally as the person in possession of a negotiable instrument that is payable either to bearer or to an identified person in possession. Under the Uniform Commercial Code (UCC), a holder has the right to enforce the instrument and collect payment. The distinction between a holder and a holder in due course hinges on the latter's acquisition of the instrument for value, in good faith, and without notice of any defects or claims.

Legal Definition of a Holder in Due Course

A Holder in Due Course (HDC) is a party who has acquired a negotiable instrument in good faith, for value, and without notice of any defects or claims against it. This legal status provides the HDC with enhanced protections, allowing them to enforce the instrument free from many defenses that could be raised against the original payee. The Holder vs Holder in Due Course distinction centers on the additional rights granted to the HDC, emphasizing legitimacy and good faith in the transfer of negotiable instruments under the Uniform Commercial Code (UCC).

Key Differences Between Holder and Holder in Due Course

A Holder is a person in possession of a negotiable instrument that is payable either to bearer or to an identified person, while a Holder in Due Course (HDC) takes the instrument for value, in good faith, and without notice of any defects or claims. The key difference lies in the HDC's enhanced protection, enabling them to enforce the instrument free from certain defenses available against ordinary Holders, such as fraud or breach of contract. Unlike a Holder, a Holder in Due Course's rights are superior, ensuring better security in commercial transactions.

Rights and Privileges of a Holder

A Holder possesses possession of a negotiable instrument and holds the legal right to enforce payment, but these rights are limited to claims valid against the original parties. The Holder's privileges include the ability to transfer the instrument to another party. In contrast, a Holder in Due Course enjoys enhanced rights, including immunity from many defenses that could be raised against the original payee, ensuring stronger protection and priority in enforcing payment.

Special Rights of a Holder in Due Course

A Holder in Due Course (HDC) possesses special rights that protect them from many defenses available against the original payee, ensuring enforceability of the instrument free from personal defenses like fraud or breach of contract. These rights enable the HDC to collect payment even if the instrument was previously subject to disputes, providing greater security and negotiability in commercial transactions. Unlike a regular holder, an HDC's status requires the instrument to be acquired for value, in good faith, and without notice of defects, granting superior legal protection under the Uniform Commercial Code (UCC).

Conditions for Becoming a Holder in Due Course

A Holder in Due Course must take a negotiable instrument for value, in good faith, and without notice of any defects or claims against it. The instrument must be complete and regular on its face, and the holder must have acquired it before any dishonor or default occurs. Meeting these conditions grants the holder enforceable rights free from many defenses and claims that could be asserted against the original payee.

Defenses Available Against a Holder vs Holder in Due Course

Defenses available against a holder include both real defenses, such as forgery, fraud in the factum, or alteration, and personal defenses like breach of contract or lack of consideration. In contrast, a holder in due course (HDC) is protected against most personal defenses and can only be challenged using real defenses, which preserve the integrity of negotiable instruments. This distinction significantly limits the types of defenses that can be asserted when dealing with an HDC, emphasizing the priority of commercial certainty and negotiability.

Legal Implications in Negotiable Instruments

Holder vs Holder in Due Course presents distinct legal implications in negotiable instruments law. A Holder is simply in possession of an instrument, while a Holder in Due Course acquires it through legitimate means, free from defenses and claims adverse to payment. Courts favor Holders in Due Course with greater protection, ensuring enforceability against all parties except those with real defenses such as fraud or forgery.

Conclusion: Importance in Commercial Transactions

The distinction between a holder and a holder in due course is crucial for ensuring the enforceability of negotiable instruments in commercial transactions. A holder in due course obtains greater protection against certain defenses and claims, promoting confidence and reliability in financial dealings. Understanding this difference enhances the predictability and security of credit and payment systems.

Holder Infographic

libterm.com

libterm.com