Statutory fee refers to a fixed charge established by law for specific services, transactions, or legal processes, ensuring standardized costs across jurisdictions. This fee often applies to court filings, official documents, and government services, providing transparency and predictability in legal and administrative expenses. Explore the rest of this article to understand how statutory fees might impact your financial obligations.

Table of Comparison

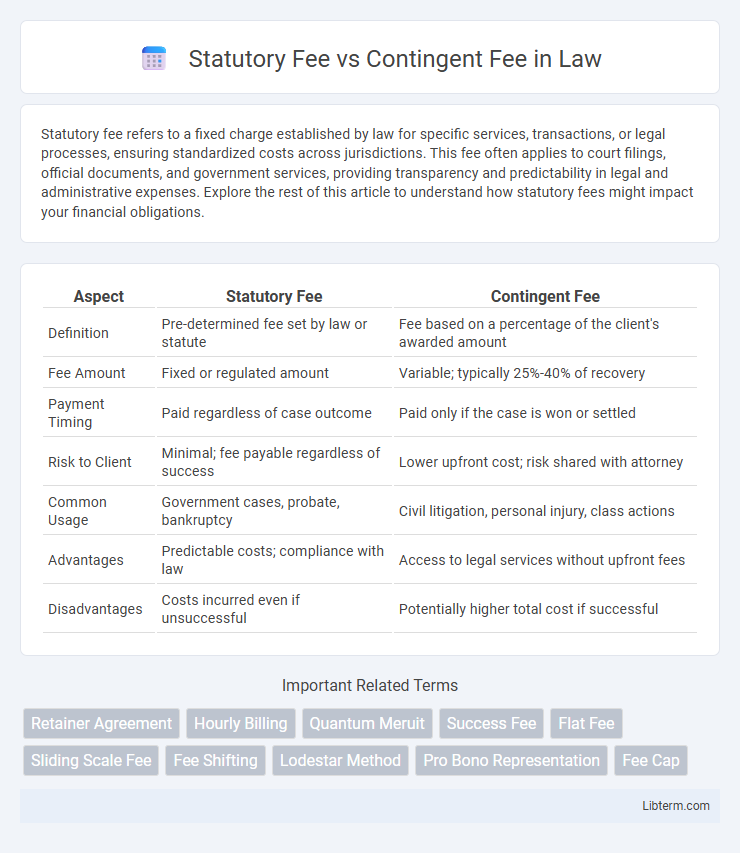

| Aspect | Statutory Fee | Contingent Fee |

|---|---|---|

| Definition | Pre-determined fee set by law or statute | Fee based on a percentage of the client's awarded amount |

| Fee Amount | Fixed or regulated amount | Variable; typically 25%-40% of recovery |

| Payment Timing | Paid regardless of case outcome | Paid only if the case is won or settled |

| Risk to Client | Minimal; fee payable regardless of success | Lower upfront cost; risk shared with attorney |

| Common Usage | Government cases, probate, bankruptcy | Civil litigation, personal injury, class actions |

| Advantages | Predictable costs; compliance with law | Access to legal services without upfront fees |

| Disadvantages | Costs incurred even if unsuccessful | Potentially higher total cost if successful |

Understanding Statutory Fees

Statutory fees are fixed charges set by law or regulation that govern payments in legal or professional services, ensuring transparency and predictability. These fees are predetermined and apply uniformly, regardless of the case outcome, unlike contingent fees which depend on the success of the claim. Understanding statutory fees is essential for clients to anticipate legal costs accurately and for professionals to comply with regulatory standards.

What is a Contingent Fee?

A contingent fee is a payment arrangement where a lawyer receives a percentage of the client's settlement or award only if the case is won, typically ranging from 25% to 40%. This fee structure is common in personal injury and tort law cases, allowing clients access to legal representation without upfront costs. Unlike statutory fees, which are fixed by law or statute, contingent fees depend entirely on the case outcome and offer risk-sharing between attorney and client.

