Satisfaction plays a crucial role in personal well-being and productivity, influencing how you perceive success and happiness in various aspects of life. Understanding the factors that contribute to satisfaction can help you make informed decisions that enhance your overall quality of life. Explore the rest of the article to discover practical strategies for increasing your satisfaction and fulfillment.

Table of Comparison

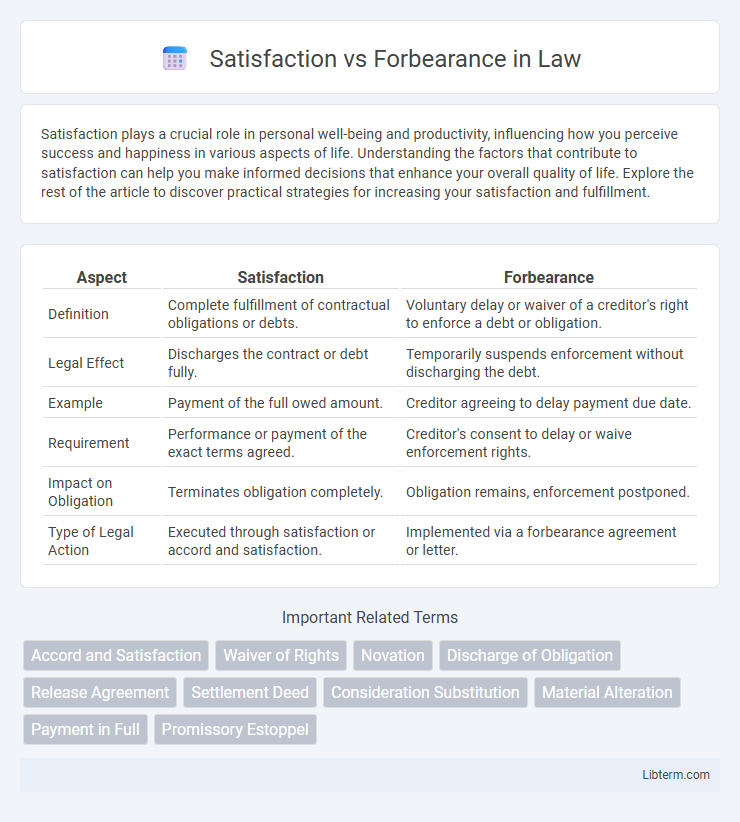

| Aspect | Satisfaction | Forbearance |

|---|---|---|

| Definition | Complete fulfillment of contractual obligations or debts. | Voluntary delay or waiver of a creditor's right to enforce a debt or obligation. |

| Legal Effect | Discharges the contract or debt fully. | Temporarily suspends enforcement without discharging the debt. |

| Example | Payment of the full owed amount. | Creditor agreeing to delay payment due date. |

| Requirement | Performance or payment of the exact terms agreed. | Creditor's consent to delay or waive enforcement rights. |

| Impact on Obligation | Terminates obligation completely. | Obligation remains, enforcement postponed. |

| Type of Legal Action | Executed through satisfaction or accord and satisfaction. | Implemented via a forbearance agreement or letter. |

Understanding Satisfaction and Forbearance

Satisfaction refers to the act of fulfilling an obligation by performing the agreed-upon duty or payment, effectively discharging the debtor's responsibility. Forbearance involves the creditor's intentional decision to delay enforcing a debt or obligation, granting the debtor extra time to fulfill their duty without penalty. Understanding the distinction between satisfaction and forbearance is crucial for managing contractual obligations and creditor-debtor relationships.

Key Differences Between Satisfaction and Forbearance

Satisfaction refers to the fulfillment of an obligation or claim through complete or partial performance, resulting in the discharge of the debt or duty, whereas forbearance involves the creditor's intentional delay or refraining from enforcing their legal rights despite a debtor's default. Unlike satisfaction, which extinguishes the original obligation, forbearance merely suspends enforcement and does not alter the creditor's ultimate right to demand payment. Key differences include the legal effect on the obligation, the presence or absence of performance, and the creditor's consent to postpone enforcement without releasing the debtor.

