Personal action empowers you to initiate meaningful change by taking responsibility for your decisions and behaviors. It involves setting clear goals, maintaining consistent effort, and adapting strategies to overcome obstacles effectively. Discover how embracing personal action can transform your life and ways to implement it in the full article.

Table of Comparison

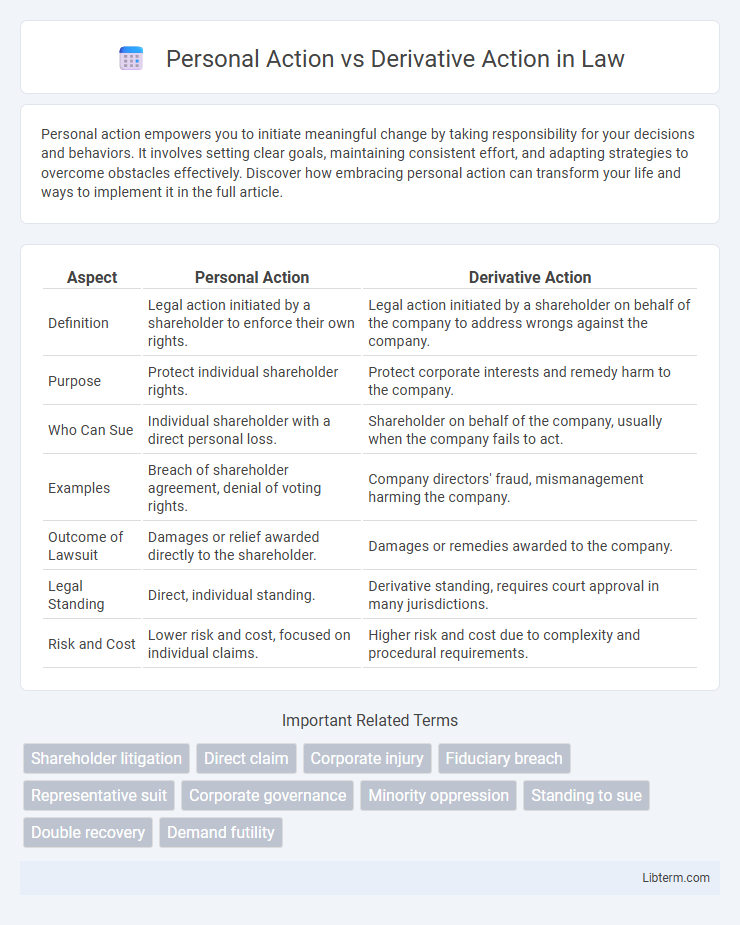

| Aspect | Personal Action | Derivative Action |

|---|---|---|

| Definition | Legal action initiated by a shareholder to enforce their own rights. | Legal action initiated by a shareholder on behalf of the company to address wrongs against the company. |

| Purpose | Protect individual shareholder rights. | Protect corporate interests and remedy harm to the company. |

| Who Can Sue | Individual shareholder with a direct personal loss. | Shareholder on behalf of the company, usually when the company fails to act. |

| Examples | Breach of shareholder agreement, denial of voting rights. | Company directors' fraud, mismanagement harming the company. |

| Outcome of Lawsuit | Damages or relief awarded directly to the shareholder. | Damages or remedies awarded to the company. |

| Legal Standing | Direct, individual standing. | Derivative standing, requires court approval in many jurisdictions. |

| Risk and Cost | Lower risk and cost, focused on individual claims. | Higher risk and cost due to complexity and procedural requirements. |

Understanding Personal Action and Derivative Action

Personal action allows shareholders to sue for their own rights when they are directly harmed by a company's decision or misconduct. Derivative action enables shareholders to sue on behalf of the corporation when the harm is done to the company itself, typically involving breaches of fiduciary duty by directors or officers. Understanding the distinction is crucial for determining who has standing to bring the lawsuit and what remedies are available.

