A trustee is a person or organization appointed to manage assets or property on behalf of beneficiaries, ensuring fiduciary duties are upheld with loyalty and care. They play a crucial role in estate planning, trusts, and legal arrangements to protect and distribute assets according to established terms. Discover how understanding the role of a trustee can safeguard Your interests by reading the rest of this article.

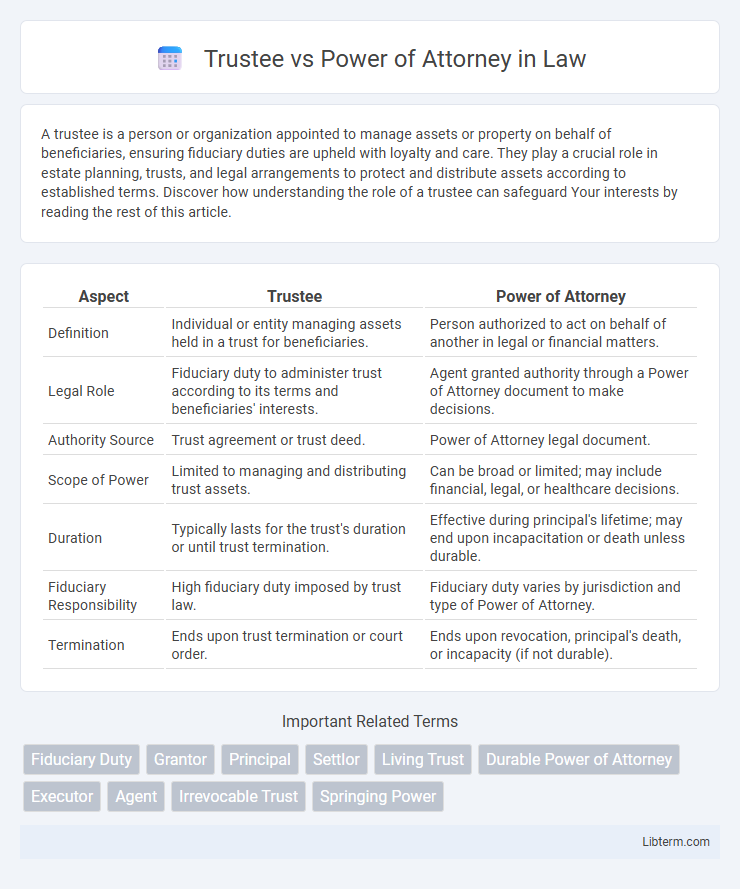

Table of Comparison

| Aspect | Trustee | Power of Attorney |

|---|---|---|

| Definition | Individual or entity managing assets held in a trust for beneficiaries. | Person authorized to act on behalf of another in legal or financial matters. |

| Legal Role | Fiduciary duty to administer trust according to its terms and beneficiaries' interests. | Agent granted authority through a Power of Attorney document to make decisions. |

| Authority Source | Trust agreement or trust deed. | Power of Attorney legal document. |

| Scope of Power | Limited to managing and distributing trust assets. | Can be broad or limited; may include financial, legal, or healthcare decisions. |

| Duration | Typically lasts for the trust's duration or until trust termination. | Effective during principal's lifetime; may end upon incapacitation or death unless durable. |

| Fiduciary Responsibility | High fiduciary duty imposed by trust law. | Fiduciary duty varies by jurisdiction and type of Power of Attorney. |

| Termination | Ends upon trust termination or court order. | Ends upon revocation, principal's death, or incapacity (if not durable). |

Understanding Trustees and Power of Attorney

Trustees manage assets held in a trust according to its terms, ensuring beneficiaries receive their designated benefits, while a power of attorney grants an agent the legal authority to act on behalf of a principal in personal, financial, or legal matters. Trustees have fiduciary responsibilities and operate under strict legal guidelines to administer the trust's assets, whereas a power of attorney can be limited or broad depending on the document's scope and may terminate upon the principal's incapacity unless it is a durable power of attorney. Understanding the distinctions involves recognizing that trustees hold ongoing control over trust property, whereas agents with power of attorney act temporarily or as specified by the principal.

