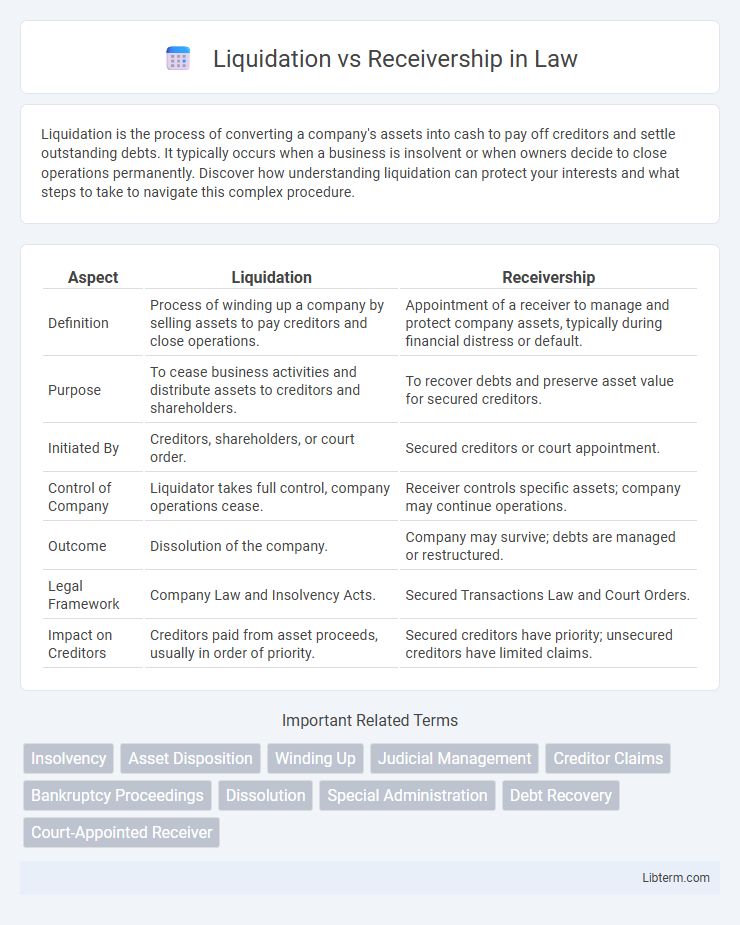

Liquidation is the process of converting a company's assets into cash to pay off creditors and settle outstanding debts. It typically occurs when a business is insolvent or when owners decide to close operations permanently. Discover how understanding liquidation can protect your interests and what steps to take to navigate this complex procedure.

Table of Comparison

| Aspect | Liquidation | Receivership |

|---|---|---|

| Definition | Process of winding up a company by selling assets to pay creditors and close operations. | Appointment of a receiver to manage and protect company assets, typically during financial distress or default. |

| Purpose | To cease business activities and distribute assets to creditors and shareholders. | To recover debts and preserve asset value for secured creditors. |

| Initiated By | Creditors, shareholders, or court order. | Secured creditors or court appointment. |

| Control of Company | Liquidator takes full control, company operations cease. | Receiver controls specific assets; company may continue operations. |

| Outcome | Dissolution of the company. | Company may survive; debts are managed or restructured. |

| Legal Framework | Company Law and Insolvency Acts. | Secured Transactions Law and Court Orders. |

| Impact on Creditors | Creditors paid from asset proceeds, usually in order of priority. | Secured creditors have priority; unsecured creditors have limited claims. |

Understanding Liquidation: Definition and Process

Liquidation is the formal process of winding up a company's financial affairs by selling its assets to repay creditors, often resulting in the company ceasing operations. This process typically involves appointing a liquidator who oversees asset valuation, creditor notifications, and distribution of proceeds according to legal priorities. Understanding liquidation requires recognizing its role as a mechanism for resolving insolvency and ensuring an orderly settlement of outstanding obligations.

