A beneficiary is an individual or entity designated to receive benefits, assets, or funds from a will, trust, insurance policy, or retirement plan. Understanding the rights and responsibilities of a beneficiary helps you manage inheritance and financial planning effectively. Explore the rest of the article to learn how to protect your interests and ensure a smooth transfer of your assets.

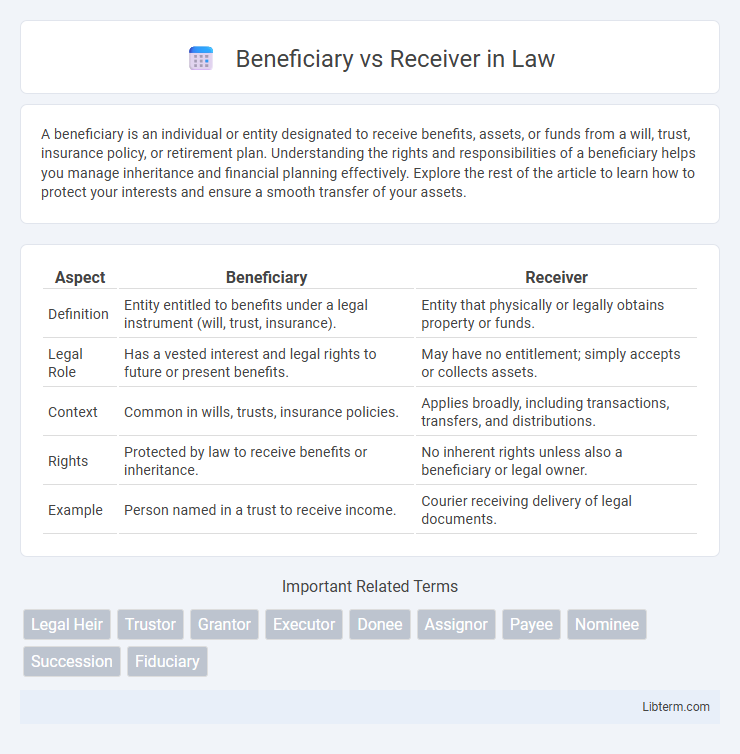

Table of Comparison

| Aspect | Beneficiary | Receiver |

|---|---|---|

| Definition | Entity entitled to benefits under a legal instrument (will, trust, insurance). | Entity that physically or legally obtains property or funds. |

| Legal Role | Has a vested interest and legal rights to future or present benefits. | May have no entitlement; simply accepts or collects assets. |

| Context | Common in wills, trusts, insurance policies. | Applies broadly, including transactions, transfers, and distributions. |

| Rights | Protected by law to receive benefits or inheritance. | No inherent rights unless also a beneficiary or legal owner. |

| Example | Person named in a trust to receive income. | Courier receiving delivery of legal documents. |

Understanding the Terms: Beneficiary vs Receiver

A beneficiary is an individual or entity legally entitled to receive benefits from a financial instrument, trust, or will, often designated by the grantor or testator. A receiver, however, is typically appointed by a court or organization to manage or collect assets, funds, or property during legal proceedings or financial restructuring. Understanding the distinction clarifies rights and responsibilities in estate planning, insurance claims, and legal contexts.

Definition of Beneficiary

A beneficiary is an individual or entity designated to receive benefits, assets, or proceeds from a will, trust, insurance policy, or retirement plan. This role implies a legal or financial entitlement to the specified benefits under the terms of the governing document or contract. Understanding the distinction between beneficiary and receiver is crucial, as a receiver typically refers to someone who physically accepts goods or payments but may not have legal entitlement to them.

Definition of Receiver

A receiver is an individual or entity appointed to take possession of assets, property, or funds, often during legal proceedings or financial restructuring. Unlike a beneficiary who is designated to inherit or benefit from an asset under a will or trust, a receiver holds temporary control to manage, protect, and distribute the assets according to court orders or contractual agreements. This role ensures proper administration and safeguards interests during disputes, insolvency, or foreclosure cases.

Key Differences Between Beneficiary and Receiver

A beneficiary is the individual or entity entitled to receive benefits, assets, or payments from a trust, insurance policy, will, or contract, whereas a receiver is appointed by the court or authority to manage or liquidate assets during legal proceedings. Beneficiaries have a right to the property or funds as designated, while receivers act as fiduciaries responsible for preserving or distributing those assets impartially. The key difference lies in beneficiaries being the end recipients of benefits, whereas receivers serve as temporary overseers without ownership rights.

Legal Contexts: Beneficiary vs Receiver

In legal contexts, a beneficiary is a person or entity entitled to receive benefits, assets, or property from a trust, will, or insurance policy. A receiver, however, is a court-appointed individual responsible for managing or preserving property involved in litigation or insolvency proceedings. The beneficiary holds a right to the asset, while the receiver acts as a custodian enforcing or protecting those rights during legal disputes.

Financial Implications for Beneficiaries and Receivers

Beneficiaries often have legal rights to assets or funds specified in wills, trusts, or insurance policies, impacting inheritance tax liabilities and estate planning strategies. Receivers, appointed to manage or settle an entity's debts, may collect funds under court supervision but do not hold ownership rights, affecting creditors' claims and financial recoveries. Understanding the distinctions influences tax obligations, entitlement to funds, and the handling of financial assets in legal contexts.

Common Scenarios Involving Beneficiaries

Beneficiaries commonly appear in insurance policies, wills, trusts, and retirement accounts, where they are designated to receive assets or benefits upon the occurrence of specific events such as death or contract maturity. In retirement accounts like IRAs and 401(k)s, beneficiaries are named to inherit the funds, which may offer tax advantages not available to regular receivers. Unlike receivers who may simply receive payments or distributions, beneficiaries typically have legal rights tied to contingency plans and estate regulations.

Situations Where a Receiver is Appointed

A receiver is appointed in situations involving insolvency, bankruptcy, or court orders to manage or protect assets during legal or financial distress. Unlike a beneficiary, who is designated to receive benefits or assets under a will, trust, or insurance policy, a receiver acts as a neutral third party responsible for preserving property value and ensuring equitable distribution. This appointment typically occurs in creditor-debtor disputes, foreclosure proceedings, or business restructuring scenarios.

Rights and Responsibilities: Beneficiary vs Receiver

A beneficiary holds legal rights to benefits or assets outlined in a contract or will, often entitling them to ongoing obligations like fiduciary duties and asset management responsibilities. A receiver, appointed by a court or authority, has a duty to manage, protect, and distribute assets during legal proceedings but holds no inherent right to the assets themselves. Beneficiaries possess inheritance or payout entitlements, while receivers function as temporary custodians responsible for safeguarding interests without beneficiary ownership rights.

Choosing Between Beneficiary and Receiver in Legal Documents

Choosing between a beneficiary and a receiver in legal documents depends on the nature of the asset transfer and legal context. Beneficiaries are designated individuals or entities entitled to receive benefits from wills, trusts, or insurance policies, directly owning the asset or interest. Receivers are court-appointed or contract-specified agents responsible for managing, safeguarding, or distributing assets temporarily during legal proceedings or disputes.

Beneficiary Infographic

libterm.com

libterm.com