The Doctrine of Cy Pres allows courts to modify the terms of a charitable trust or will to closely align with the donor's original intent when literal fulfillment is impossible or impracticable. This legal principle ensures that charitable gifts continue to benefit the intended cause, preserving the donor's philanthropic vision. Explore the rest of the article to understand how Cy Pres operates in different jurisdictions and its implications for your charitable planning.

Table of Comparison

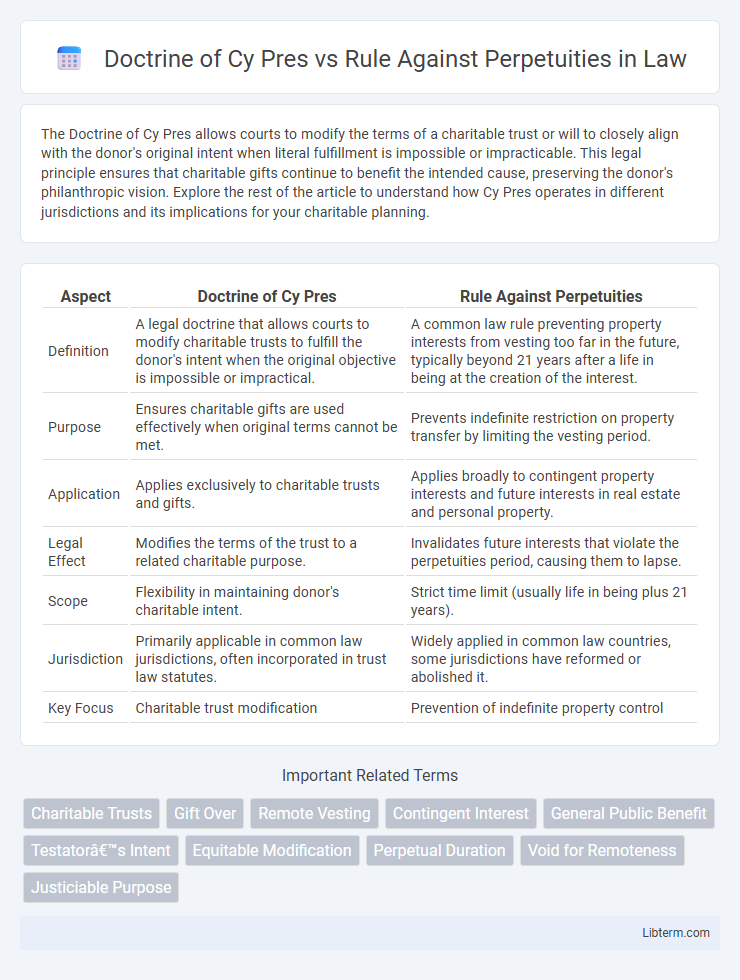

| Aspect | Doctrine of Cy Pres | Rule Against Perpetuities |

|---|---|---|

| Definition | A legal doctrine that allows courts to modify charitable trusts to fulfill the donor's intent when the original objective is impossible or impractical. | A common law rule preventing property interests from vesting too far in the future, typically beyond 21 years after a life in being at the creation of the interest. |

| Purpose | Ensures charitable gifts are used effectively when original terms cannot be met. | Prevents indefinite restriction on property transfer by limiting the vesting period. |

| Application | Applies exclusively to charitable trusts and gifts. | Applies broadly to contingent property interests and future interests in real estate and personal property. |

| Legal Effect | Modifies the terms of the trust to a related charitable purpose. | Invalidates future interests that violate the perpetuities period, causing them to lapse. |

| Scope | Flexibility in maintaining donor's charitable intent. | Strict time limit (usually life in being plus 21 years). |

| Jurisdiction | Primarily applicable in common law jurisdictions, often incorporated in trust law statutes. | Widely applied in common law countries, some jurisdictions have reformed or abolished it. |

| Key Focus | Charitable trust modification | Prevention of indefinite property control |

Understanding the Doctrine of Cy Pres

The Doctrine of Cy Pres allows courts to modify charitable trusts when the original objective becomes impossible or impractical, ensuring the donor's intent is honored as closely as possible. This equitable doctrine differs from the Rule Against Perpetuities, which restricts the duration of property interests to prevent indefinite control beyond a certain time frame. Understanding Cy Pres is essential for legal professionals handling charitable trusts, as it provides flexibility in trust administration while maintaining fidelity to the settlor's philanthropic goals.

Overview of the Rule Against Perpetuities

The Rule Against Perpetuities limits the duration in which property interests must vest, ensuring they do so within 21 years after a life in being at the creation of the interest. This common law doctrine prevents the indefinite tying up of property by future interests that might vest too remotely, promoting marketability and clear title. Courts apply this rule strictly to validate only those interests that comply with the timing restrictions, contrasting with the Doctrine of Cy Pres, which modifies charitable trusts to approximate donor intent when exact terms are impossible or impracticable.

