Permanent alimony provides long-term financial support to a spouse following divorce, ensuring stability when one partner cannot sustain themselves independently. Courts assess factors like the length of the marriage, income disparity, and each party's financial needs before awarding permanent alimony. Discover how permanent alimony could impact your financial future by reading the full article.

Table of Comparison

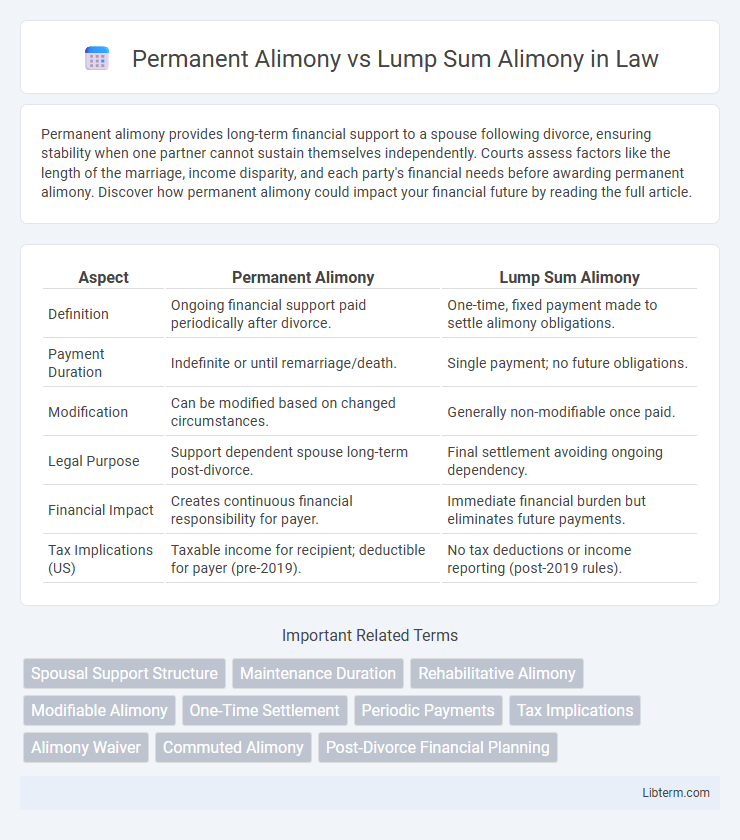

| Aspect | Permanent Alimony | Lump Sum Alimony |

|---|---|---|

| Definition | Ongoing financial support paid periodically after divorce. | One-time, fixed payment made to settle alimony obligations. |

| Payment Duration | Indefinite or until remarriage/death. | Single payment; no future obligations. |

| Modification | Can be modified based on changed circumstances. | Generally non-modifiable once paid. |

| Legal Purpose | Support dependent spouse long-term post-divorce. | Final settlement avoiding ongoing dependency. |

| Financial Impact | Creates continuous financial responsibility for payer. | Immediate financial burden but eliminates future payments. |

| Tax Implications (US) | Taxable income for recipient; deductible for payer (pre-2019). | No tax deductions or income reporting (post-2019 rules). |

Understanding Permanent Alimony

Permanent alimony is a court-ordered financial support that continues indefinitely, typically awarded when one spouse lacks the means to become self-sufficient after divorce. This type of alimony considers factors such as the duration of the marriage, age, health, and earning capacity of both parties. Understanding permanent alimony helps ensure long-term financial stability for the recipient spouse while balancing fairness in spousal support obligations.

What Is Lump Sum Alimony?

Lump sum alimony is a fixed amount of money paid by one spouse to the other either as a one-time payment or in installments over a specified period. This type of alimony is non-modifiable and final, providing financial certainty without ongoing obligations. Unlike permanent alimony, which involves regular payments indefinitely or until a triggering event, lump sum alimony settles the obligation through a clear, predetermined sum.

Key Differences Between Permanent and Lump Sum Alimony

Permanent alimony provides ongoing financial support until the recipient remarries or either party passes away, ensuring long-term stability, while lump sum alimony is a one-time, fixed payment that does not change or require modifications. Unlike permanent alimony, lump sum alimony is non-modifiable and typically suits cases where both parties prefer a clean break or when the paying spouse has fluctuating income. Key differences include the form of payment, duration, and potential for modification, impacting the financial planning and legal obligations of both spouses.

Factors Courts Consider When Awarding Alimony

Courts consider factors such as the length of the marriage, each spouse's financial needs and earning capacity, and contributions to the household when determining between permanent alimony and lump sum alimony. The recipient's age, health, and ability to become self-supporting weigh heavily in awarding permanent alimony. Lump sum alimony is often favored when a clear, finite payment can satisfy financial obligations or the parties prefer finality in the settlement.

Pros and Cons of Permanent Alimony

Permanent alimony provides ongoing financial support, ensuring the recipient's lifestyle is maintained after divorce, which offers long-term stability but may create dependency. The continuous payments can be adjusted with changes in circumstances, though they require long-term commitment from the payer and may lead to financial strain. Unlike lump sum alimony, permanent alimony lacks finality, leaving open-ended obligations that may be difficult to modify.

Pros and Cons of Lump Sum Alimony

Lump sum alimony offers the advantage of a fixed, one-time payment that provides immediate financial certainty and eliminates future obligations, reducing the risk of missed or delayed payments. However, it lacks flexibility as changes in financial circumstances after the agreement are not accommodated, potentially causing hardship for either party. This type of alimony also requires accurate valuation and negotiation to ensure fairness, which can be complex and contentious during divorce settlements.

Tax Implications of Each Alimony Type

Permanent alimony payments are generally tax-deductible for the payer and considered taxable income for the recipient under current IRS rules, impacting annual tax liabilities. Lump sum alimony, treated as a property settlement, is neither tax-deductible by the payer nor taxable to the recipient, providing clarity in tax reporting but lacking annual tax benefits. Understanding these distinctions helps both parties optimize their financial and tax planning during divorce settlements.

Impact on Future Relationships and Remarriage

Permanent alimony provides ongoing financial support until death or remarriage, potentially discouraging recipients from pursuing new relationships due to the risk of losing payments. Lump sum alimony offers a one-time payment, allowing recipients to manage finances independently and reducing financial entanglements in future partnerships. Courts often consider the impact of remarriage on alimony obligations, with lump sum arrangements providing clearer resolution compared to indefinite permanent payments.

Choosing the Right Alimony Structure

Choosing the right alimony structure depends on factors like the length of marriage, financial stability, and housing arrangements. Permanent alimony provides ongoing financial support, suitable for long-term marriages where one spouse lacks sufficient income. Lump sum alimony offers a one-time payment, ideal for couples seeking finality and those with shared assets or property settlements.

Legal Advice for Alimony Decisions

Permanent alimony provides ongoing financial support to a spouse following divorce, typically based on factors like the length of the marriage, income disparity, and the recipient's needs. Lump sum alimony involves a one-time payment meant to settle all future financial obligations, offering finality and avoiding prolonged court involvement. Seeking legal advice ensures that alimony decisions account for individual circumstances, enforceability issues, and tax implications tailored to both parties' financial stability.

Permanent Alimony Infographic

libterm.com

libterm.com