A defeasible fee is a type of property ownership that can be voided or terminated upon the occurrence of a specific event or condition. This ownership interest provides flexibility, allowing rights to revert to the original grantor or their heirs if set terms are violated or conditions are met. Discover how understanding defeasible fees can protect your property rights and legal interests by reading the full article.

Table of Comparison

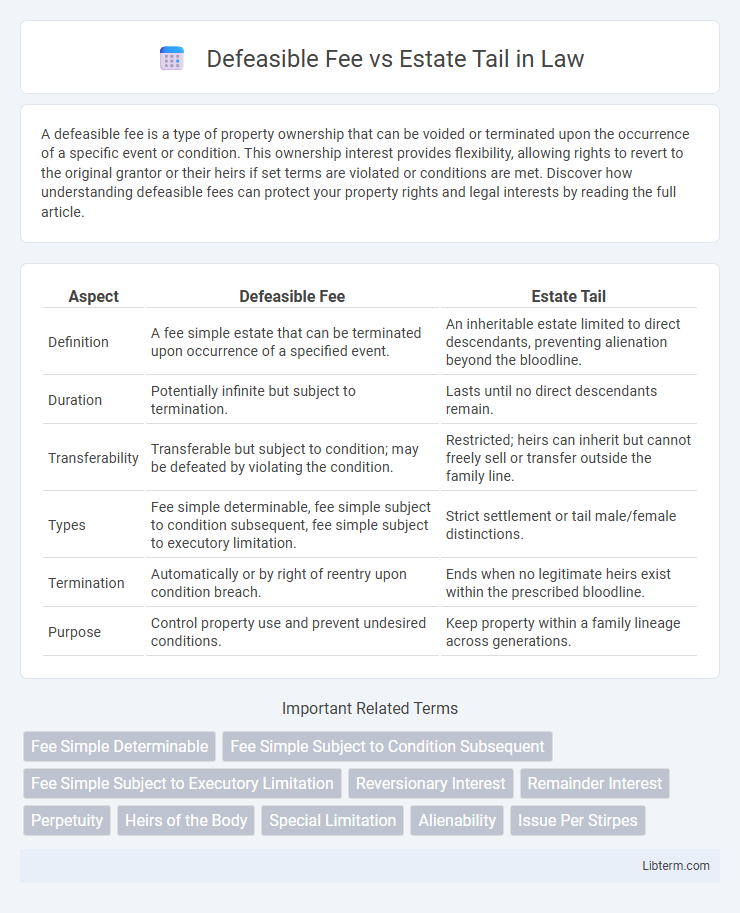

| Aspect | Defeasible Fee | Estate Tail |

|---|---|---|

| Definition | A fee simple estate that can be terminated upon occurrence of a specified event. | An inheritable estate limited to direct descendants, preventing alienation beyond the bloodline. |

| Duration | Potentially infinite but subject to termination. | Lasts until no direct descendants remain. |

| Transferability | Transferable but subject to condition; may be defeated by violating the condition. | Restricted; heirs can inherit but cannot freely sell or transfer outside the family line. |

| Types | Fee simple determinable, fee simple subject to condition subsequent, fee simple subject to executory limitation. | Strict settlement or tail male/female distinctions. |

| Termination | Automatically or by right of reentry upon condition breach. | Ends when no legitimate heirs exist within the prescribed bloodline. |

| Purpose | Control property use and prevent undesired conditions. | Keep property within a family lineage across generations. |

Introduction to Defeasible Fee and Estate Tail

A defeasible fee is a type of property interest that can be terminated upon the occurrence or non-occurrence of a specified event, creating a conditional ownership subject to forfeiture. An estate tail, also known as a fee tail, is a hereditary estate that restricts inheritance to the direct descendants of the original grantee, preventing the property from being freely sold or devised outside the family line. Both interests impose limitations on absolute ownership, but defeasible fees hinge on specific conditions while estates tail limit the line of succession.