Key Differences Between Statutory and Contingent Fees

Statutory fees are fixed amounts established by law or regulation, ensuring uniformity and predictability in charges for legal services, while contingent fees depend on the outcome of the case and represent a percentage of the client's awarded damages or settlement. Statutory fees provide clarity and avoid disputes over payment, but contingent fees align the lawyer's incentives with the client's success, often used in personal injury or class action lawsuits. The key differences lie in fee structure, risk allocation, and the timing of payment, impacting both client affordability and attorney motivation.

Legal Contexts for Statutory Fees

Statutory fees are predetermined charges established by law for specific legal services, ensuring predictability and uniformity in legal billing, particularly in contexts such as probate, bankruptcy, and court filings. These fees provide clear guidelines for attorneys and clients, minimizing disputes over payment amounts and facilitating streamlined administrative processes. Contingent fees, by contrast, depend on the outcome of a case, commonly used in personal injury and class action lawsuits, where fees are calculated as a percentage of the client's awarded damages.

When Are Contingent Fees Used?

Contingent fees are primarily used in personal injury, wrongful death, and other tort cases where the client may lack the upfront resources to pay legal fees, allowing attorneys to be compensated only upon winning the case or securing a settlement. These fees align the lawyer's incentives with the client's outcome, especially in cases involving damages for medical expenses, lost wages, or pain and suffering. Statutory fees, in contrast, are predetermined by law and commonly applied in probate, bankruptcy, or government-related matters where fee amounts are fixed regardless of case outcome.

Pros and Cons of Statutory Fees

Statutory fees provide transparent, fixed legal costs established by law, ensuring predictability for clients and reducing disputes over charges. However, their rigidity can limit flexibility and may not adequately compensate lawyers for complex or time-consuming cases. Clients benefit from clarity and budget control, but this structure might discourage attorneys from taking on highly demanding or specialized work that requires greater effort beyond standard fee schedules.

Advantages and Disadvantages of Contingent Fees

Contingent fees offer clients access to legal representation without upfront costs, as lawyers receive payment only upon winning the case, aligning their interests with the client's success and reducing financial risk. However, contingent fees can lead to higher overall costs if the case is successful, potentially exceeding statutory fees, and may limit a lawyer's willingness to take cases with lower chances of winning. This fee structure can also cause ethical concerns regarding prioritizing cases based on profitability rather than merit.

Factors Influencing Attorney Fee Structures

Statutory fees are fixed amounts set by law for specific legal services, ensuring predictability and compliance, while contingent fees depend on the case outcome, typically calculated as a percentage of the settlement or judgment. Factors influencing attorney fee structures include case complexity, risk level, jurisdictional regulations, and client ability to pay. Market competition and the attorney's experience also play critical roles in determining whether a statutory or contingent fee is more appropriate.

Statutory Fee vs Contingent Fee: Which Is Right for You?

Statutory fees are fixed by law, ensuring predictable legal costs based on specific services rendered, while contingent fees depend on the case outcome, typically a percentage of the settlement or award, reducing upfront expenses. Choosing between statutory and contingent fees depends on factors like case type, financial situation, and risk tolerance; statutory fees suit clients seeking cost certainty, whereas contingent fees benefit those unable to pay upfront but willing to share a portion of potential winnings. Evaluating your legal needs, budget, and willingness to assume financial risk helps determine the best fee structure for your situation.

Frequently Asked Questions About Legal Fees

Statutory fees are fixed amounts set by law for specific legal services, ensuring predictable costs for clients, while contingent fees depend on the case outcome, typically a percentage of the settlement or award. Frequently asked questions about legal fees often address how statutory fees guarantee transparency, whereas contingent fees offer access to legal representation without upfront costs but involve sharing part of the recovered amount. Understanding these fee structures helps clients make informed decisions about attorney payments based on case type and financial capability.

Statutory Fee Infographic

libterm.com

libterm.com