A trustee holds the legal responsibility to manage assets or property on behalf of a beneficiary according to the terms set out in a trust agreement. Understanding the duties and powers of a trustee is crucial to ensure that your interests are protected and the trust is administered properly. Explore the article to learn more about the role of a trustee and how it can impact your financial planning.

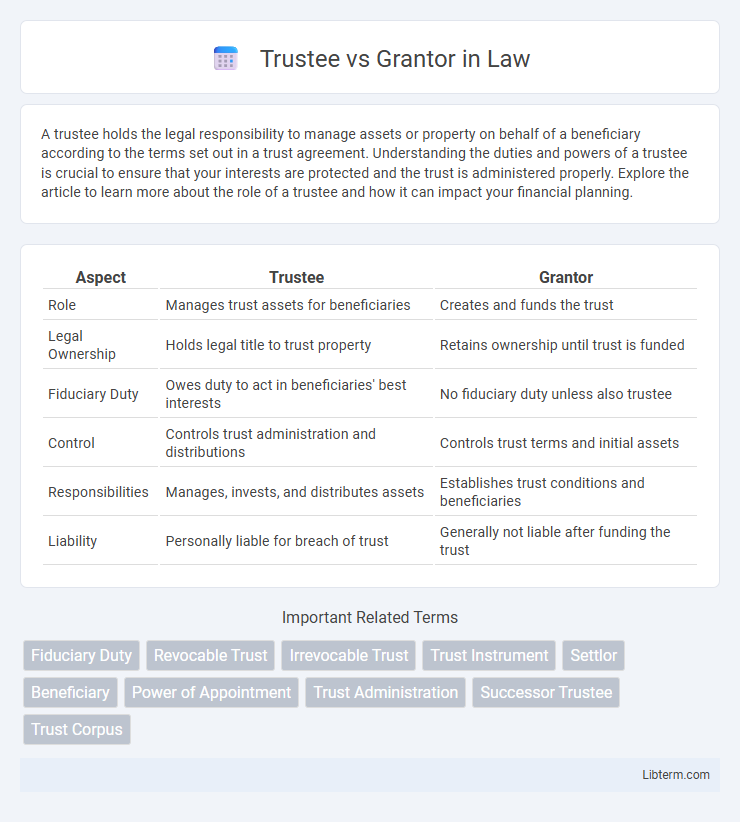

Table of Comparison

| Aspect | Trustee | Grantor |

|---|---|---|

| Role | Manages trust assets for beneficiaries | Creates and funds the trust |

| Legal Ownership | Holds legal title to trust property | Retains ownership until trust is funded |

| Fiduciary Duty | Owes duty to act in beneficiaries' best interests | No fiduciary duty unless also trustee |

| Control | Controls trust administration and distributions | Controls trust terms and initial assets |

| Responsibilities | Manages, invests, and distributes assets | Establishes trust conditions and beneficiaries |

| Liability | Personally liable for breach of trust | Generally not liable after funding the trust |

Trustee vs Grantor: Key Definitions

A trustee is an individual or entity responsible for managing and administering assets held in a trust according to the terms set by the trust document. The grantor, also known as the settlor or trustor, is the person who creates the trust and transfers assets into it. Understanding the roles of trustee versus grantor is essential for effective trust administration and legal compliance.

Roles and Responsibilities of a Trustee

A trustee is responsible for managing and administering the trust's assets according to the terms set forth in the trust agreement and in the best interests of the beneficiaries. Duties include fiduciary responsibilities such as maintaining accurate records, investing assets prudently, and distributing income or principal as specified by the grantor. Unlike the grantor, who creates and funds the trust, the trustee ensures compliance with legal requirements and acts impartially to uphold the trust's objectives.

Duties and Powers of a Grantor

The grantor holds the authority to create, modify, or revoke a trust, retaining control over the trust assets until the trust becomes irrevocable. Duties of a grantor include clearly defining the terms of the trust and funding it by transferring assets, which empowers the trustee to manage those assets effectively. Unlike the trustee, who manages and administers the trust according to its terms, the grantor's powers primarily involve the initial establishment and legal directives governing the trust.

Legal Differences Between Trustee and Grantor

The grantor is the individual who creates and funds the trust, transferring legal ownership of assets to the trust, while the trustee is the party responsible for managing and administering the trust property according to its terms and fiduciary duties. Legally, the grantor holds the power to modify or revoke the trust provisions if it is a revocable trust, whereas the trustee holds fiduciary responsibility to act in the best interests of the beneficiaries and cannot alter trust terms unilaterally. The distinction lies in the grantor's role as creator and owner of the trust assets and the trustee's role as the legal holder and manager of those assets under the trust agreement.

Trust Establishment: Grantor’s Role Explained

The grantor, also known as the trustor or settlor, plays a crucial role in trust establishment by creating the trust and transferring assets into it. This individual outlines the trust's terms, defines beneficiaries, and appoints a trustee to manage the trust assets. Unlike the trustee who administers the trust, the grantor's main responsibility is setting up the legal framework and funding the trust for future management.

Trustee’s Fiduciary Duties to Beneficiaries

A trustee holds a legal obligation to manage the trust assets prudently and in the best interests of the beneficiaries, adhering to duties of loyalty, care, and impartiality. Unlike the grantor who establishes the trust, the trustee must avoid conflicts of interest and ensure transparent administration of trust property. Fiduciary duties require the trustee to act with honesty, maintain accurate records, and regularly communicate trust performance to beneficiaries.

Authority and Decision Making: Trustee vs Grantor

The trustee holds the authority to manage and make decisions regarding trust assets based on the trust's terms, often acting independently to benefit the beneficiaries. In contrast, the grantor retains control during the trust's creation but relinquishes decision-making power once the trust is established. This division of authority ensures fiduciary responsibility lies with the trustee, while the grantor's role primarily involves initiating the trust and setting its directives.

Succession Planning: What Happens When Grantor or Trustee Changes?

Succession planning in trusts hinges on the roles of the grantor and trustee; when the grantor changes or passes away, the trust typically becomes irrevocable, and the successor trustee assumes management to ensure continuity. Trustee changes are governed by the trust document or state law, often requiring formal appointment or court approval to maintain fiduciary duties and protect beneficiaries' interests. Effective succession planning involves clear provisions for appointing successor trustees and addressing the grantor's incapacity or death to avoid disruption in trust administration.

Common Misconceptions: Trustee and Grantor Compared

Common misconceptions often confuse the roles of trustee and grantor, though they serve distinct functions in a trust arrangement. The grantor, also known as the settlor or trustor, is the individual who creates the trust and transfers assets into it, whereas the trustee is responsible for managing and administering those assets on behalf of the beneficiaries. Misunderstandings arise when people assume the trustee holds ownership of the assets, but legally, the trustee acts as a fiduciary custodian, ensuring the trust's terms set by the grantor are faithfully executed.

Choosing the Right Trustee and Grantor for Your Trust

Selecting the right trustee and grantor is critical to the success of your trust arrangement, as the grantor establishes the terms and objectives while the trustee manages the assets and ensures fiduciary duties are fulfilled. Experience in trust administration, knowledge of relevant state laws, and a strong sense of integrity are essential qualities for an effective trustee. The grantor must clearly define the trust's purpose and choose a trustee capable of executing its provisions in accordance with the grantor's intent.

Trustee Infographic

libterm.com

libterm.com