A principal debtor is the individual or entity primarily responsible for repaying a debt or fulfilling a financial obligation. This role entails direct accountability for the amount owed, distinguishing the principal debtor from guarantors or sureties who only step in if the principal defaults. Explore the article to understand the implications of being a principal debtor and how it affects your financial responsibilities.

Table of Comparison

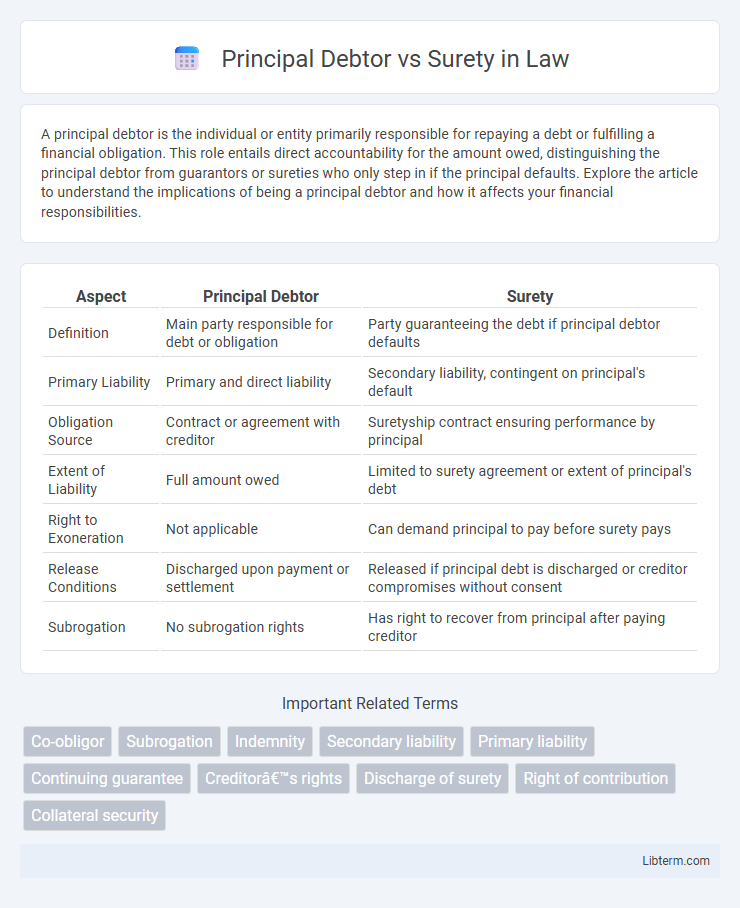

| Aspect | Principal Debtor | Surety |

|---|---|---|

| Definition | Main party responsible for debt or obligation | Party guaranteeing the debt if principal debtor defaults |

| Primary Liability | Primary and direct liability | Secondary liability, contingent on principal's default |

| Obligation Source | Contract or agreement with creditor | Suretyship contract ensuring performance by principal |

| Extent of Liability | Full amount owed | Limited to surety agreement or extent of principal's debt |

| Right to Exoneration | Not applicable | Can demand principal to pay before surety pays |

| Release Conditions | Discharged upon payment or settlement | Released if principal debt is discharged or creditor compromises without consent |

| Subrogation | No subrogation rights | Has right to recover from principal after paying creditor |

Introduction to Principal Debtor and Surety

The principal debtor is the party primarily responsible for repaying a loan or fulfilling a financial obligation contracted with a creditor. The surety acts as a guarantor who pledges to pay the debt or perform the obligation if the principal debtor defaults. Understanding the roles and liabilities of both entities is crucial in contract law and financial agreements.

Definition of Principal Debtor

The principal debtor is the primary party obligated to fulfill a debt or contractual duty directly with the creditor, bearing the main responsibility for repayment. This entity holds the legal liability to perform the agreed obligations, making them the central figure in the debt agreement. A surety, in contrast, acts as a secondary party who guarantees performance only if the principal debtor defaults.

Definition of Surety

A surety is a person or entity that guarantees the performance or obligations of the principal debtor to a creditor, ensuring repayment or fulfillment of a contract if the principal debtor defaults. Unlike the principal debtor, who has the primary responsibility for the debt, the surety's liability is secondary and contingent upon the principal's failure to meet their commitments. Suretyship creates a legal obligation where the surety agrees to be liable for the debt, enhancing security for creditors in loan agreements and contractual obligations.

Key Differences Between Principal Debtor and Surety

The principal debtor is the primary party responsible for repaying a debt or fulfilling an obligation, while the surety guarantees the debt repayment if the principal debtor defaults. The principal debtor's liability is direct and unconditional, whereas the surety's liability is secondary and contingent upon the principal debtor's failure. In legal terms, the surety's role involves a contractual agreement to support the principal debtor, often requiring formal consent and documentation distinct from the principal debtor's primary obligation.

Legal Obligations of Principal Debtor

The principal debtor holds the primary legal obligation to fulfill the contractual debt or duty, making them directly liable to the creditor under the terms of the agreement. Their responsibility includes timely payment or performance as stipulated, and failure to comply can trigger legal enforcement actions or claims for damages. Unlike the surety, whose liability is secondary and conditional, the principal debtor's obligation is absolute and must be discharged before any suretyship liability arises.

Legal Responsibilities of Surety

The legal responsibilities of a surety involve guaranteeing the performance or obligations of the principal debtor under a contract or loan agreement. The surety is liable to fulfill the debtor's obligations if the principal debtor defaults, but this liability is secondary, activating only after the creditor exhausts remedies against the principal. Suretyship contracts require clear consent and are strictly construed in favor of the surety, often including rights of subrogation and reimbursement upon fulfilling the debtor's obligations.

Rights of Principal Debtor vs Surety

The principal debtor holds the primary obligation to repay the debt and has the right to compel the creditor to first exhaust remedies against the surety before pursuing the principal debtor. The surety possesses the right of subrogation, allowing them to step into the creditor's position after paying the debt and recover from the principal debtor. Furthermore, the surety can demand indemnity from the principal debtor and is entitled to raise all defenses available to the principal debtor against the creditor's claim.

Termination of Suretyship

Termination of suretyship occurs when the principal debtor fulfills the obligation, releases the surety from liability, or when the creditor agrees to release the surety. The surety may also terminate the contract by notifying the creditor, but liability continues for existing debts incurred before termination. Legal grounds such as expiration of the suretyship term or creditor's breach of contract can also result in termination of suretyship.

Common Scenarios Involving Principal Debtor and Surety

In common scenarios involving a principal debtor and surety, the principal debtor is primarily responsible for repaying the debt, while the surety provides a guarantee to the creditor that the obligation will be fulfilled if the principal debtor defaults. Typical cases include loan agreements, lease contracts, and performance bonds where the surety acts as a secondary party ensuring payment or performance. Legal disputes often arise when the principal debtor defaults, leading the creditor to demand payment from the surety under the terms of the suretyship agreement.

Conclusion: Choosing Between Principal Debtor and Surety

Choosing between a principal debtor and a surety depends on the risk allocation and financial responsibility desired in a contract. A principal debtor holds the primary obligation to fulfill the debt, ensuring direct accountability, while a surety acts as a secondary party, providing a guarantee only if the principal debtor defaults. Evaluating the certainty of repayment and the strength of creditworthiness helps determine the most appropriate party to assume liability in financial agreements.

Principal Debtor Infographic

libterm.com

libterm.com