A guarantee ensures your purchase is protected against defects or unsatisfactory performance, offering peace of mind and confidence in the product. It often outlines specific terms and conditions, including duration and coverage scope, to clarify your rights and remedies. Explore the article to discover how guarantees can safeguard your investment and what to look for in a reliable guarantee.

Table of Comparison

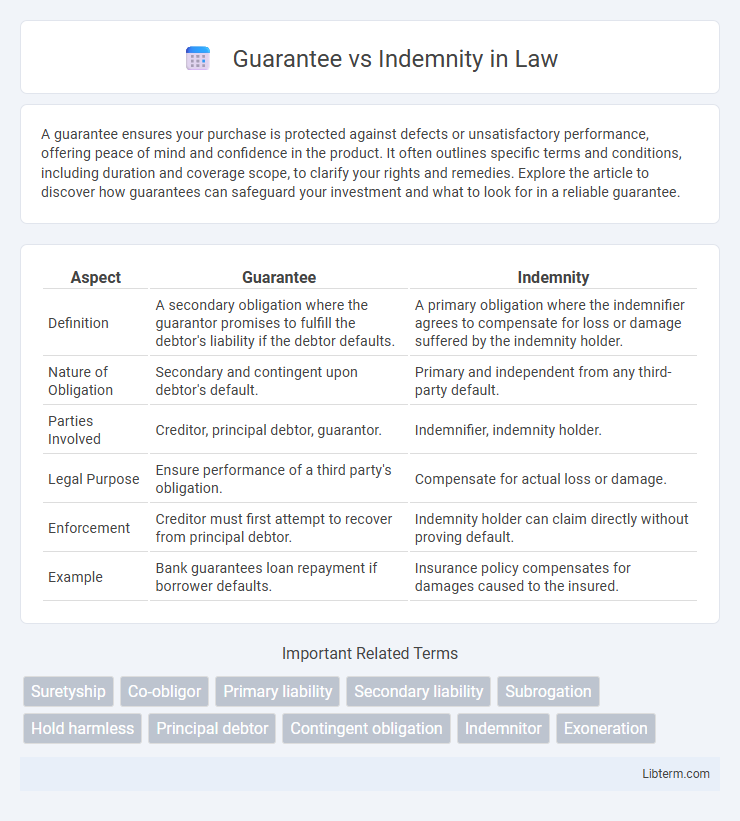

| Aspect | Guarantee | Indemnity |

|---|---|---|

| Definition | A secondary obligation where the guarantor promises to fulfill the debtor's liability if the debtor defaults. | A primary obligation where the indemnifier agrees to compensate for loss or damage suffered by the indemnity holder. |

| Nature of Obligation | Secondary and contingent upon debtor's default. | Primary and independent from any third-party default. |

| Parties Involved | Creditor, principal debtor, guarantor. | Indemnifier, indemnity holder. |

| Legal Purpose | Ensure performance of a third party's obligation. | Compensate for actual loss or damage. |

| Enforcement | Creditor must first attempt to recover from principal debtor. | Indemnity holder can claim directly without proving default. |

| Example | Bank guarantees loan repayment if borrower defaults. | Insurance policy compensates for damages caused to the insured. |

Understanding the Basics: Guarantee vs Indemnity

A guarantee involves one party promising to pay a debt or perform an obligation if the primary party fails, creating a secondary liability, whereas an indemnity is a primary obligation where one party agrees to compensate the other for specific losses or damages incurred. In legal contexts, the guarantee requires enforcement only after the principal debt is proven in default, while indemnity allows direct claim for losses without proving default by a third party. Understanding this distinction is crucial for contract drafting, risk management, and determining claims processes in financial and commercial agreements.

Key Definitions: What is a Guarantee?

A guarantee is a legally binding commitment where one party, the guarantor, agrees to fulfill the obligations or debts of another party, the principal debtor, if they default. It serves as a secondary liability, ensuring the creditor recovers funds or performance when the primary party fails to meet contractual terms. Guarantees are commonly used in loan agreements, leases, and commercial contracts to reduce the creditor's financial risk.

Indemnity Explained: Legal Meaning and Usage

Indemnity refers to a legal obligation where one party agrees to compensate another for a loss or damage incurred, ensuring financial protection against specified risks. It typically involves direct reimbursement for actual harm or liabilities, differentiating it from a guarantee, which is a secondary promise to fulfill another's obligation if they default. Indemnity clauses are commonly used in contracts to allocate risk and protect parties from potential claims, making them fundamental in commercial agreements and insurance policies.

Core Differences Between Guarantee and Indemnity

A guarantee involves a third party promising to fulfill a debtor's obligation if the primary party defaults, creating a secondary liability contingent on the principal debt. An indemnity entails a promise to compensate for any loss or damage incurred, establishing a primary liability that arises immediately upon loss. The core difference lies in the nature of liability: guarantee is conditional and secondary, while indemnity is absolute and primary.

Legal Obligations: How Guarantees and Indemnities Work

Guarantees and indemnities create distinct legal obligations where a guarantee involves a third party promising to fulfill a debtor's obligation if the debtor defaults, thus serving as secondary liability. An indemnity imposes a primary liability on the indemnifier to compensate for loss or damage regardless of the debtor's default, often covering broader risk scenarios. Enforcement of guarantees requires proving the debtor's default, while indemnities grant direct claim rights, affecting risk management and contractual risk allocation in commercial agreements.

Types of Guarantees and Indemnities

Types of guarantees include payment guarantees, performance guarantees, and financial guarantees, each ensuring obligations are met by a third party if the primary debtor defaults. Indemnities often take the form of contractual promises to compensate for specific losses or damages, such as loss of property, breach of contract, or fiduciary liability. Both guarantees and indemnities are essential risk management tools in commercial contracts, defining the scope and extent of financial responsibility.

Enforcement and Remedies in Guarantee vs Indemnity

Enforcement of a guarantee requires the creditor to first pursue the principal debtor before holding the guarantor liable, limiting immediate claims against the guarantor. In indemnity agreements, the indemnifier is directly liable to compensate the indemnitee upon loss, allowing for immediate enforcement without necessitating action against a third party. Remedies under guarantees typically involve contingent obligations triggered by default, whereas indemnities provide direct, primary, and unconditional rights to recover losses.

Rights and Liabilities of Parties Involved

Guarantee involves a secondary obligation where the guarantor agrees to fulfill the debtor's liability if the principal obligor defaults, limiting the guarantor's liability to the extent of the guaranteed obligation. Indemnity establishes a primary liability where the indemnifier promises to compensate the indemnity-holder for specific losses independently of any default by a third party. Rights and liabilities differ as the guarantor's responsibility is contingent and secondary, whereas the indemnifier has an immediate and independent duty to compensate upon loss.

Practical Applications in Business and Finance

Guarantee involves a third party promising to fulfill a debtor's obligation if they default, widely used in loan agreements to secure financing and reduce lender risk. Indemnity provides direct compensation for loss or damage, commonly applied in insurance contracts and risk management to allocate financial responsibility efficiently. Both instruments enhance trust in business transactions by mitigating potential financial exposure and ensuring continuity in commercial operations.

Choosing Between Guarantee and Indemnity: Key Considerations

Choosing between a guarantee and indemnity involves assessing the level of risk and the nature of the obligation. Guarantees provide secondary liability, activating only if the primary party defaults, while indemnities impose primary liability requiring compensation for loss regardless of fault. Evaluating factors such as enforceability, scope of liability, and the financial standing of the parties helps determine the most suitable legal instrument for risk management and contractual security.

Guarantee Infographic

libterm.com

libterm.com