An irrevocable trust offers a powerful estate planning tool designed to protect assets from creditors and reduce estate taxes by permanently transferring ownership out of Your control. Once established, the terms cannot be easily modified or revoked, ensuring your assets are managed according to your specific wishes. Discover more about how an irrevocable trust can safeguard your legacy by reading the full article.

Table of Comparison

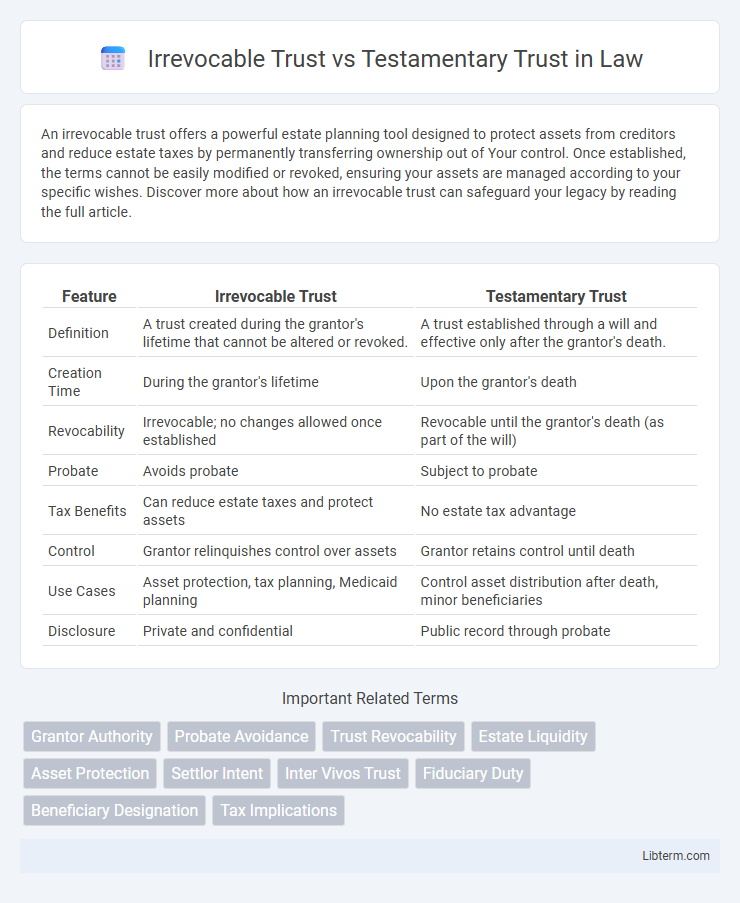

| Feature | Irrevocable Trust | Testamentary Trust |

|---|---|---|

| Definition | A trust created during the grantor's lifetime that cannot be altered or revoked. | A trust established through a will and effective only after the grantor's death. |

| Creation Time | During the grantor's lifetime | Upon the grantor's death |

| Revocability | Irrevocable; no changes allowed once established | Revocable until the grantor's death (as part of the will) |

| Probate | Avoids probate | Subject to probate |

| Tax Benefits | Can reduce estate taxes and protect assets | No estate tax advantage |

| Control | Grantor relinquishes control over assets | Grantor retains control until death |

| Use Cases | Asset protection, tax planning, Medicaid planning | Control asset distribution after death, minor beneficiaries |

| Disclosure | Private and confidential | Public record through probate |

Introduction to Trusts

Irrevocable trusts transfer asset ownership permanently to the trust, providing strong asset protection and tax advantages, whereas testamentary trusts are established through a will and take effect only after the grantor's death. Both trust types offer distinct benefits in estate planning, allowing for control over asset distribution and minimizing probate costs. Understanding the key differences in their creation and operation is essential for effective wealth management and legacy planning.

What is an Irrevocable Trust?

