Forgery involves creating false documents, signatures, or imitations of objects with the intent to deceive or defraud. This illegal act can significantly impact legal transactions, financial agreements, and personal reputations, posing serious risks to individuals and businesses alike. Discover how to protect yourself from forgery and recognize its warning signs by reading the rest of the article.

Table of Comparison

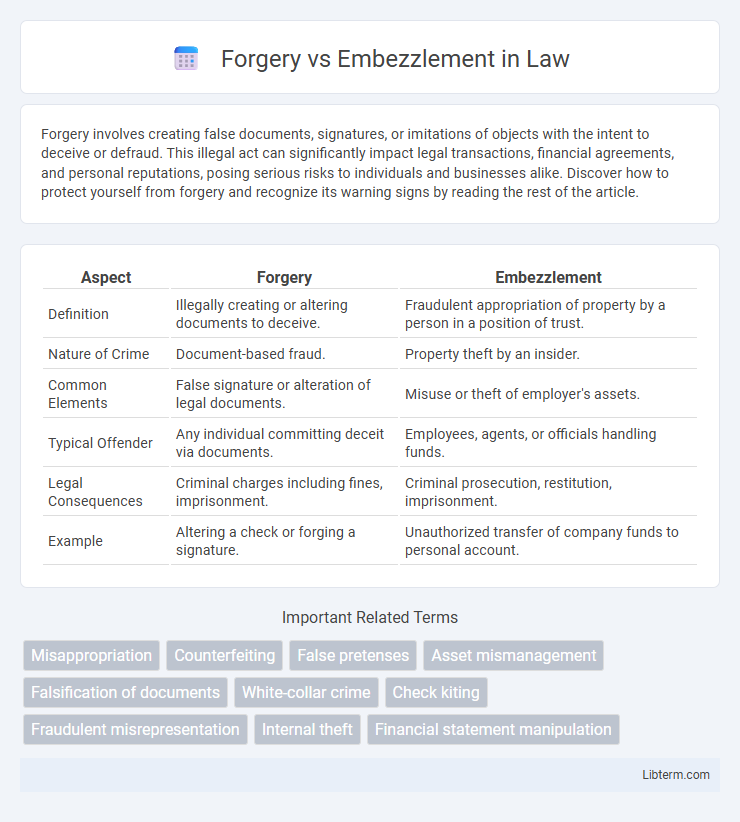

| Aspect | Forgery | Embezzlement |

|---|---|---|

| Definition | Illegally creating or altering documents to deceive. | Fraudulent appropriation of property by a person in a position of trust. |

| Nature of Crime | Document-based fraud. | Property theft by an insider. |

| Common Elements | False signature or alteration of legal documents. | Misuse or theft of employer's assets. |

| Typical Offender | Any individual committing deceit via documents. | Employees, agents, or officials handling funds. |

| Legal Consequences | Criminal charges including fines, imprisonment. | Criminal prosecution, restitution, imprisonment. |

| Example | Altering a check or forging a signature. | Unauthorized transfer of company funds to personal account. |

Introduction to Forgery and Embezzlement

Forgery involves the illegal alteration or creation of documents, signatures, or other objects with the intent to deceive, often leading to financial or legal gain. Embezzlement is the fraudulent appropriation of funds or property by a person entrusted with its care, typically within an organizational or employment context. Both crimes undermine trust and involve deception, but forgery centers on false documentation, while embezzlement revolves around the misappropriation of assets.

Defining Forgery: Meaning and Examples

Forgery involves the deliberate creation or alteration of documents, signatures, or financial instruments with the intent to deceive or defraud. Common examples include falsifying checks, forging signatures on contracts, and producing counterfeit identification cards. This criminal act undermines trust in legal and financial systems by presenting fabricated evidence as genuine.

What is Embezzlement? Key Characteristics

Embezzlement is the fraudulent appropriation of funds or property entrusted to an individual's care, typically occurring within a professional or fiduciary relationship. Key characteristics include the lawful possession of assets initially, followed by their unauthorized conversion for personal use, distinguishing it from outright theft. This crime often involves employees or officials exploiting their access to financial resources, emphasizing breach of trust and intent to defraud.

Legal Framework: Laws Governing Forgery

Forgery is governed by strict statutory laws that criminalize the creation, alteration, or use of false documents with intent to deceive or defraud, often outlined in criminal codes such as the Uniform Commercial Code or specific state laws. Penalties for forgery typically include fines, imprisonment, and restitution, reflecting the severity of undermining legal and financial trust. Legal frameworks emphasize proof of intent, material falsity, and unauthorized use, distinguishing forgery from other offenses like embezzlement which involve misappropriation of funds rather than document fraud.

Legal Framework: Laws Governing Embezzlement

Embezzlement is primarily governed by statutes such as the Theft Act and specific financial fraud laws, which define it as the fraudulent appropriation of property by a person entrusted with its possession. Unlike forgery, which involves the creation or alteration of documents to deceive, embezzlement laws focus on breach of fiduciary duties and the misuse of assets. Penalties for embezzlement often include restitution, fines, and imprisonment, reflecting the seriousness of violating trust within legal and financial frameworks.

Major Differences Between Forgery and Embezzlement

Forgery involves creating, altering, or falsifying documents or signatures to deceive, while embezzlement refers to the misappropriation or theft of funds or property entrusted to one's care. The key difference lies in forgery being a crime against authenticity and trust in documentation, whereas embezzlement is a financial crime centered on unlawfully converting assets for personal gain. Legal consequences for forgery often focus on fraud prevention, whereas embezzlement charges pertain more directly to theft and breach of fiduciary duty.

Common Methods and Techniques Used

Forgery commonly involves creating fake documents, altering signatures, and fabricating financial records to deceive and misrepresent ownership or authenticity. Embezzlement techniques frequently include manipulating accounting entries, creating false invoices, and diverting funds through unauthorized transfers or expense reimbursements. Both crimes exploit weaknesses in internal controls and rely on concealment strategies to evade detection.

Real-World Case Studies

Forgery and embezzlement cases often reveal distinct patterns in financial crimes, with forgery involving the illicit alteration of documents to deceive, while embezzlement centers on the misappropriation of funds by trusted individuals. The Enron scandal exemplifies embezzlement through executives manipulating financial reports for personal gain, whereas the case of the forged art sales by Knoedler Gallery demonstrates the complexities of forgery in the art market. These real-world cases illustrate the diverse methods and legal challenges in prosecuting forgery versus embezzlement.

Penalties and Consequences

Forgery typically carries penalties including fines, restitution, and imprisonment ranging from one to ten years depending on the severity and jurisdiction. Embezzlement penalties vary based on the amount stolen, with felony charges resulting in lengthy prison terms, often exceeding five years, alongside mandatory restitution and loss of professional licenses. Both crimes result in long-term consequences like damaged reputation, difficulty securing employment, and potential civil lawsuits for financial recovery.

Preventive Measures and Best Practices

Implement robust internal controls, such as segregation of duties and regular financial audits, to prevent forgery and embezzlement. Utilize advanced technology solutions like secure digital signatures and real-time transaction monitoring to detect unauthorized activities early. Employee training on ethical practices and establishing clear reporting channels further strengthen organizational defenses against financial fraud.

Forgery Infographic

libterm.com

libterm.com