What is Receivership? Key Concepts Explained

Receivership is a legal process in which a court-appointed receiver takes control of a company's assets and operations to manage debts and protect creditors' interests. The receiver's primary duties include preserving asset value, operating the business if viable, and facilitating repayment to secured creditors. Unlike liquidation, where the company ceases operations and assets are sold off, receivership aims to maximize returns by restructuring or selling assets under court supervision.

Main Differences Between Liquidation and Receivership

Liquidation involves winding up a company's affairs by selling assets to pay creditors and then dissolving the company, whereas receivership appoints a receiver to manage company assets primarily to recover debt for secured creditors without necessarily dissolving the business. Liquidation results in the company ceasing to exist, while receivership may allow the company to continue operating under receiver control. The key difference lies in liquidation's focus on closure and payout distribution, contrasting with receivership's emphasis on asset management and debt recovery.

Legal Framework Governing Liquidation and Receivership

The legal framework governing liquidation involves a court-supervised process where a company's assets are sold to repay creditors, typically under insolvency laws such as the Insolvency and Bankruptcy Code (IBC) in India or the Bankruptcy Code in the United States. Receivership is regulated through specific statutory provisions or court orders that appoint a receiver to manage and protect assets, often under the authority of secured creditors or courts, as outlined in laws like the U.S. Uniform Commercial Code (UCC) or the UK's Insolvency Act 1986. Both processes are distinct but overlap in insolvency situations, with liquidation concluding a company's existence and receivership focusing on asset preservation and recovery.

Triggers and Causes: When Are Liquidation or Receivership Initiated?

Liquidation is typically triggered by insolvency, where a company cannot pay its debts and creditors seek to recover their funds, often through a court order. Receivership is usually initiated when secured creditors appoint a receiver to take control of the company's assets to recover specific debts, often without the company being fully insolvent. Both processes are prompted by financial distress, but liquidation aims to wind down the company entirely, whereas receivership focuses on asset management and debt recovery.

Roles and Responsibilities: Liquidators vs Receivers

Liquidators are appointed to wind up a company's affairs by selling assets, paying debts, and distributing any remaining funds to shareholders, ensuring compliance with insolvency laws. Receivers are typically appointed by secured creditors to take control of specific assets or business operations, aiming to recover owed amounts on secured debts. While liquidators handle the entire dissolution process, receivers focus on maximizing recovery from designated assets without necessarily ending the company's existence.

Impact on Creditors and Stakeholders

Liquidation dissolves a company by selling all assets to repay creditors, often resulting in lower returns for unsecured creditors due to asset distribution priorities. Receivership appoints a receiver to manage and preserve assets, which can enhance creditor recoveries by potentially restructuring or continuing operations. Stakeholders in receivership may have better chances of preserving value and jobs compared to liquidation's total asset sell-off.

Asset Distribution in Liquidation vs Receivership

In liquidation, asset distribution follows a strict priority order where secured creditors are paid first, followed by unsecured creditors and equity holders last. Receivership involves a court-appointed receiver managing or selling assets to recover debts, often prioritizing specific secured creditors based on the receiver's mandate. The key distinction lies in liquidation aiming for complete asset conversion to cash and full creditor repayment, while receivership may focus on preserving asset value and operational continuity.

Advantages and Disadvantages of Each Process

Liquidation offers the advantage of fully winding up a company's affairs and distributing remaining assets to creditors, providing a clear endpoint, but it results in the cessation of business operations and potential job losses. Receivership allows a receiver to manage and protect assets, often enabling business continuity and maximizing creditor recoveries, yet it can limit management's control and may negatively impact stakeholder confidence. Both processes present distinct challenges: liquidation can be lengthy and complex, while receivership might lead to less favorable outcomes if asset values decline due to ongoing operations.

Choosing the Right Path: Factors to Consider

Evaluating the financial health, stakeholder interests, and future business viability is essential when choosing between liquidation and receivership. Liquidation involves winding up assets to pay creditors, often signaling the end of the business, while receivership appoints a receiver to manage and recover company assets, potentially allowing continuation. Factors such as creditor priorities, legal obligations, and the likelihood of company recovery play a critical role in determining the appropriate insolvency process.

Liquidation Infographic

libterm.com

libterm.com