A direct suit is a legal action filed directly against a party without prior claims or negotiations, often used to expedite the resolution of disputes. This approach can save time and resources by bypassing preliminary steps, but it also requires a thorough understanding of the legal requirements and potential consequences. Discover how a direct suit might impact your case and what you need to consider by reading the rest of the article.

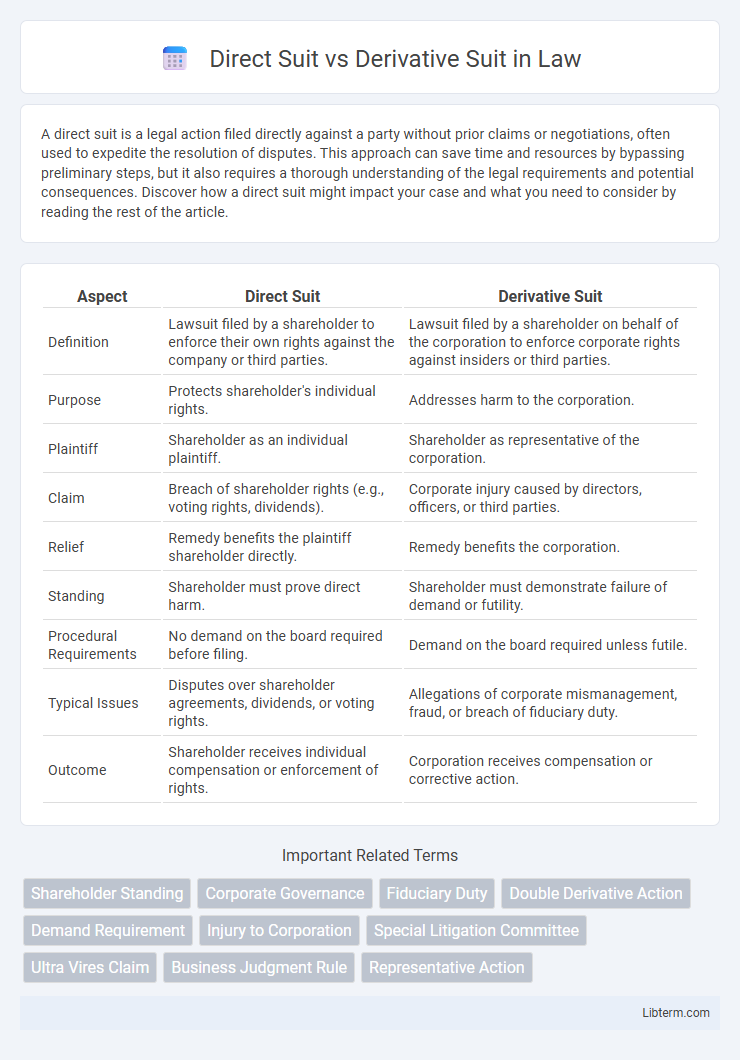

Table of Comparison

| Aspect | Direct Suit | Derivative Suit |

|---|---|---|

| Definition | Lawsuit filed by a shareholder to enforce their own rights against the company or third parties. | Lawsuit filed by a shareholder on behalf of the corporation to enforce corporate rights against insiders or third parties. |

| Purpose | Protects shareholder's individual rights. | Addresses harm to the corporation. |

| Plaintiff | Shareholder as an individual plaintiff. | Shareholder as representative of the corporation. |

| Claim | Breach of shareholder rights (e.g., voting rights, dividends). | Corporate injury caused by directors, officers, or third parties. |

| Relief | Remedy benefits the plaintiff shareholder directly. | Remedy benefits the corporation. |

| Standing | Shareholder must prove direct harm. | Shareholder must demonstrate failure of demand or futility. |

| Procedural Requirements | No demand on the board required before filing. | Demand on the board required unless futile. |

| Typical Issues | Disputes over shareholder agreements, dividends, or voting rights. | Allegations of corporate mismanagement, fraud, or breach of fiduciary duty. |

| Outcome | Shareholder receives individual compensation or enforcement of rights. | Corporation receives compensation or corrective action. |

Understanding Direct Suits: Definition and Purpose

A Direct Suit is a legal action initiated by shareholders to enforce their individual rights against a corporation, typically arising from injuries directly affecting their personal interests, such as denied dividends or voting rights. Unlike Derivative Suits, which address wrongs done to the corporation itself and benefit all shareholders collectively, Direct Suits seek remedies for specific shareholder harms. The primary purpose of a Direct Suit is to provide an avenue for shareholders to obtain relief for personal financial losses or violations of their shareholder agreements.

