Community property laws govern the ownership and division of assets acquired during marriage, ensuring equitable distribution between spouses. Understanding these rules can protect Your financial interests in the event of divorce or death. Explore the details of community property to safeguard Your rights and assets effectively.

Table of Comparison

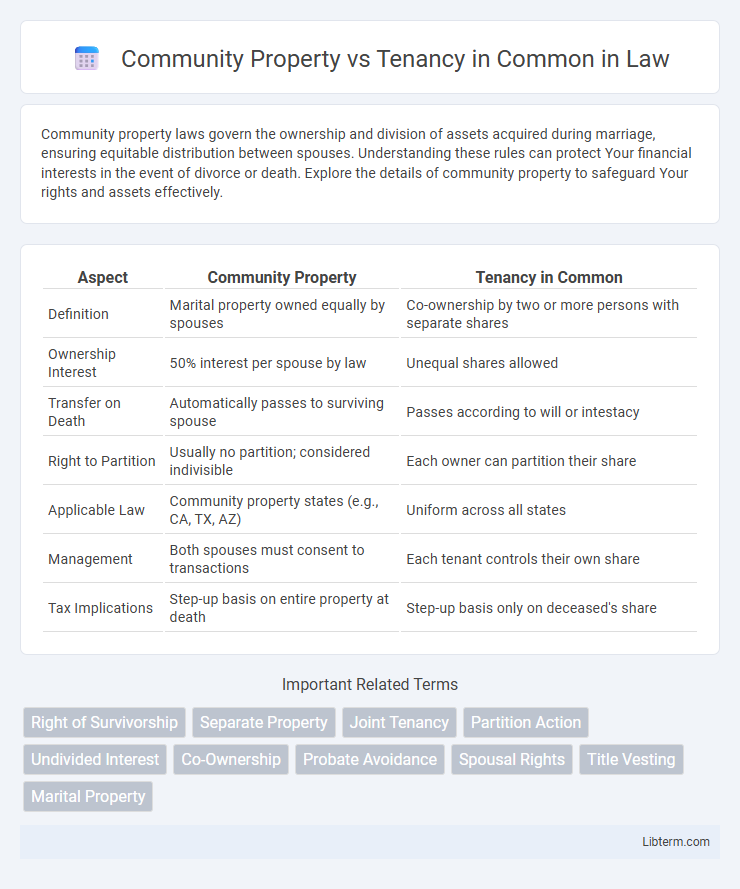

| Aspect | Community Property | Tenancy in Common |

|---|---|---|

| Definition | Marital property owned equally by spouses | Co-ownership by two or more persons with separate shares |

| Ownership Interest | 50% interest per spouse by law | Unequal shares allowed |

| Transfer on Death | Automatically passes to surviving spouse | Passes according to will or intestacy |

| Right to Partition | Usually no partition; considered indivisible | Each owner can partition their share |

| Applicable Law | Community property states (e.g., CA, TX, AZ) | Uniform across all states |

| Management | Both spouses must consent to transactions | Each tenant controls their own share |

| Tax Implications | Step-up basis on entire property at death | Step-up basis only on deceased's share |

Introduction to Property Ownership Types

Community property and tenancy in common represent two distinct forms of property ownership primarily differentiated by the relationship between co-owners and legal rights. Community property is a form of ownership specific to married couples where assets acquired during marriage are jointly owned and divided equally upon dissolution. In contrast, tenancy in common allows multiple parties, related or unrelated, to own specific shares of a property independently, with each having the right to transfer or sell their interest without consent from others.

What is Community Property?

Community Property is a form of ownership recognized in nine U.S. states where assets acquired during marriage are jointly owned by both spouses equally. This legal framework treats property obtained throughout the marriage as belonging 50/50, regardless of whose name is on the title or who earned the income. Unlike Tenancy in Common, Community Property automatically passes to the surviving spouse without probate, offering distinct estate planning advantages.

What is Tenancy in Common?

Tenancy in Common is a form of property ownership where two or more individuals hold undivided shares in the property, each owning a specific percentage that can differ among co-owners. Unlike community property, tenants in common have the right to transfer or will their share independently without the consent of the other owners. This type of ownership allows flexibility in inheritance and ownership proportions, making it a common choice for unrelated co-owners or investors.

Key Legal Differences

Community property legally binds spouses to equal ownership of assets acquired during marriage, whereas tenancy in common allows multiple parties to hold distinct, divisible shares in a property without spousal status requirements. In community property states, assets are presumed to be owned equally by both spouses regardless of individual contribution, while tenancy in common owners can independently sell, transfer, or bequeath their shares. Upon death, community property typically passes to the surviving spouse by right of survivorship or will, whereas tenancy in common interests pass according to each owner's estate plan, as there is no right of survivorship.

Rights and Responsibilities of Co-Owners

Community property grants spouses equal ownership of assets acquired during marriage, with both having the right to control and use the property, and responsibilities including shared debts and obligations. Tenancy in common allows co-owners to hold unequal shares with distinct rights to sell, transfer, or bequeath their interest independently, but each is responsible only for debts tied to their ownership portion. Both forms require co-owners to respect each other's rights, contribute to property maintenance costs, and manage the asset in good faith to prevent disputes.

Inheritance and Succession Implications

Community Property grants equal ownership of assets acquired during marriage, automatically passing to the surviving spouse upon death, bypassing probate and simplifying inheritance. Tenancy in Common allows each owner to hold distinct shares, which can be bequeathed freely through a will or estate plan, often requiring probate. Understanding these differences is crucial for estate planning, as Community Property protects spousal rights, while Tenancy in Common offers individual control over inheritance distribution.

Tax Consequences and Considerations

Community property offers a stepped-up basis for both spouses on the entire property upon the first death, reducing capital gains tax liability when sold. In tenancy in common, only the deceased tenant's share receives a stepped-up basis, potentially increasing taxable gains for surviving co-owners. Tax planning considerations differ as community property benefits married couples with equal ownership, while tenancy in common allows unequal shares but may result in higher capital gains taxes for heirs.

Pros and Cons: Community Property

Community property offers equal ownership and automatic rights of survivorship, simplifying asset division upon death or divorce and fostering financial transparency between spouses. However, it limits individual control over separate property and may complicate estate planning since all assets acquired during marriage are considered jointly owned. Tax benefits include the step-up in basis for both halves of the property at death, but community property laws only apply in certain states, restricting its availability.

Pros and Cons: Tenancy in Common

Tenancy in Common offers flexibility in ownership shares, allowing co-owners to hold unequal interests and freely transfer their portion without consent from others, which benefits estate planning and investment diversification. However, it lacks the right of survivorship, meaning a deceased owner's share passes according to their will or state law, potentially complicating ownership and leading to disputes among heirs. Co-owners may also face challenges in managing or partitioning the property, as unanimous agreement is not required but practical cooperation is necessary to avoid legal conflicts.

Choosing the Right Ownership Structure

Choosing the right ownership structure hinges on understanding the key differences between community property and tenancy in common, especially regarding rights to survivorship and asset division. Community property, available in certain states like California and Texas, automatically splits ownership equally between spouses and provides a step-up in basis for tax purposes upon death. Tenancy in common allows multiple owners to hold unequal shares, transfer their interests independently, and avoid automatic survivorship, offering greater flexibility for non-spousal co-owners or estate planning goals.

Community Property Infographic

libterm.com

libterm.com