A limitation of liability clause restricts the amount or types of damages one party can recover from another in a contract or agreement. It is essential for protecting businesses from excessive financial exposure due to unforeseen events or breaches. Explore the full article to understand how this clause can safeguard your interests effectively.

Table of Comparison

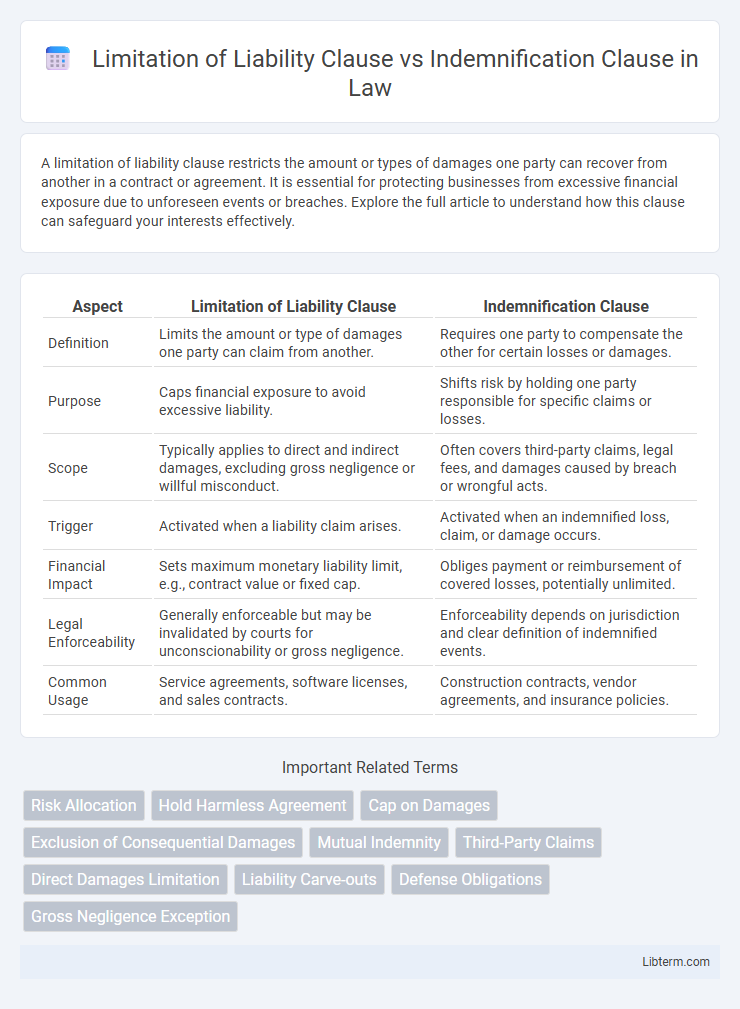

| Aspect | Limitation of Liability Clause | Indemnification Clause |

|---|---|---|

| Definition | Limits the amount or type of damages one party can claim from another. | Requires one party to compensate the other for certain losses or damages. |

| Purpose | Caps financial exposure to avoid excessive liability. | Shifts risk by holding one party responsible for specific claims or losses. |

| Scope | Typically applies to direct and indirect damages, excluding gross negligence or willful misconduct. | Often covers third-party claims, legal fees, and damages caused by breach or wrongful acts. |

| Trigger | Activated when a liability claim arises. | Activated when an indemnified loss, claim, or damage occurs. |

| Financial Impact | Sets maximum monetary liability limit, e.g., contract value or fixed cap. | Obliges payment or reimbursement of covered losses, potentially unlimited. |

| Legal Enforceability | Generally enforceable but may be invalidated by courts for unconscionability or gross negligence. | Enforceability depends on jurisdiction and clear definition of indemnified events. |

| Common Usage | Service agreements, software licenses, and sales contracts. | Construction contracts, vendor agreements, and insurance policies. |

Introduction to Contractual Risk Management

Limitation of Liability Clauses define the maximum extent to which a party can be held financially responsible for damages, crucial for mitigating unpredictable losses in contractual risk management. Indemnification Clauses allocate risk by requiring one party to compensate the other for specific losses or damages, providing clear financial protection against third-party claims. Effective introduction to contractual risk management involves understanding these clauses to balance liability exposure and safeguard business interests.

