Incurred But Not Reported (IBNR) reserves represent the estimated liabilities for insurance claims that have occurred but have not yet been reported to the insurer. Accurately calculating IBNR reserves is crucial for maintaining the financial health and regulatory compliance of insurance companies. Discover how understanding IBNR reserves can improve your risk management in the detailed analysis below.

Table of Comparison

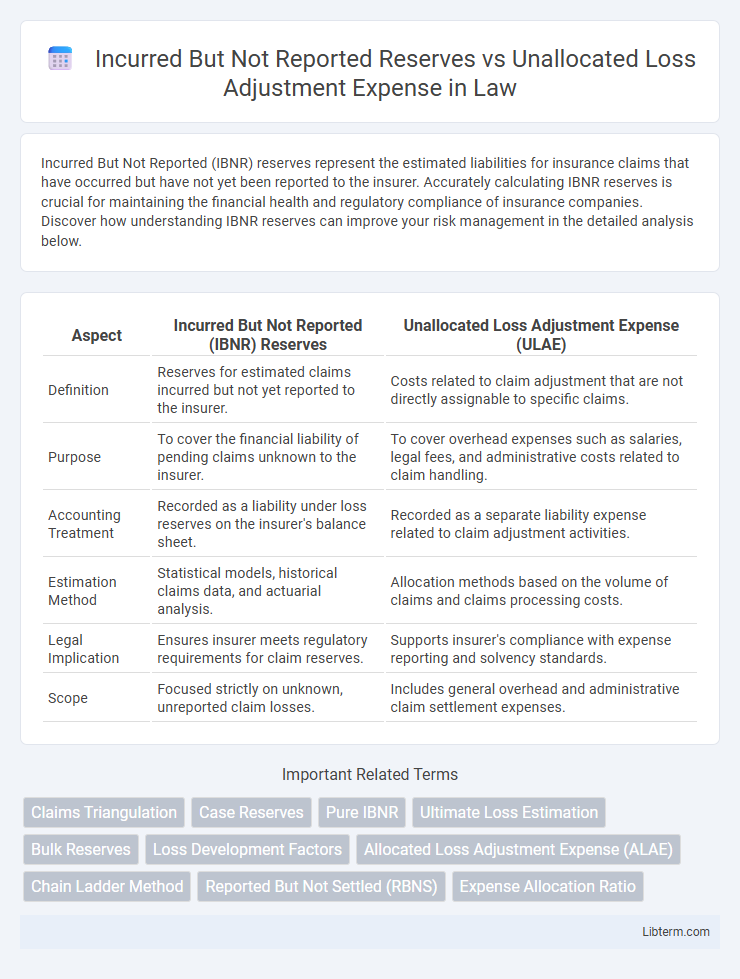

| Aspect | Incurred But Not Reported (IBNR) Reserves | Unallocated Loss Adjustment Expense (ULAE) |

|---|---|---|

| Definition | Reserves for estimated claims incurred but not yet reported to the insurer. | Costs related to claim adjustment that are not directly assignable to specific claims. |

| Purpose | To cover the financial liability of pending claims unknown to the insurer. | To cover overhead expenses such as salaries, legal fees, and administrative costs related to claim handling. |

| Accounting Treatment | Recorded as a liability under loss reserves on the insurer's balance sheet. | Recorded as a separate liability expense related to claim adjustment activities. |

| Estimation Method | Statistical models, historical claims data, and actuarial analysis. | Allocation methods based on the volume of claims and claims processing costs. |

| Legal Implication | Ensures insurer meets regulatory requirements for claim reserves. | Supports insurer's compliance with expense reporting and solvency standards. |

| Scope | Focused strictly on unknown, unreported claim losses. | Includes general overhead and administrative claim settlement expenses. |

Understanding Incurred But Not Reported (IBNR) Reserves

Incurred But Not Reported (IBNR) reserves represent the estimated liability for claims that have occurred but have not yet been reported to the insurer, playing a critical role in accurate loss reserving. These reserves differ from Unallocated Loss Adjustment Expense (ULAE), which covers the insurer's overhead costs related to handling claims, rather than the claims' direct costs. Properly estimating IBNR reserves ensures that an insurance company's financial statements reflect the true cost of claims exposure not yet captured by reported losses.

What is Unallocated Loss Adjustment Expense (ULAE)?

Unallocated Loss Adjustment Expense (ULAE) refers to the overhead costs insurers incur while handling claims that cannot be directly attributed to a specific claim, such as salaries of claims personnel, office expenses, and administrative support. Unlike Incurred But Not Reported (IBNR) reserves, which estimate the cost of claims yet to be reported, ULAE covers ongoing expenses related to managing both reported and unreported claims. Properly estimating ULAE is crucial for insurers to maintain accurate loss reserves and ensure financial stability.

