A well-drafted contract clearly outlines the rights and obligations of all parties involved, ensuring legal protection and minimizing disputes. Understanding key elements such as offer, acceptance, consideration, and mutual consent is essential for enforceability. Discover how mastering contracts can safeguard your interests in the detailed insights ahead.

Table of Comparison

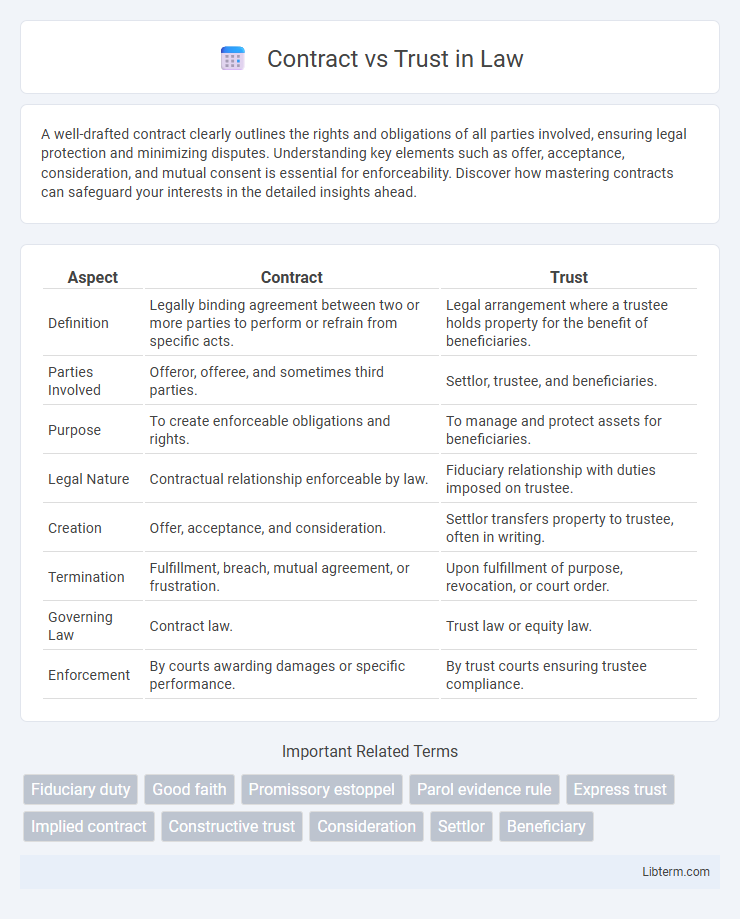

| Aspect | Contract | Trust |

|---|---|---|

| Definition | Legally binding agreement between two or more parties to perform or refrain from specific acts. | Legal arrangement where a trustee holds property for the benefit of beneficiaries. |

| Parties Involved | Offeror, offeree, and sometimes third parties. | Settlor, trustee, and beneficiaries. |

| Purpose | To create enforceable obligations and rights. | To manage and protect assets for beneficiaries. |

| Legal Nature | Contractual relationship enforceable by law. | Fiduciary relationship with duties imposed on trustee. |

| Creation | Offer, acceptance, and consideration. | Settlor transfers property to trustee, often in writing. |

| Termination | Fulfillment, breach, mutual agreement, or frustration. | Upon fulfillment of purpose, revocation, or court order. |

| Governing Law | Contract law. | Trust law or equity law. |

| Enforcement | By courts awarding damages or specific performance. | By trust courts ensuring trustee compliance. |

Understanding the Basics: Contract vs Trust

Contracts are legally binding agreements between parties that outline specific obligations and expectations, while trusts involve the fiduciary arrangement where a trustee holds and manages assets for the benefit of beneficiaries. Contracts require mutual consent, offer consideration, and are enforceable through courts, whereas trusts operate based on the settlor's intent and are governed by trust law principles. Understanding these distinctions clarifies how contracts establish explicit duties, while trusts create ongoing management relationships for asset protection and estate planning.