Defining Limitation of Liability Clauses

Limitation of liability clauses establish the maximum amount or types of damages a party can be held responsible for under a contract, thereby capping financial exposure. These provisions often specify monetary limits or exclude certain categories of damages such as consequential, incidental, or punitive losses. By clearly defining risk boundaries, limitation of liability clauses protect parties from disproportionate claims and enhance contractual certainty.

Understanding Indemnification Clauses

Indemnification clauses require one party to compensate the other for specific losses or damages, often including legal fees related to third-party claims. These clauses protect against liabilities arising from negligence, breaches, or other specified events, ensuring financial responsibility is clearly allocated. Understanding the scope, triggers, and limits of indemnification clauses is crucial to effectively managing risk in contracts.

Key Differences Between Limitation of Liability and Indemnification

Limitation of Liability clauses cap the amount or types of damages a party can recover, restricting financial exposure in contractual relationships. Indemnification clauses require one party to compensate the other for specified losses or damages, often including third-party claims, shifting risk rather than limiting it. Key differences include that limitation of liability controls the maximum recovery from a party, whereas indemnification mandates reimbursement for losses, shaping risk allocation and financial responsibility in contracts.

Typical Purposes of Limitation of Liability Clauses

Limitation of liability clauses primarily aim to cap the amount or type of damages a party can recover under a contract, protecting businesses from excessive financial exposure in cases of breach or negligence. These clauses often specify maximum liability limits or exclude certain types of damages such as consequential or incidental losses. By providing predictable risk boundaries, limitation of liability clauses help companies manage potential legal costs and allocate risks more effectively in commercial agreements.

Common Applications of Indemnification Clauses

Indemnification clauses are commonly used in commercial contracts to allocate risk by requiring one party to compensate the other for specific losses or damages arising from third-party claims, such as intellectual property infringement or personal injury. These clauses often appear in service agreements, construction contracts, and licensing deals to protect against liabilities that exceed the scope of limitation of liability provisions. Unlike limitation of liability clauses that cap the maximum financial exposure, indemnification clauses create direct monetary obligations to cover losses caused by negligence or breach of contract.

Practical Examples in Commercial Agreements

A Limitation of Liability Clause in commercial agreements often caps the amount a party can be held responsible for, such as limiting damages to the contract value in a software licensing deal. In contrast, an Indemnification Clause requires one party to compensate the other for specific losses or damages, like a supplier indemnifying a retailer against product liability claims. Practical applications include a service provider limiting liability for indirect damages, while agreeing to indemnify the client against third-party intellectual property infringement claims.

Legal Implications and Enforceability

Limitation of liability clauses restrict the amount or type of damages a party can recover, primarily protecting businesses from excessive financial exposure, whereas indemnification clauses require one party to compensate the other for specific losses or damages arising from third-party claims. Courts closely scrutinize both clauses, often enforcing limitation of liability provisions if they are clear, unambiguous, and not unconscionable, while indemnification clauses must explicitly define the scope of indemnified claims to be upheld. Legal implications hinge on jurisdictional differences and contract context, making precise drafting crucial to ensure enforceability and to avoid unintended liability exposure.

Drafting Considerations for Both Clauses

Drafting a Limitation of Liability Clause requires precise language to cap damages and clearly define exclusions, ensuring enforceability under jurisdiction-specific laws. Indemnification Clauses must specify the scope of liabilities covered, including third-party claims, and establish procedures for defense and indemnity claims. Combining both clauses in contracts demands careful coordination to avoid overlapping responsibilities and conflicting obligations.

Best Practices for Negotiating Risk Allocation

Limitation of liability clauses and indemnification clauses both play crucial roles in risk allocation but serve different purposes: limitation clauses cap the maximum financial exposure, while indemnification clauses require one party to compensate the other for specific losses. Best practices for negotiating these clauses include clearly defining the scope of liability, specifying excluded damages, and ensuring mutual understanding of indemnity triggers such as negligence or breach of contract. Parties should tailor provisions to reflect the nature of the transaction, allocate risks proportionate to control and responsibility, and seek balanced language to avoid overly broad or ambiguous obligations.

Limitation of Liability Clause Infographic

libterm.com

libterm.com