Indemnity expense refers to the costs incurred by an insurer when compensating a claimant for covered losses or damages under an insurance policy. This expense directly impacts an insurer's financial performance and is a critical factor in assessing policy profitability and risk management strategies. Dive deeper into this article to understand how indemnity expenses affect your insurance coverage and premiums.

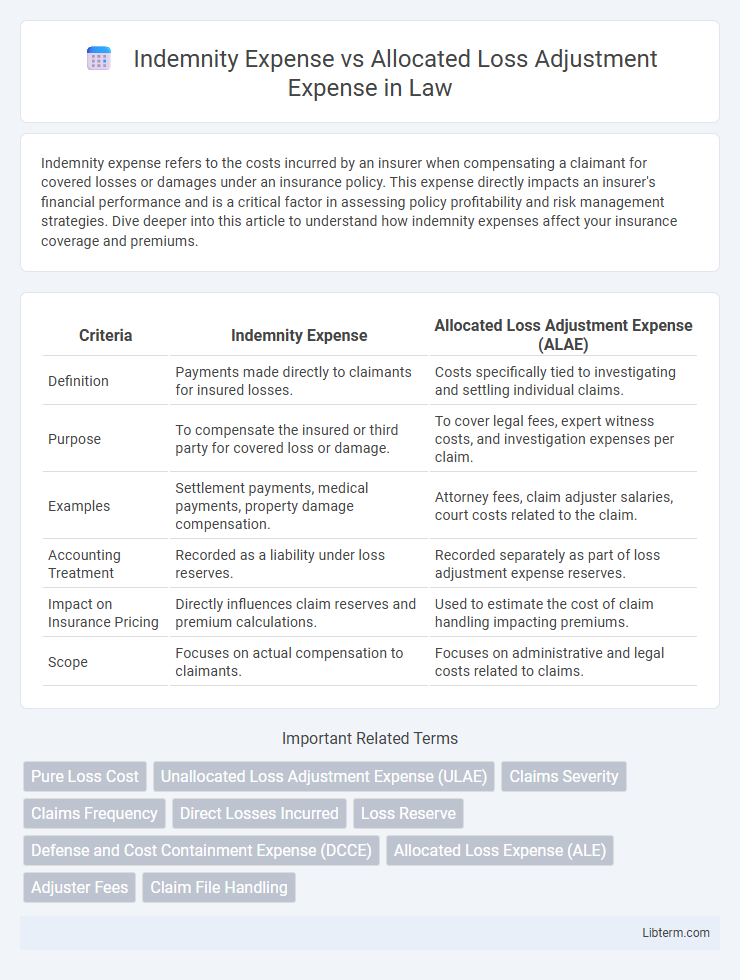

Table of Comparison

| Criteria | Indemnity Expense | Allocated Loss Adjustment Expense (ALAE) |

|---|---|---|

| Definition | Payments made directly to claimants for insured losses. | Costs specifically tied to investigating and settling individual claims. |

| Purpose | To compensate the insured or third party for covered loss or damage. | To cover legal fees, expert witness costs, and investigation expenses per claim. |

| Examples | Settlement payments, medical payments, property damage compensation. | Attorney fees, claim adjuster salaries, court costs related to the claim. |

| Accounting Treatment | Recorded as a liability under loss reserves. | Recorded separately as part of loss adjustment expense reserves. |

| Impact on Insurance Pricing | Directly influences claim reserves and premium calculations. | Used to estimate the cost of claim handling impacting premiums. |

| Scope | Focuses on actual compensation to claimants. | Focuses on administrative and legal costs related to claims. |

Introduction to Indemnity Expense and Allocated Loss Adjustment Expense

Indemnity Expense refers to the payments made by an insurance company to policyholders or beneficiaries as compensation for covered losses under an insurance policy. Allocated Loss Adjustment Expense (ALAE) represents the costs directly associated with investigating, defending, and settling specific claims, such as legal fees and expert witness costs. Understanding the distinction between indemnity expenses and ALAE is crucial for accurate insurance claim accounting and financial reporting.

Defining Indemnity Expense

Indemnity Expense refers to the payments made by an insurer to claimants or policyholders to cover losses or damages resulting from insured events, excluding any legal or administrative costs. These expenses represent the core compensation directly related to claims settlements, such as medical bills, property repairs, or personal injury compensation. Unlike Allocated Loss Adjustment Expense, which covers expenses tied to specific claims handling and investigation, Indemnity Expense strictly accounts for the monetary value disbursed to settle the insured losses.

