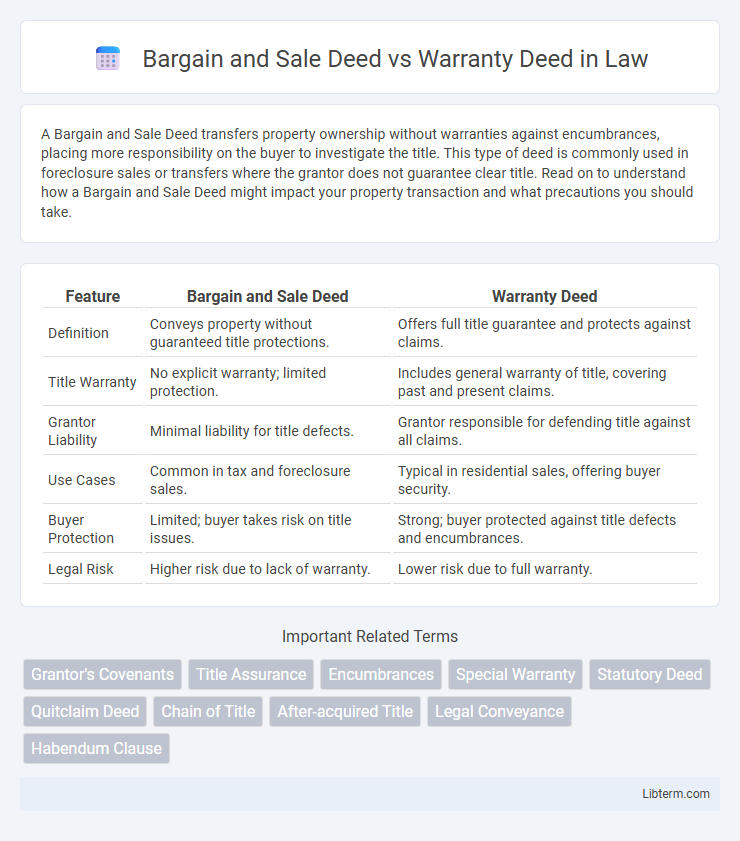

A Bargain and Sale Deed transfers property ownership without warranties against encumbrances, placing more responsibility on the buyer to investigate the title. This type of deed is commonly used in foreclosure sales or transfers where the grantor does not guarantee clear title. Read on to understand how a Bargain and Sale Deed might impact your property transaction and what precautions you should take.

Table of Comparison

| Feature | Bargain and Sale Deed | Warranty Deed |

|---|---|---|

| Definition | Conveys property without guaranteed title protections. | Offers full title guarantee and protects against claims. |

| Title Warranty | No explicit warranty; limited protection. | Includes general warranty of title, covering past and present claims. |

| Grantor Liability | Minimal liability for title defects. | Grantor responsible for defending title against all claims. |

| Use Cases | Common in tax and foreclosure sales. | Typical in residential sales, offering buyer security. |

| Buyer Protection | Limited; buyer takes risk on title issues. | Strong; buyer protected against title defects and encumbrances. |

| Legal Risk | Higher risk due to lack of warranty. | Lower risk due to full warranty. |

Introduction to Property Deeds

Property deeds serve as legal documents transferring ownership rights between parties. A Bargain and Sale Deed conveys title with limited warranties, implying the grantor holds title but offers no guarantees against encumbrances. Conversely, a Warranty Deed provides the strongest protection, guaranteeing the title is clear of defects and the grantor will defend against claims.

What Is a Bargain and Sale Deed?

A Bargain and Sale Deed transfers property ownership without guaranteeing clear title, implying the grantor holds ownership rights but does not assure against claims or encumbrances. This deed type is commonly used in tax sales, foreclosures, and estates where the seller's warranty is limited. In contrast, a Warranty Deed provides full title guarantees and protects the buyer from future claims on the property.

Key Features of Bargain and Sale Deeds

Bargain and Sale Deeds convey property without warranties against encumbrances, transferring ownership but not guaranteeing clear title. Key features include implied ownership rights and protection limited to possession, making them common in foreclosure or tax sales. Unlike Warranty Deeds, they do not promise defense against future claims, impacting buyer risk and title insurance considerations.

Understanding Warranty Deeds

Warranty Deeds provide the highest level of protection for property buyers by guaranteeing clear title free from liens or claims, with the grantor legally responsible for defending the title against any future disputes. Unlike Bargain and Sale Deeds, which imply ownership without explicit warranties, Warranty Deeds include explicit covenants assuring the buyer's rights and offering remedies if title defects arise. Understanding Warranty Deeds is essential for buyers seeking secure property ownership and peace of mind in real estate transactions.

Major Differences Between Bargain and Sale Deeds and Warranty Deeds

Bargain and Sale Deeds transfer property ownership without guaranteeing clear title, placing risk on the buyer, while Warranty Deeds provide a comprehensive title guarantee, protecting the buyer against past claims or disputes. Warranty Deeds include covenants such as covenant of seisin, covenant against encumbrances, and covenant of quiet enjoyment, which are absent in Bargain and Sale Deeds. The key difference lies in the extent of title protection, with Warranty Deeds offering full legal assurance and Bargain and Sale Deeds offering limited or no warranties.

Pros and Cons of Bargain and Sale Deeds

Bargain and Sale Deeds provide sellers with limited liability, transferring title without explicit warranties, which reduces risk exposure but may leave buyers vulnerable to undisclosed claims. These deeds are often faster and less costly compared to Warranty Deeds, making them attractive in certain real estate transactions. However, the lack of guarantees means buyers should conduct thorough title searches or obtain title insurance to mitigate potential title defects.

Pros and Cons of Warranty Deeds

Warranty deeds provide the strongest legal protection for buyers by guaranteeing clear title and defending against claims arising from previous ownership. The main advantage is that sellers legally assure the property is free from liens and encumbrances, reducing the risk of future disputes. However, the cons include increased seller liability and potential for prolonged legal involvement if title defects emerge after the sale.

When to Use a Bargain and Sale Deed

A Bargain and Sale Deed is typically used in transactions where the seller implies ownership but does not guarantee clear title against all claims, making it suitable for foreclosures or tax sales. This deed transfers ownership while protecting the buyer less than a Warranty Deed, which provides full title assurance and covers any potential title defects. Buyers should consider a Bargain and Sale Deed when acquiring property "as is," often at a lower risk or cost, and conduct thorough title searches beforehand.

When to Use a Warranty Deed

A Warranty Deed is ideal when buyers need maximum protection, as it guarantees the seller holds clear title to the property free from any encumbrances or claims. This deed is commonly used in traditional real estate transactions or when purchasing property from unknown sellers to ensure legal ownership and defend against future title disputes. Opting for a Warranty Deed provides peace of mind by legally obligating the seller to address any title defects discovered after the sale.

Choosing the Right Deed for Your Real Estate Transaction

Choosing the right deed for your real estate transaction depends on the level of protection you need; a Warranty Deed offers the strongest guarantee by ensuring the seller holds clear title and will defend against future claims, making it ideal for buyers seeking maximum security. In contrast, a Bargain and Sale Deed conveys ownership without warranties against encumbrances or title defects, often used in tax sales or foreclosures where less assurance exists. Understanding these distinctions is crucial for buyers and sellers to protect their interests and minimize risk during property transfers.

Bargain and Sale Deed Infographic

libterm.com

libterm.com