Key Differences Between Trustee and Power of Attorney

A trustee manages assets held in a trust according to the trust agreement for the benefit of beneficiaries, whereas a power of attorney grants an individual authority to act on behalf of another in financial, legal, or medical matters, typically during the principal's incapacity. Trustees have fiduciary duties to administer trust property seamlessly over time, while power of attorney agents operate temporarily and cease authority upon death or revocation. The scope of a trustee's role is generally broader and ongoing, focusing on asset management and distribution, compared to the often more limited and task-specific powers granted under a power of attorney.

Roles and Responsibilities of a Trustee

A trustee manages and protects assets held in a trust, ensuring they are distributed according to the grantor's instructions and in the best interest of the beneficiaries. Responsibilities include fiduciary duties such as prudent investment, record-keeping, tax filings, and regular communication with beneficiaries. Unlike a power of attorney, which grants authority for financial or medical decisions temporarily or under specific circumstances, a trustee's role is ongoing and focused specifically on trust administration.

Duties and Powers of a Power of Attorney

A Power of Attorney (POA) grants an appointed agent the authority to make financial, legal, or medical decisions on behalf of the principal, based on the scope defined in the document. The duties of a POA include managing assets, paying bills, filing taxes, and handling healthcare decisions if specified, always acting in the principal's best interest. Unlike a trustee who manages trust assets under fiduciary obligations outlined by the trust agreement, a POA's powers cease upon the principal's death or revocation of authority.

Legal Authority: Trustee vs. Power of Attorney

A trustee holds legal authority to manage and distribute trust assets according to the trust document, operating with a fiduciary duty to beneficiaries that typically lasts until the trust is terminated. A power of attorney grants an agent the authority to act on behalf of the principal in financial, legal, or healthcare matters, with powers limited to the scope and duration specified in the document. Unlike trustees who manage trust property, agents under a power of attorney have authority only during the principal's lifetime and can be revoked or terminated at any time by the principal.

When to Appoint a Trustee or Power of Attorney

Appoint a trustee when managing complex assets or long-term estate planning requires ongoing oversight and fiduciary responsibility, ensuring funds are distributed according to a trust agreement. Choose a power of attorney for immediate, short-term decision-making related to financial, medical, or legal matters when an individual becomes incapacitated or unavailable. Trustees handle asset management within a trust, while powers of attorney grant authority to act on behalf of another person in specified situations.

Decision-Making Scope: Trustee vs. Power of Attorney

A trustee manages assets held within a trust and has a fiduciary duty to act in the best interests of the beneficiaries, often with broader decision-making authority over property and financial matters specified in the trust document. A power of attorney grants an agent limited or general authority to make decisions on behalf of the principal, which may include financial, legal, or healthcare decisions, but this authority typically ends upon the principal's incapacity or death. The trustee's decision-making scope is ongoing and governed by the trust terms, while the power of attorney's scope is defined by the power of attorney document and is usually more narrowly tailored and temporary.

Revocation and Termination: What You Need to Know

Trustee roles involve managing trust assets and responsibilities that continue until the trust is revoked or terminated according to trust terms or court order. Power of attorney authority ends upon revocation by the principal, incapacitation, or death, immediately terminating the agent's legal power. Understanding these distinctions in revocation and termination ensures proper legal control over assets and decision-making authority.

Choosing the Right Representative for Your Needs

Selecting between a trustee and a power of attorney depends on the specific responsibilities and duration of authority required. Trustees manage assets held in a trust and make decisions consistent with the trust's terms, often used for long-term estate planning. Powers of attorney grant decision-making authority for financial, legal, or healthcare matters, typically activated during incapacity or temporary situations.

Trustee and Power of Attorney: Common Misconceptions

Trustees are often confused with agents holding a power of attorney, but they serve distinct roles in legal and financial matters. A trustee manages assets held in a trust according to its terms and fiduciary duties, while a power of attorney grants authority to act on someone's behalf, typically for specific tasks or periods. Misconceptions arise when people assume a power of attorney remains effective after the principal's death, whereas a trustee's responsibilities continue as outlined in the trust document.

Trustee Infographic

libterm.com

libterm.com