What is Allocated Loss Adjustment Expense (ALAE)?

Allocated Loss Adjustment Expense (ALAE) refers to specific costs directly associated with investigating, defending, and settling individual insurance claims, such as legal fees and expert witness expenses. These expenses are distinct from Indemnity Expenses, which cover the actual compensation paid to policyholders for losses. Properly distinguishing ALAE helps insurers accurately allocate claim-related costs and manage loss reserves.

Key Differences Between Indemnity Expense and ALAE

Indemnity Expense refers to the payments made directly to claimants as compensation for covered losses, while Allocated Loss Adjustment Expense (ALAE) comprises costs specifically attributed to adjusting and investigating individual claims, such as legal fees and expert witness costs. Indemnity expenses fluctuate based on the severity and frequency of claims, whereas ALAE varies according to the complexity and handling requirements of each claim. Understanding the distinction between these expenses is crucial for accurate loss reserving and claims management in insurance accounting.

Importance of Accurately Categorizing Claims Costs

Accurately categorizing claims costs between Indemnity Expense and Allocated Loss Adjustment Expense (ALAE) is critical for precise insurance financial reporting and risk management. Indemnity Expense covers direct claim payments to policyholders, while ALAE includes costs related to claim adjustment processes such as legal fees and investigation expenses. Proper allocation ensures accurate reserve setting, premium calculation, and compliance with regulatory requirements, thereby safeguarding insurer solvency and profitability.

Impact on Insurance Premiums and Reserves

Indemnity expense represents the direct payments made to policyholders for covered losses, significantly influencing insurance premiums as higher indemnity claims typically lead to increased premium rates to cover anticipated payouts. Allocated Loss Adjustment Expense (ALAE) encompasses the costs directly associated with investigating and settling claims, such as legal fees and adjuster costs, which also impact premiums by adding to the insurer's overall claim handling expenses. Both indemnity expense and ALAE affect reserves differently: reserves for indemnity expense are set aside for expected claim payments, while ALAE reserves cover future administrative costs, thus shaping the insurer's financial stability and pricing strategies.

Examples of Indemnity Expenses vs ALAE

Indemnity expenses primarily cover direct payments to claimants, such as medical bills, property damage repairs, and settlement amounts, while Allocated Loss Adjustment Expenses (ALAE) include costs tied to claim handling like attorney fees, expert witness charges, and investigation costs. For example, indemnity expenses arise when an insurance company pays a policyholder's hospital bills after a car accident, whereas ALAE occurs when the insurer hires a private investigator to verify the claim's legitimacy. Understanding these distinctions helps insurers accurately allocate resources and maintain effective reserve calculations.

Reporting and Regulatory Considerations

Indemnity Expense involves payments made directly to claimants for covered losses, while Allocated Loss Adjustment Expense (ALAE) covers costs specifically related to claims adjustment, such as legal and investigation fees. Accurate reporting of Indemnity and ALAE expenses is critical for compliance with regulatory requirements, impacting reserve adequacy and financial statement transparency. Regulators emphasize detailed documentation and classification to ensure insurers maintain sufficient reserves and reflect true claim liabilities.

Best Practices for Managing Loss Expenses

Indemnity Expense represents the payments made directly to claimants for covered losses, while Allocated Loss Adjustment Expense (ALAE) includes costs specifically tied to investigating and settling those claims, such as legal fees and expert witness costs. Best practices for managing these loss expenses involve meticulous claim evaluation to ensure accurate indemnity reserves and rigorous monitoring of ALAE to prevent excessive spending on claim adjustments. Implementing data analytics to track trends in both indemnity and ALAE supports refined risk assessment and cost containment strategies in insurance operations.

Conclusion: Optimizing Claims Management Strategies

Indemnity Expense represents payments made directly to claimants for covered losses, while Allocated Loss Adjustment Expense (ALAE) covers costs specifically tied to investigating and settling claims, such as legal fees and expert evaluations. Effective claims management strategies prioritize precise differentiation between these expenses to allocate resources efficiently and improve financial forecasting. Optimizing claims processes by leveraging data analytics and automated workflows enhances accuracy in managing indemnity and ALAE, ultimately reducing overall claim cycle time and cost.

Indemnity Expense Infographic

libterm.com

libterm.com