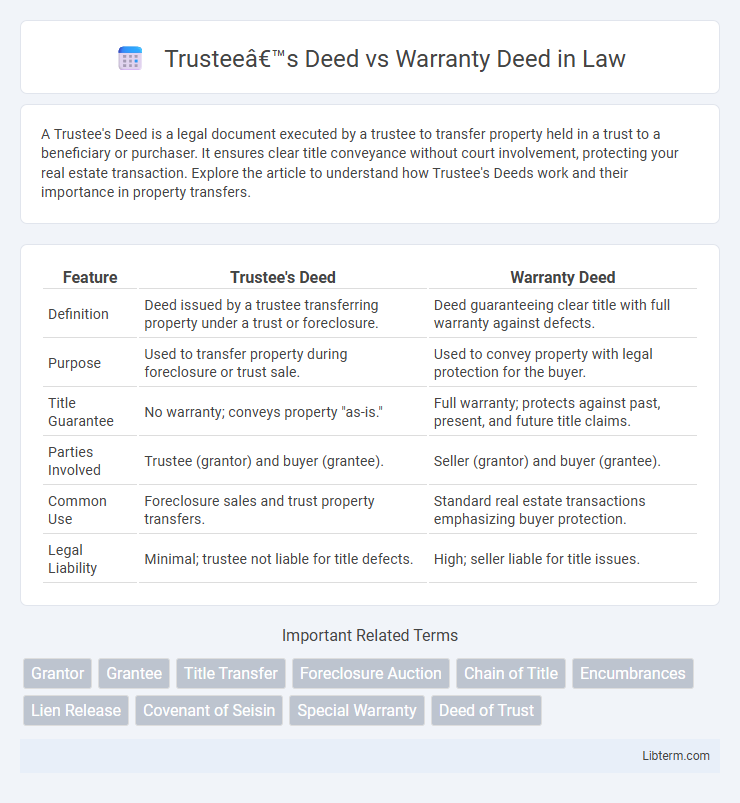

A Trustee's Deed is a legal document executed by a trustee to transfer property held in a trust to a beneficiary or purchaser. It ensures clear title conveyance without court involvement, protecting your real estate transaction. Explore the article to understand how Trustee's Deeds work and their importance in property transfers.

Table of Comparison

| Feature | Trustee's Deed | Warranty Deed |

|---|---|---|

| Definition | Deed issued by a trustee transferring property under a trust or foreclosure. | Deed guaranteeing clear title with full warranty against defects. |

| Purpose | Used to transfer property during foreclosure or trust sale. | Used to convey property with legal protection for the buyer. |

| Title Guarantee | No warranty; conveys property "as-is." | Full warranty; protects against past, present, and future title claims. |

| Parties Involved | Trustee (grantor) and buyer (grantee). | Seller (grantor) and buyer (grantee). |

| Common Use | Foreclosure sales and trust property transfers. | Standard real estate transactions emphasizing buyer protection. |

| Legal Liability | Minimal; trustee not liable for title defects. | High; seller liable for title issues. |

Introduction to Property Deeds

Trustee's Deed transfers property ownership from a trustee to a buyer, often used in foreclosure sales, with limited guarantees about the title. Warranty Deed provides the buyer with full legal protection, ensuring the property is free from liens or claims and that the seller has the right to transfer ownership. Understanding these deeds is essential for navigating property transactions and securing clear title.

What is a Trustee’s Deed?

A Trustee's Deed is a legal document used in real estate transactions where a trustee transfers property title to a buyer after a foreclosure or trust deed sale. It conveys ownership without warranties against liens or claims, unlike a Warranty Deed which guarantees clear title and protection from future disputes. Understanding the differences is crucial for buyers to assess risks in purchasing property through a Trustee's Deed.

What is a Warranty Deed?

A Warranty Deed is a legal document guaranteeing that the property title is free from any liens or encumbrances and that the seller holds clear ownership. It provides the buyer with full protection against future claims or disputes over the property title. This deed ensures the seller will defend the buyer's ownership rights against any third-party claims.

Key Differences: Trustee’s Deed vs Warranty Deed

A Trustee's Deed conveys property from a trustee after a trust sale or foreclosure, transferring ownership "as is" without guarantees on title quality. In contrast, a Warranty Deed provides the buyer with a full guarantee that the title is clear, free of liens, and defects, legally protecting against future claims. The key difference lies in the warranty of title: Trustee's Deeds offer limited or no warranties, whereas Warranty Deeds assure complete title protection.

Legal Rights Conveyed by Each Deed

A Trustee's Deed conveys legal rights held by a trustee, typically transferring property under a trust or foreclosure without guaranteeing clear title or protection against claims. A Warranty Deed provides the buyer with the strongest legal rights, including a guarantee that the title is clear and free from encumbrances, and the seller's obligation to defend the title against any future claims. The key distinction lies in the warranty deeds offering full legal protection, whereas trustee's deeds convey property "as-is" with limited or no title guarantees.

Common Uses for Trustee’s Deeds

Trustee's deeds are commonly used in foreclosure sales and real estate transactions involving a trust or deed of trust, conveying the property from the trustee to the buyer without extensive warranties. These deeds typically provide limited protection, transferring only the title held by the trustee, unlike warranty deeds that guarantee clear title and defend against prior claims. Real estate investors and buyers often encounter trustee's deeds in sale auctions or when properties are sold due to loan defaults or trust-related arrangements.

Common Uses for Warranty Deeds

Warranty deeds are commonly used in real estate transactions to provide buyers with a guarantee that the seller holds clear title to the property and has the legal right to transfer ownership. These deeds offer full protection against any future claims or liens that may arise from previous owners, making them ideal for residential home sales and commercial property purchases. Unlike trustee's deeds, warranty deeds ensure the buyer receives an unencumbered title, giving them greater confidence and legal recourse in case of disputes.

Risks and Protections for Buyers

A Trustee's Deed transfers property ownership but typically offers limited warranties, increasing the buyer's risk of undiscovered liens or title defects. Warranty Deeds provide stronger protections by guaranteeing clear title and the grantor's right to sell, reducing potential legal disputes for buyers. Buyers should carefully assess the deed type to balance risk exposure and title security in real estate transactions.

Title Insurance Considerations

A Trustee's Deed typically transfers property held in a trust without warranties against title defects, making title insurance crucial to protect against unknown encumbrances. Warranty Deeds provide explicit guarantees that the title is clear, often resulting in fewer title insurance risks and potentially lower premiums. Title insurance underwriters assess the extent of warranty in the deed to determine coverage scope and liability exposure.

Choosing the Right Deed for Your Transaction

A Trustee's Deed offers limited protection by transferring property through a trustee, often used in foreclosure or trust-related sales, while a Warranty Deed provides the highest level of buyer protection with a guarantee against title defects and clear ownership. Choosing the right deed depends on the nature of the transaction, with Warranty Deeds preferred for standard property sales to ensure full seller warranties and legal recourse. Understanding the differences in liability and title assurance ensures informed decisions, minimizing risks in real estate transfers.

Trustee’s Deed Infographic

libterm.com

libterm.com