An irrevocable trust is a legal arrangement where the grantor permanently transfers assets into the trust, relinquishing control and ownership rights. This trust type offers significant benefits like asset protection, tax advantages, and avoidance of probate, making it a strategic estate planning tool. Unlike testamentary trusts, which are created through a will and activated after death, irrevocable trusts take effect immediately and cannot be modified or revoked without the beneficiary's consent.

What is a Testamentary Trust?

A testamentary trust is a legal arrangement created through a will that takes effect only after the testator's death, providing controlled distribution of assets to beneficiaries. Unlike irrevocable trusts established during a lifetime, testamentary trusts are used to manage estate assets, protect minors or incapacitated heirs, and potentially reduce estate taxes. This type of trust offers flexibility in managing the deceased's estate while ensuring that the deceased's directives are upheld according to probate court supervision.

Key Differences Between Irrevocable and Testamentary Trusts

Irrevocable trusts are established during the grantor's lifetime and cannot be altered or revoked once created, providing asset protection and potential tax benefits, while testamentary trusts are created through a will and come into effect only after the grantor's death, offering controlled asset distribution to beneficiaries. Irrevocable trusts offer immediate management and protection of assets, whereas testamentary trusts function as part of the probate process and may have limited privacy. The key difference lies in timing and flexibility: irrevocable trusts operate during the grantor's life with ongoing control limitations, whereas testamentary trusts are dependent on probate court administration postmortem.

Advantages of Irrevocable Trusts

Irrevocable trusts offer significant asset protection by removing ownership from the grantor, thereby shielding assets from creditors and lawsuits. They provide potential estate tax benefits by excluding transferred assets from the grantor's taxable estate. Moreover, irrevocable trusts can ensure more control over asset distribution, allowing for tailored management and protection of beneficiaries' interests over time.

Benefits of Testamentary Trusts

Testamentary trusts offer significant benefits such as providing control over asset distribution after death, ensuring beneficiaries receive inheritances according to specific terms set forth in a will. They provide protection for minor children or beneficiaries with special needs by managing assets prudently until certain conditions, such as age or milestones, are met. Testamentary trusts can also offer potential tax advantages by spreading income among beneficiaries and minimizing estate taxes.

Tax Implications: Irrevocable vs Testamentary Trusts

Irrevocable trusts offer significant tax advantages by removing assets from the grantor's estate, potentially reducing estate taxes and allowing for greater control over income tax liabilities during the grantor's lifetime. Testamentary trusts, established through a will after death, typically do not provide immediate tax benefits as the assets remain part of the taxable estate until transferred. Understanding the differences in income tax treatment and estate tax exposure is crucial for effective estate planning and minimizing overall tax obligations.

Asset Protection Considerations

Irrevocable trusts offer stronger asset protection by removing assets from the grantor's estate, shielding them from creditors and legal claims, while testamentary trusts become effective only after death and provide limited protection during the grantor's lifetime. Irrevocable trusts ensure greater privacy and control over asset distribution, preventing beneficiaries' creditors from accessing the assets. Testamentary trusts primarily serve estate planning purposes with less emphasis on shielding assets from lawsuits or creditors before probate.

Choosing the Right Trust for Your Estate Plan

Choosing the right trust for your estate plan depends on your specific goals and asset protection needs; irrevocable trusts offer strong asset protection and tax benefits by transferring control and ownership outside your estate. Testamentary trusts are created through a will and become effective only after death, providing flexibility and control over asset distribution but lacking the immediate protection of irrevocable trusts. Understanding the differences in timing, tax implications, and control is essential for tailoring an estate plan that aligns with your financial objectives and family needs.

Conclusion: Which Trust is Best for You?

Choosing between an irrevocable trust and a testamentary trust depends on your specific financial goals, asset protection needs, and estate planning timeline. Irrevocable trusts offer stronger asset protection and potential tax benefits during your lifetime, while testamentary trusts provide control and flexibility after death through a will. Consulting with an estate planning attorney ensures the selected trust aligns with your long-term intentions and legal requirements.

Irrevocable Trust Infographic

libterm.com

libterm.com