Key Differences Between IBNR and ULAE

Incurred But Not Reported (IBNR) reserves represent the estimated liabilities for claims that have occurred but have not yet been reported to the insurer, whereas Unallocated Loss Adjustment Expense (ULAE) covers the indirect costs of handling all claims, such as administrative expenses. IBNR quantifies the outstanding claim amounts based on statistical models and historical data, while ULAE allocates expenses not attributable to individual claims but necessary for claims settlement activities. Understanding the distinction between IBNR and ULAE is crucial for accurate reserving and financial reporting in insurance operations.

Importance of Accurate IBNR Estimation

Accurate estimation of Incurred But Not Reported (IBNR) reserves is critical for insurance companies to maintain financial stability and ensure sufficient claim liabilities are recorded, reflecting true risk exposure. Misestimating IBNR can lead to significant discrepancies in Unallocated Loss Adjustment Expense (ULAE), affecting the overall claims management cost allocation and profitability analysis. Precision in IBNR directly impacts the adequacy of reserve setting, regulatory compliance, and investor confidence in the insurer's financial health.

Methods for Calculating ULAE

Methods for calculating Unallocated Loss Adjustment Expense (ULAE) primarily include the percentage of loss method, where ULAE is estimated as a fixed percentage of incurred losses, and the per claim method, which allocates expenses based on the number of claims handled. The weighted average method combines historical ULAE ratios with exposure measures to refine estimates. Actuarial analysis and loss development factors further enhance accuracy by adjusting for changes in claim patterns and operational efficiency.

Impact of IBNR and ULAE on Insurer Financials

Incurred But Not Reported (IBNR) reserves represent the estimated liabilities for claims that have occurred but are not yet reported, directly impacting an insurer's loss reserves and overall balance sheet strength. Unallocated Loss Adjustment Expense (ULAE) covers the indirect costs of claims handling, influencing the insurer's underwriting expenses and profitability metrics. Proper estimation of IBNR and ULAE is critical for accurate financial reporting, solvency assessment, and regulatory compliance within the insurance industry.

Challenges in IBNR and ULAE Reserve Management

Challenges in managing Incurred But Not Reported (IBNR) reserves and Unallocated Loss Adjustment Expense (ULAE) revolve around accurate estimation amid uncertainty and data limitations. IBNR reserve estimation requires actuaries to predict future claim occurrences and development patterns, often hindered by incomplete reporting and evolving claim trends. ULAE reserves face difficulties in allocating expenses properly without direct linkage to specific claims, complicating financial planning and regulatory compliance.

Regulatory Requirements for IBNR and ULAE

Regulatory requirements for Incurred But Not Reported (IBNR) reserves mandate insurers to estimate and hold reserves for claims incurred but not yet reported, ensuring statutory solvency and financial stability. Unallocated Loss Adjustment Expense (ULAE) reserves must also comply with regulatory guidelines, reflecting costs related to claims handling that are not directly attributable to specific claims. Accurate reserving for both IBNR and ULAE is critical for meeting state insurance department standards and maintaining compliance with financial reporting and risk management protocols.

Best Practices for Monitoring Reserves

Effective monitoring of Incurred But Not Reported (IBNR) Reserves and Unallocated Loss Adjustment Expense (ULAE) demands rigorous data analysis and regular reconciliation to ensure reserve adequacy and financial accuracy. Employing predictive modeling techniques enhances the estimation of IBNR by capturing latent claim liabilities, while tracking ULAE requires detailed expense allocation to distinguish indirect claim handling costs from direct losses. Implementing robust governance frameworks with periodic reserve reviews and clear documentation supports compliance and improves risk management in insurance reserve practices.

Future Trends in Reserve Estimation and Reporting

Incurred But Not Reported (IBNR) reserves and Unallocated Loss Adjustment Expense (ULAE) are critical components in insurance reserve estimation, with future trends emphasizing enhanced predictive analytics and machine learning models to improve accuracy and timeliness. Advances in big data integration enable actuaries to refine IBNR reserve calculations by leveraging real-time claims data and external factors, reducing uncertainty in loss development patterns. Emerging regulatory requirements and increased demand for transparency drive the adoption of automated reporting systems, ensuring more precise allocation and detailed disclosure of ULAE costs within overall reserve frameworks.

Incurred But Not Reported Reserves Infographic

libterm.com

libterm.com