A joint venture is a strategic partnership where two or more parties collaborate to achieve a specific business goal while sharing risks and rewards. This arrangement allows companies to combine resources, expertise, and market access to enhance their competitive advantage. Explore the article to understand how joint ventures can drive your business growth and success.

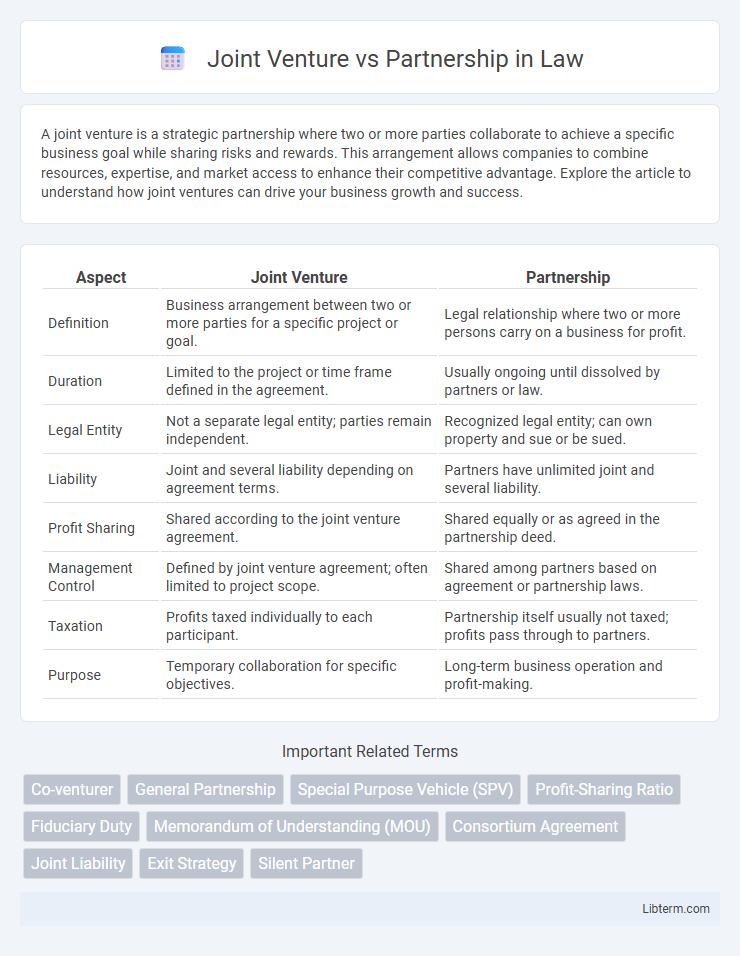

Table of Comparison

| Aspect | Joint Venture | Partnership |

|---|---|---|

| Definition | Business arrangement between two or more parties for a specific project or goal. | Legal relationship where two or more persons carry on a business for profit. |

| Duration | Limited to the project or time frame defined in the agreement. | Usually ongoing until dissolved by partners or law. |

| Legal Entity | Not a separate legal entity; parties remain independent. | Recognized legal entity; can own property and sue or be sued. |

| Liability | Joint and several liability depending on agreement terms. | Partners have unlimited joint and several liability. |

| Profit Sharing | Shared according to the joint venture agreement. | Shared equally or as agreed in the partnership deed. |

| Management Control | Defined by joint venture agreement; often limited to project scope. | Shared among partners based on agreement or partnership laws. |

| Taxation | Profits taxed individually to each participant. | Partnership itself usually not taxed; profits pass through to partners. |

| Purpose | Temporary collaboration for specific objectives. | Long-term business operation and profit-making. |

Understanding Joint Ventures and Partnerships

A joint venture is a strategic alliance where two or more parties create a new entity to share resources, risks, and profits for a specific project or business activity. Partnerships involve individuals or entities working together under a unified agreement, sharing management responsibilities and continuous profits without forming a separate entity. Understanding the legal structure, liability implications, and tax treatment differences is essential for choosing between a joint venture and a partnership.