Key Differences Between Cy Pres and Perpetuities

The Doctrine of Cy Pres modifies charitable trusts to closely match the donor's original intent when the initial purpose becomes impossible or impracticable, ensuring ongoing benefit to a similar charitable objective. The Rule Against Perpetuities restricts the duration of certain future interests in property, typically invalidating interests that vest beyond 21 years after the death of a relevant life in being, to prevent indefinite control over property. Key differences include Cy Pres addressing modification of charitable purposes for practicality, while Perpetuities focuses on limiting property interest duration to avoid perpetually tying up assets.

Historical Origins of Both Doctrines

The Doctrine of Cy Pres originated in English equity law during the 17th century to address the challenge of executing charitable trusts when literal compliance was impossible, allowing courts to amend terms to fulfill the donor's intent as closely as possible. The Rule Against Perpetuities, developed in common law during the 18th century, aimed to prevent property from being tied up indefinitely by restricting interests that might vest beyond 21 years after a life in being. Both doctrines emerged to balance individual property rights with broader societal interests, influencing modern trust and estate law frameworks.

Core Legal Principles: Cy Pres vs Perpetuities

The Doctrine of Cy Pres allows courts to modify charitable trusts to fulfill the donor's original charitable intent when the specific objective becomes impossible or impracticable, ensuring the trust's purpose continues within legal bounds. The Rule Against Perpetuities restricts the duration of certain future interests in property, preventing them from vesting beyond 21 years after the death of a relevant life in being to avoid perpetual control over assets. While Cy Pres addresses charitable trusts' adaptability, the Rule Against Perpetuities enforces temporal limits on property interests to promote free alienability and legal certainty.

Application of Cy Pres in Modern Trust Law

The Doctrine of Cy Pres allows courts to modify the terms of a charitable trust to closely align with the donor's intent when the original purpose is impossible or impractical to achieve, ensuring continued use of the trust assets. In contrast, the Rule Against Perpetuities limits the duration of non-charitable trusts to prevent indefinite control over property, typically restricting enforceability beyond 21 years after the beneficiary's death. Modern trust law frequently applies Cy Pres to adapt charitable trusts in response to changing social needs and legal frameworks, maintaining their validity and public benefit despite evolving circumstances.

Perpetuities Rule: Purpose and Impact

The Rule Against Perpetuities prevents property interests from vesting beyond 21 years after the death of a relevant life in being, ensuring the rapid turnover of property and avoiding indefinite restrictions. This legal doctrine promotes marketability by limiting the duration of future interests, preventing dead-hand control over assets. The Rule's strict temporal boundaries impact estate planning and trusts by compelling precise timing for the vesting of interests, contrasting with the flexibility offered by the Doctrine of Cy Pres in modifying charitable trusts.

Common Legal Challenges and Case Studies

The Doctrine of Cy Pres addresses challenges in charitable trusts when the original purpose becomes impracticable, allowing courts to modify the terms to approximate donor intent, exemplified in cases like Jackson v. Phillips where adjustments preserved charitable objectives. The Rule Against Perpetuities restricts interests in property from vesting beyond 21 years after the death of a measuring life, often causing invalidation of future interests, as demonstrated in landmarks such as Duke of Norfolk's Case. Legal disputes frequently arise over timing and intent interpretations, where courts balance donor intent against statutory limitations, highlighting complexities in estate planning and trust administration.

Exceptions and Reforms in Both Doctrines

The Doctrine of Cy Pres allows courts to modify charitable trusts when the original purpose becomes impossible or impracticable, serving as an exception to strict adherence and ensuring the trust's objective is still fulfilled. The Rule Against Perpetuities restricts the duration of interests in property to prevent indefinite control, but reforms such as the Uniform Statutory Rule Against Perpetuities (USRAP) and wait-and-see doctrines have softened its rigid application. Both doctrines have evolved with statutory reforms to balance the intent of property dispositions and charitable purposes, offering flexibility through judicial exceptions to address changing circumstances.

Practical Implications for Estate Planning

The Doctrine of Cy Pres allows courts to modify charitable trusts to align as closely as possible with the donor's original intent when the initial purpose becomes impracticable or impossible, ensuring the continued use of funds in estate plans. The Rule Against Perpetuities restricts the duration of certain future interests, preventing assets from being tied up indefinitely and promoting the free transfer of property, which requires estate planners to carefully structure interests to avoid invalidation. Understanding the balance and interaction between these doctrines is crucial in estate planning to maximize the longevity and enforceability of trusts while complying with legal time limits.

Doctrine of Cy Pres Infographic

libterm.com

libterm.com