Legal expense insurance covers your costs related to legal advice, representation, and court fees, ensuring financial protection during disputes. It helps you handle legal matters confidently without worrying about excessive expenses. Discover how legal expense insurance can safeguard your interests by reading the rest of the article.

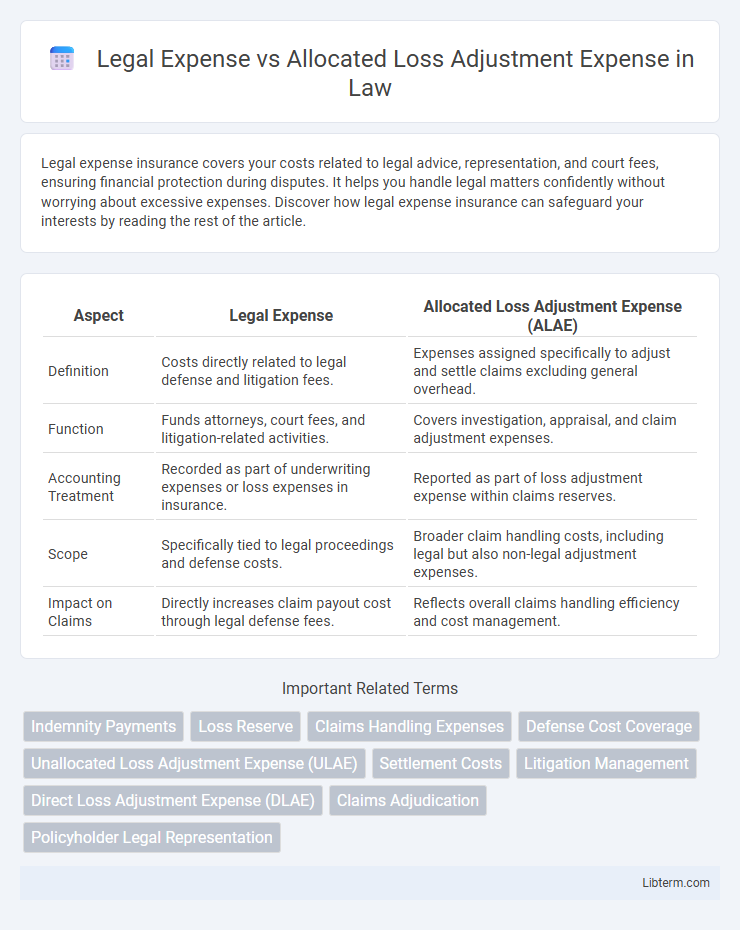

Table of Comparison

| Aspect | Legal Expense | Allocated Loss Adjustment Expense (ALAE) |

|---|---|---|

| Definition | Costs directly related to legal defense and litigation fees. | Expenses assigned specifically to adjust and settle claims excluding general overhead. |

| Function | Funds attorneys, court fees, and litigation-related activities. | Covers investigation, appraisal, and claim adjustment expenses. |

| Accounting Treatment | Recorded as part of underwriting expenses or loss expenses in insurance. | Reported as part of loss adjustment expense within claims reserves. |

| Scope | Specifically tied to legal proceedings and defense costs. | Broader claim handling costs, including legal but also non-legal adjustment expenses. |

| Impact on Claims | Directly increases claim payout cost through legal defense fees. | Reflects overall claims handling efficiency and cost management. |

Introduction to Legal Expense and Allocated Loss Adjustment Expense

Legal Expense encompasses the costs incurred by an insurer for legal services related to claim settlements, including attorney fees and court costs. Allocated Loss Adjustment Expense (ALAE) refers to specific expenses directly attributed to handling and investigating individual claims, such as expert witness fees and legal defense costs. Understanding the distinction helps insurers accurately allocate costs between claim handling and broader operational expenses.

Definitions: Legal Expense vs Allocated Loss Adjustment Expense

Legal expense refers to the costs incurred by an insurance company for legal services related to claims, including attorney fees and court costs. Allocated Loss Adjustment Expense (ALAE) represents specific expenses directly tied to the investigation, defense, and settlement of individual claims. While legal expenses are a subset of ALAE, ALAE encompasses all claim-related costs that can be assigned to a particular claim, differentiating it from unallocated loss adjustment expenses.