Key Differences Between Joint Ventures and Partnerships

Joint ventures are typically formed for a specific project or limited duration, while partnerships involve an ongoing business relationship with shared responsibilities and profits. In a joint venture, parties maintain their separate legal identities, unlike partnerships where partners share liability and operate as a single entity for tax and legal purposes. Control and decision-making in joint ventures are usually restricted to the scope of the project, whereas partnerships involve broader management roles and long-term collaboration.

Legal Structures and Formalities

A joint venture typically involves a specific, limited project where two or more parties share resources and profits under a formal agreement, often forming a distinct legal entity such as a corporation or limited liability company (LLC). Partnerships usually operate under less formal legal structures, like general or limited partnerships, where partners share liabilities and profits based on an agreed partnership agreement without necessarily creating a separate legal entity. Legal formalities for joint ventures often require detailed contracts defining roles, contributions, and duration, while partnerships focus on mutual agreement terms with fewer regulatory requirements.

Ownership and Control Dynamics

Joint ventures typically involve shared ownership and control between participating entities for a specific project or timeframe, with clearly defined roles and contributions. Partnerships establish joint ownership and ongoing control responsibilities among partners in a business, allowing for shared decision-making and profit distribution across all activities. The ownership structure in joint ventures is often limited to the project scope, whereas partnerships maintain a continuous, collective ownership and governance framework.

Duration and Purpose of the Relationship

A joint venture is typically established for a specific project or limited duration with a clearly defined objective, such as developing a new product or entering a new market, after which the collaboration usually ends. Partnerships often involve a long-term, ongoing business relationship where partners share profits, losses, and management responsibilities continuously. The purpose of a joint venture is project-specific and finite, while partnerships aim to sustain a collective business operation over time.

Financial Contributions and Profit Sharing

In a joint venture, financial contributions are typically project-specific and limited in scope, with profits shared based on the agreed-upon terms for that particular collaboration. Partnerships involve ongoing financial commitments from each partner, with profits distributed according to the partnership agreement, often reflecting each partner's capital contribution and role. Joint ventures usually have a defined duration, while partnerships are more permanent, affecting long-term financial and profit-sharing arrangements.

Liability and Risk Management

In a joint venture, liability is typically shared based on each party's contribution and is often limited to the scope of the project, allowing for more controlled risk management within a defined timeframe. Partnerships generally involve unlimited joint and several liabilities, meaning each partner can be held personally responsible for the debts and obligations of the business, increasing overall risk exposure. Effective risk management in a joint venture often includes clear contractual terms outlining responsibilities, whereas partnerships rely on mutual trust and legal structures, such as limited liability partnerships (LLPs), to mitigate personal liability.

Tax Implications and Obligations

Joint ventures and partnerships differ significantly in tax implications and obligations; joint ventures are typically treated as separate taxable entities or pass-through entities depending on jurisdiction, requiring distinct tax filings, whereas partnerships usually function as pass-through entities, with income reported on partners' individual tax returns. In a joint venture, each party's tax responsibility corresponds to their share of income or losses, often necessitating compliance with multiple tax jurisdictions if the venture operates internationally. Partnerships must adhere to partnership tax rules, including filing informational returns such as IRS Form 1065 in the U.S., and distributing Schedule K-1 to partners to report their share of taxable income, which impacts personal tax liabilities.

Termination and Exit Strategies

Joint venture termination commonly occurs upon project completion or through mutual agreement, often including predefined exit clauses specifying asset division and liability settlement. Partnership dissolution typically requires unanimous consent or court intervention, with exit strategies focusing on buyout options, liquidation, or restructuring to address ongoing business obligations. Effective termination and exit planning in both entities minimize disputes by clearly outlining procedures, timelines, and financial responsibilities.

Choosing the Right Model for Your Business Goals

Choosing the right business model depends on your company's long-term objectives, risk tolerance, and resource sharing preferences. Joint ventures offer a temporary collaboration for specific projects with shared resources and profits, ideal for entering new markets or developing new products. Partnerships involve ongoing relationships with shared liabilities and decision-making, suited for businesses seeking stable, mutual growth and operational control.

Joint Venture Infographic

libterm.com

libterm.com