Defining Derivative Suits: Protecting Corporate Interests

Derivative suits allow shareholders to initiate legal action on behalf of the corporation against insiders such as directors or officers for breaches of fiduciary duty. These lawsuits protect corporate interests by addressing harm suffered by the company rather than individual shareholders. The goal of derivative suits is to enforce corporate governance and rectify wrongdoing that negatively impacts the corporation's value.

Key Differences Between Direct and Derivative Suits

Direct suits involve shareholders suing on their own behalf for personal harm, such as violations of voting rights or denial of dividends, while derivative suits are filed on behalf of the corporation to address wrongs committed against the company, like breaches of fiduciary duty by directors. In direct suits, the plaintiff retains any recovery obtained, whereas in derivative suits, any monetary award or settlement belongs to the corporation. Standing requirements differ significantly: direct suits require proof of individual harm, whereas derivative suits necessitate demonstrating demand futility or prior demand on the board before filing.

Who Can Initiate: Standing in Direct and Derivative Actions

Direct suits can be initiated only by shareholders who have suffered a personal and distinct injury separate from the corporation, granting them standing to sue for their individual harm. Derivative suits must be brought by shareholders on behalf of the corporation to address wrongs done to the corporation itself, requiring that the plaintiff adequately represent the interests of the corporation and its shareholders. Shareholder standing in derivative actions typically involves filing a demand on the board or demonstrating why such demand would be futile, whereas direct suits do not require this procedural step.

Procedural Requirements for Filing Each Suit

Direct suits require the shareholder to file individually for wrongs done directly to their own rights, with procedural requirements including proper notice to the corporation and adherence to strict timelines for filing. Derivative suits must meet the demand requirement, where the shareholder formally requests the board to address the alleged harm before initiating litigation; if the demand is refused or ignored, the shareholder can proceed with the suit on the corporation's behalf. Both actions require compliance with jurisdictional rules, and derivative suits also demand proof of standing and a demonstration that the corporation suffered harm impacting all shareholders.

Common Grounds for Direct Lawsuits by Shareholders

Direct suits by shareholders arise when individual rights are violated, such as denial of dividends, misrepresentation in stock issuance, or interference with voting rights. These lawsuits address harm to the shareholder's personal interests, distinct from harm to the corporation. Common grounds include breach of fiduciary duty directly affecting the shareholder, illegal shareholder discrimination, and violations of shareholder agreements.

Typical Scenarios for Derivative Suits

Derivative suits commonly arise when minority shareholders seek to address harm to the corporation caused by executives or board members without proper corporate action. Typical scenarios include alleged breaches of fiduciary duty, waste of corporate assets, or conflicts of interest where the corporation fails to enforce its rights. In these cases, shareholders file derivative suits to compel corrective measures and recover damages on behalf of the corporation.

Legal Remedies Available in Direct vs. Derivative Suits

In direct suits, shareholders seek personal legal remedies such as injunctions, monetary damages, or corrective actions for harm directly affecting their individual rights. Derivative suits enable shareholders to pursue remedies on behalf of the corporation, targeting fiduciary breaches or corporate mismanagement, with recovered damages benefiting the company rather than individual shareholders. Courts often require derivative suits to meet procedural prerequisites like demand futility or board refusal before granting relief to protect corporate interests.

Impact on Shareholders and the Corporation

Direct suits enable shareholders to pursue claims for violations of their individual rights, leading to potential personal recoveries without implicating the corporation's overall assets. Derivative suits involve shareholders suing on behalf of the corporation for harm done to the company, with any recovery benefiting the corporation and indirectly affecting all shareholders. The impact on shareholders in derivative suits can include increased corporate governance transparency, while direct suits typically focus on safeguarding shareholder-specific interests.

Recent Case Law and Trends in Direct and Derivative Litigation

Recent case law in direct suits emphasizes shareholder rights to challenge corporate mismanagement when personal harm is distinct from that of the corporation, as seen in landmark rulings such as Dell Inc. v. Magnetar Global. Trends in derivative litigation show an increase in demands for enhanced corporate governance and transparency, driven by courts applying stricter standards on demand futility and pleadings under Rule 23.1 of the Federal Rules of Civil Procedure. These developments reflect a growing judicial focus on delineating proper claim pathways while encouraging shareholder accountability mechanisms in corporate disputes.

Direct Suit Infographic

libterm.com

libterm.com