Key Legal Definitions

Personal action refers to a lawsuit initiated by a shareholder to enforce their individual rights against a corporation or its officers for wrongs directly affecting the shareholder, such as breach of contract or denial of voting rights. Derivative action is a lawsuit brought by a shareholder on behalf of the corporation to address harm done to the corporation itself, typically involving claims of fiduciary duty breaches by directors or officers. The key legal distinction lies in the plaintiff's standing and the nature of the harm: personal actions protect individual shareholder interests, while derivative actions seek to remedy injuries to the corporation as a separate legal entity.

Distinguishing Features of Personal and Derivative Actions

Personal actions are initiated by individual shareholders to enforce their own rights, typically addressing direct harm such as breach of contract or employment disputes. Derivative actions are brought by shareholders on behalf of the corporation to remedy wrongs committed against the company, such as fiduciary breaches or fraud by directors. A key distinction lies in the beneficiary of the action: personal actions benefit the plaintiff individually, whereas derivative actions seek to redress injuries to the corporation as a whole.

Legal Standing: Who Can Sue?

Personal actions can be initiated solely by the individual whose rights have been directly violated, granting them exclusive legal standing to sue. Derivative actions are filed by shareholders or members on behalf of the corporation when the company's rights are harmed and management fails to act. Legal standing in derivative actions requires the plaintiff to demonstrate that efforts to resolve the issue internally were made or that such efforts are futile.

Typical Scenarios for Personal Action

Personal actions typically arise when a shareholder pursues a claim to enforce their individual rights, such as disputes over dividend payments or shareholder voting rights. These actions address direct harm to the plaintiff, like breach of contract or wrongful refusal to register shares. Common scenarios include contesting misrepresentations during share purchase or seeking remedy for denial of access to corporate records.

Typical Scenarios for Derivative Action

Derivative actions typically arise when shareholders sue on behalf of the corporation to address wrongs committed by insiders such as directors or officers. Common scenarios include breaches of fiduciary duty, self-dealing, and fraud that harm the company's interests. These actions ensure corporate accountability when management fails to take corrective measures.

Procedural Requirements for Filing

Personal actions require the shareholder to have suffered direct harm and must be filed by the injured party within the statute of limitations applicable to the individual claim. Derivative actions demand the plaintiff to demonstrate demand futility or that a proper demand was made on the board of directors before filing, adhering to strict procedural rules such as providing notice to the corporation. Courts typically require derivative plaintiffs to comply with legal prerequisites including continuous ownership of shares throughout the litigation and often mandate bond posting to cover corporate litigation costs.

Remedies and Outcomes Compared

Personal actions enable shareholders to sue for direct harm to their own rights, often resulting in remedies such as monetary damages or injunctions tailored to individual loss. Derivative actions address wrongs done to the corporation, with any recovered damages or remedies benefiting the company rather than the suing shareholder. Outcomes in derivative actions typically involve corporate governance reforms or financial restitution to the company, aiming to rectify harm affecting all shareholders collectively.

Challenges and Risks in Each Action

Personal actions often face challenges related to proving direct harm and maintaining individual standing in court, which can limit recovery to the plaintiff's own damages. Derivative actions involve risks such as demonstrating that the company has refused to sue, managing potential conflicts of interest with majority shareholders, and bearing high procedural costs that can delay resolution. Both actions require careful navigation of legal requirements to avoid dismissal and ensure the appropriate remedy is secured.

Practical Considerations for Choosing the Right Action

Choosing between a personal action and a derivative action depends largely on whether the harm was done directly to the individual shareholder or to the corporation as a whole. Personal actions are appropriate when the shareholder's own rights have been violated, allowing for direct claims and remedies. Derivative actions are suitable when the corporation is wronged but fails to act, requiring the shareholder to sue on behalf of the corporation to protect its interests.

Personal Action Infographic

libterm.com

libterm.com