Key Differences Between Legal Expense and ALAAE

Legal Expense refers specifically to costs incurred for legal services such as attorney fees, court costs, and settlement negotiations, directly related to litigations or claims. Allocated Loss Adjustment Expense (ALAAE) encompasses all expenses directly associated with handling a specific insurance claim, including legal expenses but also investigative costs, expert witness fees, and other claim-specific costs. The key difference lies in scope: Legal Expenses are a subset within ALAAE, which represents the broader category of all claim-adjustment costs allocated to individual claims.

Importance of Distinguishing Legal and ALAAE Costs

Distinguishing Legal Expense from Allocated Loss Adjustment Expense (ALAAE) is crucial for accurate insurance claim management and financial reporting. Legal Expenses typically include attorney fees related directly to defense and litigation, while ALAAE encompasses broader claim adjustment costs such as expert witnesses and investigations. Proper classification ensures precise cost allocation, risk assessment, and compliance with regulatory accounting standards.

Components of Legal Expense

Legal Expense primarily includes attorney fees, court costs, and other litigation-related charges incurred during the defense or prosecution of claims. This category covers retained counsel fees, expert witness fees, investigation costs, and settlement negotiation expenses that arise directly from legal proceedings. Allocated Loss Adjustment Expense (ALAE) encompasses these legal costs specifically associated with a particular claim, distinguishing them from unallocated expenses that are administrative or general overhead in nature.

Breakdown of Allocated Loss Adjustment Expense

Allocated Loss Adjustment Expense (ALAE) encompasses costs directly tied to managing and settling insurance claims, including attorney fees, investigation fees, and court costs, distinguishing it from broader Legal Expense categories. A detailed breakdown of ALAE reveals that legal fees typically constitute the largest portion, followed by expert witness fees and claim adjuster expenses, each essential for thorough claim assessment and resolution. Understanding these components helps insurers accurately forecast claim-related costs and allocate resources efficiently.

Impact on Insurance Claims Management

Legal Expense pertains to costs incurred for external legal services during insurance claim disputes, often causing a direct increase in overall claim settlement expenses. Allocated Loss Adjustment Expense (ALAE) includes these legal fees as well as other specific claim handling costs, impacting the insurer's loss reserves and influencing claim settlement timelines. Effective management of ALAE optimizes resource allocation, reduces claim cycle time, and enhances the accuracy of loss forecasting in insurance claims management.

Financial Reporting Implications

Legal Expense refers to costs directly associated with legal services incurred during the claims process, impacting immediate profit and loss accounts in financial reporting. Allocated Loss Adjustment Expense (ALAE) encompasses all claim-related expenses, including legal fees, that are separately identified and charged to specific claims, affecting reserves and liability estimations on the balance sheet. Accurate classification and allocation of these expenses are crucial for insurers to ensure transparent financial statements and compliance with regulatory reporting standards such as GAAP or IFRS.

Best Practices for Tracking and Allocating Expenses

Effective tracking and allocating Legal Expense and Allocated Loss Adjustment Expense (ALAE) requires implementing detailed cost coding systems that distinctly categorize legal fees and claims adjustment costs. Utilizing integrated claims management software enhances transparency by capturing real-time expense data and linking expenditures directly to individual claims. Regular audits and standardized reporting protocols ensure accuracy, enabling precise financial analysis and compliance with regulatory standards.

Conclusion: Optimizing Loss Adjustment Strategies

Optimizing loss adjustment strategies requires distinguishing between Legal Expense, which covers attorney fees and litigation costs, and Allocated Loss Adjustment Expense (ALAE), including all claim-specific costs directly assigned to a particular loss. Efficient management of Legal Expense and ALAE leads to more accurate reserving, improved cost control, and enhanced claims handling effectiveness. Leveraging data analytics to monitor these expenses supports strategic decisions that minimize overall claim settlement costs while maintaining compliance and policyholder satisfaction.

Legal Expense Infographic

libterm.com

libterm.com