Legal Definitions and Key Differences

A contract is a legally binding agreement between two or more parties that creates mutual obligations enforceable by law, typically involving an offer, acceptance, and consideration. A trust is a fiduciary arrangement where one party (the trustee) holds and manages property or assets for the benefit of another party (the beneficiary) according to the terms set by the grantor. The key difference lies in their purpose: contracts establish enforceable promises regarding performance or exchange, while trusts involve the management and protection of assets for beneficiaries.

Types of Contracts Explained

Contracts encompass various types, including unilateral, bilateral, express, implied, and executed contracts, each serving specific legal purposes and obligations between parties. Unilateral contracts involve one party promising a benefit in exchange for an act, whereas bilateral contracts consist of mutual promises made by both parties. Express contracts explicitly state terms either orally or in writing, while implied contracts derive from actions or circumstances, and executed contracts refer to agreements already fulfilled by all involved parties.

Types of Trusts: An Overview

Types of trusts include revocable trusts, which allow the grantor to make changes or revoke the trust during their lifetime, and irrevocable trusts, which cannot be altered once established, providing asset protection and tax benefits. Testamentary trusts are created through a will and take effect upon the grantor's death, while living trusts are established during the grantor's lifetime to manage assets efficiently. Special purpose trusts, such as charitable trusts or asset protection trusts, serve specific goals like philanthropy or shielding assets from creditors.

Purposes and Practical Uses

Contracts establish legally binding agreements between parties to outline specific rights, obligations, and remedies, commonly used in business transactions, employment, and sales to ensure clear terms and enforceability. Trusts serve as fiduciary arrangements wherein a trustee manages assets on behalf of beneficiaries, primarily utilized for estate planning, asset protection, and wealth transfer. The primary distinction lies in contracts facilitating reciprocal obligations, while trusts focus on asset management and long-term financial security.

Legal Formalities and Requirements

Contracts require offer, acceptance, consideration, and mutual intent to create legally binding obligations, often formalized in written agreements to ensure enforceability. Trusts involve a settlor transferring assets to a trustee to manage for beneficiaries, necessitating a written trust instrument that clearly outlines the trust's terms, beneficiaries, and trustee powers. Both legal structures demand compliance with jurisdiction-specific statutes, such as notarization or registration requirements for validity and protection under the law.

Rights and Obligations of Parties

In a contract, parties hold legally enforceable rights and obligations explicitly outlined in the agreement, ensuring mutual performance and remedies for breach. Trusts involve a fiduciary relationship where the trustee holds property rights for the benefit of beneficiaries while owing duties of loyalty, care, and good faith. Unlike contracts, obligations in trusts center on managing assets prudently, honoring the settlor's intent, and protecting beneficiaries' equitable interests.

Duration and Termination

Contract duration typically depends on the agreed-upon terms, ranging from fixed periods to ongoing arrangements with specified termination clauses. Trusts, on the other hand, often last longer and can continue until a specific event occurs, such as the beneficiary reaching a certain age or upon the death of the settlor, with termination outlined in the trust deed or applicable law. Termination of contracts generally requires mutual consent, breach, or fulfillment of obligations, whereas trusts terminate according to the trust's purpose, legal requirements, or court orders.

Tax Implications of Contracts and Trusts

Contracts are generally subject to income tax based on the individual or entity's earnings, with profits taxed at personal or corporate rates depending on the contracting parties. Trusts face complex tax treatment where income may be taxed at trust level or passed through to beneficiaries, often resulting in higher tax rates if income is retained within the trust. Understanding distinct tax obligations, such as grantor vs non-grantor trust classifications and contract income reporting, is essential for optimizing tax liability in legal arrangements.

Choosing Between a Contract and a Trust

Choosing between a contract and a trust depends on the purpose of asset management and legal obligations; contracts establish enforceable agreements between parties with specified duties, while trusts provide a structured way to manage and protect assets for beneficiaries over time. Trusts offer benefits such as avoiding probate, maintaining privacy, and providing ongoing control, whereas contracts primarily govern specific transactional relationships and obligations. Evaluating factors like control, duration, asset protection, and legal formalities determines the optimal choice for estate planning or business arrangements.

Contract Infographic

libterm.com

libterm.com