Historical Background of Property Interests

Defeasible fees and estates tail both emerged from medieval English property law as mechanisms to control land inheritance and ownership conditions. Defeasible fees allowed property interests to be terminated upon the occurrence of specific events, providing flexibility in land conveyance, while estates tail restricted inheritance to direct descendants, ensuring property remained within a family lineage. Over time, these concepts influenced modern property law by balancing the interests of landholders and heirs, shaping the evolution of fee simple estates and inheritance rights.

Definition of Defeasible Fee

A defeasible fee is a type of freehold estate in real property that can be terminated upon the occurrence of a specified event, creating uncertainty about the duration of ownership. It includes fee simple determinable, fee simple subject to condition subsequent, and fee simple subject to executory limitation, each defining distinct ways the estate may end. Unlike an estate tail, which restricts inheritance to direct descendants and generally limits alienation, a defeasible fee provides property interests that hinge on conditional events rather than lineage.

Definition of Estate Tail

An estate tail, also known as fee tail, is a form of property ownership that restricts inheritance to the direct descendants of the original grantee, preventing the property from being sold or inherited outside the family line. Unlike a defeasible fee, which may terminate upon the occurrence of a specified condition or event, an estate tail ensures the estate remains within the lineage, creating a hereditary estate that cannot be freely alienated. This type of estate was historically designed to preserve family estates across generations, limiting the owner's ability to transfer or encumber the property beyond the designated bloodline.

Key Differences Between Defeasible Fee and Estate Tail

Defeasible fee estates provide ownership that can be voided upon the occurrence of a specific condition, whereas an estate tail restricts ownership to direct descendants, preventing transfer outside the bloodline. Defeasible fees include fees simple determinable, fees simple subject to condition subsequent, and fees simple subject to executory limitation, offering varying conditions for termination. Estate tail limits alienation and inheritance, creating a perpetual family estate, while defeasible fees emphasize conditional ownership with potential reversion to the grantor or third party.

Types of Defeasible Fees

Defeasible fees encompass three primary types: fee simple determinable, fee simple subject to condition subsequent, and fee simple subject to executory limitation, each imposing different conditions on property ownership. A fee simple determinable automatically terminates upon the occurrence of a specified event, reverting ownership to the grantor, while a fee simple subject to condition subsequent requires the grantor to take action to reclaim the property if a condition is breached. Conversely, fee simple subject to executory limitation transfers ownership to a third party upon a triggering event, distinguishing defeasible fees from estate tail which traditionally involves inheritance restrictions limiting property transfer to direct descendants.

Legal Implications of Estate Tail

Estate tail restricts property inheritance to direct descendants, legally limiting the alienation and sale of the estate beyond the family line. Defeasible fees, by contrast, impose conditions that may terminate ownership upon specific events, but do not inherently restrict inheritance as strictly as an estate tail. The legal implications of estate tail include potential inflexibility in property transfer and challenges in marketability, affecting long-term estate planning and asset liquidity.

Modern Relevance and Applications

Defeasible fees and estates tail differ significantly in modern property law, with defeasible fees offering greater flexibility through conditions that can terminate ownership. Estate tail, traditionally used to keep property within a family line, has largely been abolished or restricted in many jurisdictions due to its limitations on inheritance freedom. Contemporary applications favor defeasible fees for conditional ownership in commercial real estate and land use planning, reflecting evolving legal preferences for adaptable property interests.

Advantages and Disadvantages

A Defeasible Fee grants property ownership subject to conditions that, if violated, can result in termination, offering flexibility but creating uncertainty in long-term property rights. An Estate Tail restricts inheritance to direct descendants, preserving family ownership across generations but limiting the owner's ability to sell or bequeath the property freely. Defeasible Fees provide adaptability but risk abrupt loss of estate, whereas Estate Tails ensure lineage continuity but sacrifice marketability and autonomous disposal.

Conclusion: Choosing Between Defeasible Fee and Estate Tail

Choosing between a defeasible fee and an estate tail depends on the grantor's intent regarding property control and inheritance. Defeasible fees offer flexibility with conditions that can terminate the estate, making them suitable for managing use restrictions. Estate tails provide long-term succession control by restricting alienation, ensuring property remains within a family line across generations.

Defeasible Fee Infographic

libterm.com

libterm.com