Policyholder benefits provide valuable protections and financial advantages tailored to your insurance needs. These benefits can include premium discounts, cash value accumulation, and access to exclusive services that enhance overall coverage value. Explore the article to understand how policyholder benefits can maximize your insurance investment.

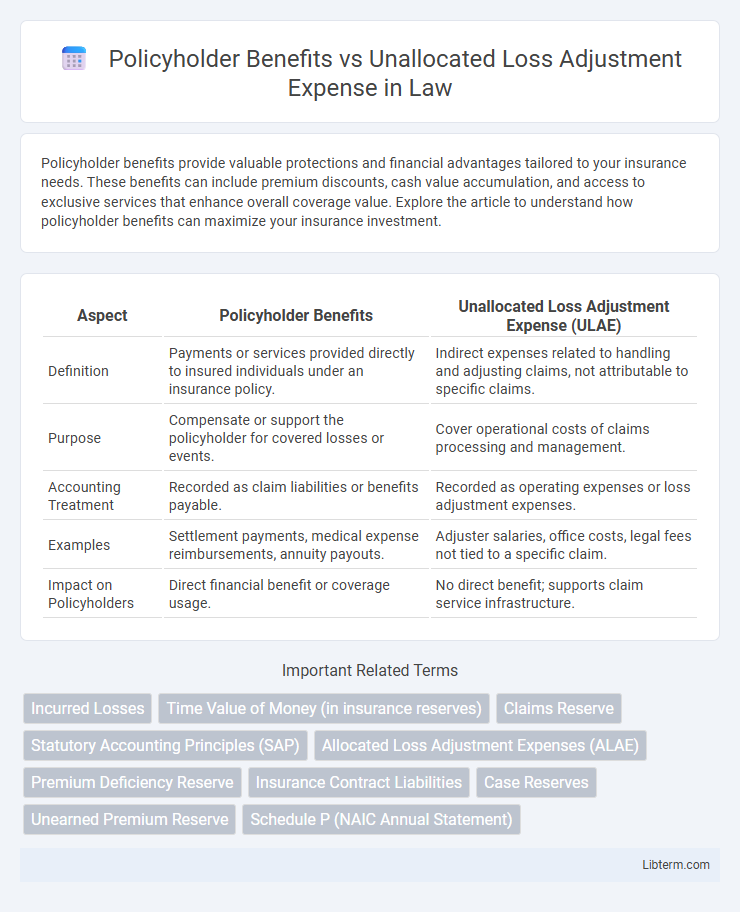

Table of Comparison

| Aspect | Policyholder Benefits | Unallocated Loss Adjustment Expense (ULAE) |

|---|---|---|

| Definition | Payments or services provided directly to insured individuals under an insurance policy. | Indirect expenses related to handling and adjusting claims, not attributable to specific claims. |

| Purpose | Compensate or support the policyholder for covered losses or events. | Cover operational costs of claims processing and management. |

| Accounting Treatment | Recorded as claim liabilities or benefits payable. | Recorded as operating expenses or loss adjustment expenses. |

| Examples | Settlement payments, medical expense reimbursements, annuity payouts. | Adjuster salaries, office costs, legal fees not tied to a specific claim. |

| Impact on Policyholders | Direct financial benefit or coverage usage. | No direct benefit; supports claim service infrastructure. |

Understanding Policyholder Benefits

Policyholder benefits represent the financial payouts or services an insurer provides directly to policyholders, reflecting claims covered under insurance contracts. Understanding policyholder benefits is crucial for accurately assessing an insurer's liabilities and overall financial health, as these benefits directly impact loss reserves. Unlike unallocated loss adjustment expenses, which cover general claim-handling costs not tied to specific claims, policyholder benefits focus on compensating insured parties for covered losses.

Defining Unallocated Loss Adjustment Expense (ULAE)

Unallocated Loss Adjustment Expense (ULAE) refers to the costs associated with handling and settling insurance claims that are not directly assignable to a specific claim, such as salaries of claims adjusters and overhead expenses. These expenses differ from Policyholder Benefits, which are direct payments made to insured individuals or entities as a result of covered losses. Understanding ULAE is crucial for accurately assessing an insurer's expense load and reserving practices within loss adjustment processes.