Legal Definitions of Satisfaction and Forbearance

Satisfaction in legal terms refers to the performance or fulfillment of an obligation, such as the payment of a debt or the execution of a contract, resulting in the discharge of the duty. Forbearance is the intentional refraining from enforcing a legal right, typically the delay or abstention from collecting a debt or exercising a claim, often agreed upon between parties. Both concepts affect contract enforcement, where satisfaction completes the obligation, while forbearance modifies the timing or conditions of enforcement without extinguishing the underlying right.

Origins and Historical Context

Satisfaction and forbearance originate from distinct legal traditions tracing back to common law and equity respectively, shaping their historical applications in debt and contractual disputes. Satisfaction emerged as a remedy ensuring the debtor fulfilled an obligation, often by payment or performance, solidifying creditor rights during medieval English law. Forbearance developed as an equitable doctrine allowing creditors to delay enforcement or accept altered terms, reflecting a flexible approach to debt management rooted in fairness within courts of equity.

Real-Life Examples of Satisfaction

Satisfaction manifests in real life through achievements such as receiving positive performance reviews at work or completing a personal fitness goal, which provide tangible affirmations of success and personal growth. For example, a student feels satisfaction after graduating with honors, reflecting the reward of sustained effort and dedication. Similarly, a homeowner experiences satisfaction upon completing a renovation, enjoying the immediate benefits of their investment and craftsmanship.

Real-Life Examples of Forbearance

Forbearance in lending allows borrowers to temporarily pause or reduce loan payments during financial hardship without penalty, preserving credit standing while preventing default. Real-life examples include mortgage forbearance programs during the COVID-19 pandemic, where millions of homeowners received relief to avoid foreclosure amid income loss. These programs demonstrate the critical role of forbearance in maintaining financial stability for individuals facing unexpected economic challenges.

Effects on Contractual Obligations

Satisfaction occurs when contractual obligations are fully performed, resulting in the discharge of all parties from further duties and preventing future claims related to the contract. Forbearance involves one party agreeing to delay or refrain from enforcing a right, which can modify the original obligations without necessarily discharging the contract. The effects of satisfaction ensure definitive closure, while forbearance creates a temporary or conditional alteration of duties, often requiring consideration to be enforceable.

Satisfaction vs Forbearance: Practical Implications

Satisfaction in legal terms refers to the fulfillment of an obligation by performance, while forbearance involves the intentional refraining from enforcing a right or claim, often as a form of compromise or negotiation. Practical implications of satisfaction include the immediate termination of liability, ensuring clear closure of contractual duties, whereas forbearance can extend contractual relationships and provide flexibility in debt management without immediate payment. Understanding the distinction is crucial for businesses and individuals to manage risk, maintain cash flow, and negotiate settlements effectively in financial and contractual disputes.

Common Misconceptions

Satisfaction and forbearance are often misunderstood as interchangeable concepts in debt management, but satisfaction refers to the full repayment or settlement of a debt, while forbearance involves a temporary pause or reduction in payments without removing the obligation. A common misconception is that forbearance erases debt, whereas it merely delays payment and may accrue additional interest or fees. Understanding these distinctions is critical for effective financial planning and avoiding long-term credit damage.

Choosing the Right Approach in Legal Agreements

Choosing between satisfaction and forbearance in legal agreements depends on the specific circumstances and desired outcomes; satisfaction involves fulfilling contractual obligations, while forbearance constitutes a deliberate delay or waiver of a right. Satisfaction conclusively resolves the debt or obligation, providing legal closure, whereas forbearance temporarily suspends enforcement, often to allow negotiation or performance improvement. Selecting the appropriate approach requires careful consideration of contractual terms, potential risks, and the impact on future rights and remedies.

Satisfaction Infographic

libterm.com

libterm.com