Key Differences Between Policyholder Benefits and ULAE

Policyholder benefits represent the amounts paid or owed directly to the insured parties under the terms of their insurance policies, reflecting compensation for covered losses. Unallocated Loss Adjustment Expense (ULAE) consists of the indirect costs associated with settling claims, such as legal fees and investigation expenses, which are not tied to specific claims. The key difference lies in their allocation: policyholder benefits are claim-specific payments, while ULAE covers general administrative costs necessary for claims processing across multiple policies.

How Policyholder Benefits Impact Insurance Claims

Policyholder Benefits directly influence the total insurance claims paid out, representing the monetary compensation or coverage provided to insured parties for covered losses. These benefits affect the insurer's financial reserves and claim settlement processes, as higher benefit payouts increase claim expenses and impact profitability. Efficient management of policyholder benefits ensures accurate claim valuation and balanced loss adjustment costs, optimizing overall claim handling.

The Role of ULAE in Insurance Operations

Unallocated Loss Adjustment Expense (ULAE) represents the indirect costs insurers incur during claim settlement, such as legal expenses and investigation, which do not directly benefit individual policyholders but are critical for efficient insurance operations. While Policyholder Benefits cover the actual claim payouts to insured parties, ULAE ensures the claims process is properly managed, safeguarding the insurer's financial stability and service quality. Effective allocation and management of ULAE help insurers balance operational costs against policyholder obligations, optimizing overall risk assessment and loss reserve adequacy.

Examples of Policyholder Benefits

Policyholder benefits include claim payments for insured events such as property damage, medical expenses, and life insurance payouts, directly compensating policyholders. These benefits represent contractual obligations of the insurer, distinct from unallocated loss adjustment expenses, which cover general administrative costs for claims handling like legal fees and investigation expenses. For example, a homeowner receiving funds after fire damage is a policyholder benefit, whereas costs spent on adjusting multiple claims fall under unallocated loss adjustment expenses.

Types of Unallocated Loss Adjustment Expenses

Unallocated Loss Adjustment Expenses (ULAE) include costs that cannot be directly attributed to a specific claim, such as salaries of claims personnel, office expenses, and legal fees related to claims handling. These expenses differ from policyholder benefits, which represent direct payments to claimants for covered losses. Understanding ULAE types, including internal costs (adjuster salaries, office overhead) and external costs (legal services, consulting fees), is essential for accurately measuring total claims costs and insurer reserves.

Accounting Practices: Policyholder Benefits vs. ULAE

Policyholder benefits represent the claims and amounts payable to insured parties, directly impacting an insurer's liability and expense accounts, while Unallocated Loss Adjustment Expense (ULAE) covers indirect costs related to claim handling that cannot be traced to specific claims. Accounting practices distinguish these by recording policyholder benefits as allocated expenses tied directly to claims, whereas ULAE is recognized as an overhead cost and accrued based on estimated claim processing activity. Accurate segregation ensures compliance with statutory and GAAP reporting standards, affecting reserve estimation and financial statement transparency.

Effect on Premium Setting and Reserve Calculations

Policyholder benefits directly impact premium setting as insurers must estimate future claim payouts, influencing the required premium to cover anticipated losses and ensure profitability. Unallocated Loss Adjustment Expenses (ULAE) affect reserve calculations by representing the indirect costs of claims handling that are not tied to specific claims, requiring actuaries to allocate adequate reserves to cover these overhead expenses. Accurate differentiation between policyholder benefits and ULAE is critical for precise premium determination and maintaining sufficient loss reserves, ultimately stabilizing insurer financial health.

Implications for Insurers and Policyholders

Policyholder benefits represent the expected payments insurers make to fulfill claims, directly impacting the insurer's reserve requirements and financial stability, while unallocated loss adjustment expenses (ULAE) cover costs indirectly tied to claim handling, affecting overall claim settlement efficiency. Insurers must carefully estimate both to maintain adequate solvency margins and avoid under-reserving, which can lead to regulatory scrutiny and reduced policyholder confidence. For policyholders, accurate accounting of ULAE ensures prompt and fair claims processing, influencing their overall satisfaction and trust in the insurer's commitment to fulfilling contractual obligations.

Policyholder Benefits Infographic

libterm.com

libterm.com