Indemnity payment serves as financial compensation to cover losses or damages sustained by an individual or entity, ensuring protection against unforeseen risks. This payment plays a crucial role in insurance claims, contractual agreements, and legal settlements by restoring your financial position to what it was before the loss occurred. Discover more about how indemnity payments work and their importance in safeguarding your interests in the full article.

Table of Comparison

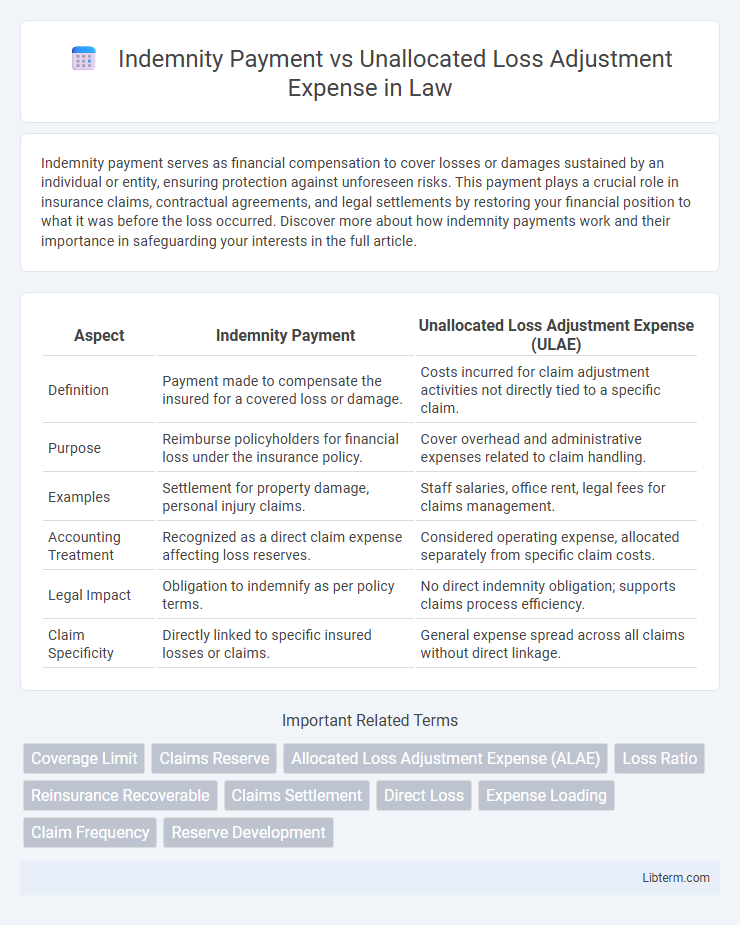

| Aspect | Indemnity Payment | Unallocated Loss Adjustment Expense (ULAE) |

|---|---|---|

| Definition | Payment made to compensate the insured for a covered loss or damage. | Costs incurred for claim adjustment activities not directly tied to a specific claim. |

| Purpose | Reimburse policyholders for financial loss under the insurance policy. | Cover overhead and administrative expenses related to claim handling. |

| Examples | Settlement for property damage, personal injury claims. | Staff salaries, office rent, legal fees for claims management. |

| Accounting Treatment | Recognized as a direct claim expense affecting loss reserves. | Considered operating expense, allocated separately from specific claim costs. |

| Legal Impact | Obligation to indemnify as per policy terms. | No direct indemnity obligation; supports claims process efficiency. |

| Claim Specificity | Directly linked to specific insured losses or claims. | General expense spread across all claims without direct linkage. |

Introduction to Indemnity Payments and ULAE

Indemnity payments refer to the compensation paid directly to policyholders to cover their covered losses following an insured event. Unallocated Loss Adjustment Expense (ULAE) represents the indirect costs incurred by insurers in the claims adjustment process, such as salaries and overhead, which are not tied to a specific claim. Understanding the distinction between indemnity payments and ULAE is crucial for accurate insurance cost assessment and reserve setting.

Defining Indemnity Payments

Indemnity payments refer to the amounts paid by an insurer to a claimant or policyholder to cover the financial loss or damage resulting from an insured event. These payments compensate for direct losses such as property damage, bodily injury, or other covered claims, reflecting the insurer's obligation under the policy terms. Indemnity payments differ from unallocated loss adjustment expenses, which represent the insurer's overhead costs related to claims processing rather than specific claim settlements.

Understanding Unallocated Loss Adjustment Expenses (ULAE)

Unallocated Loss Adjustment Expenses (ULAE) refer to the overhead costs insurance companies incur when managing claims, such as salaries of claims department staff, office expenses, and administrative fees. Unlike Indemnity Payments, which directly compensate claimants for covered losses, ULAE does not get assigned to a specific claim but is pooled across claims. Properly estimating ULAE is crucial for insurers to ensure adequate reserving and maintain financial stability while efficiently handling claim settlements.

Key Differences Between Indemnity Payment and ULAE

Indemnity Payment refers to the actual compensation paid to policyholders for covered losses, while Unallocated Loss Adjustment Expense (ULAE) represents the overhead costs incurred by insurers during the claims adjustment process that are not directly tied to a specific claim. Indemnity Payments impact claim reserves directly as they reflect the amount owed to settle claims, whereas ULAE affects expense reserves since they cover general claim handling expenses like salaries and administrative costs. The key difference lies in indemnity payments being claim-specific settlement amounts, while ULAE encompasses broader indirect expenses related to managing and processing multiple claims.

Role of Indemnity Payments in Insurance Claims

Indemnity payments represent the actual compensation paid to policyholders for covered losses, directly addressing the financial impact of insured events. Unlike unallocated loss adjustment expenses (ULAE), which cover the insurer's overhead costs for handling claims, indemnity payments serve as the core financial liability that insurers settle to restore claimants. The accurate calculation and timely disbursement of indemnity payments are crucial in maintaining policyholder trust and ensuring effective claims resolution within the insurance industry.

The Purpose of ULAE in Claims Management

Unallocated Loss Adjustment Expense (ULAE) covers the general costs of managing claims that cannot be directly assigned to a specific claim, such as salaries of claims personnel and overhead expenses. Indemnity payments, in contrast, compensate claimants for actual losses or damages incurred. ULAE plays a crucial role in claims management by ensuring that the operational expenses related to handling multiple claims are adequately accounted for, supporting efficient claims processing and organizational stability.

Accounting Treatment: Indemnity vs ULAE

Indemnity payments represent direct compensation to policyholders for insured losses and are recorded as claims expenses on the income statement, reducing retained earnings. Unallocated Loss Adjustment Expense (ULAE) covers indirect costs related to claims handling, such as legal and investigation fees, and is treated as an operating expense distinct from indemnity payments. Accounting standards require separate recognition and detailed allocation of ULAE to ensure accurate matching of claims costs and operational expenses within insurance financial statements.

Impact on Insurance Reserves and Financial Statements

Indemnity payments directly reduce insurance reserves by settling policyholder claims, impacting the insurer's loss reserves and overall financial liabilities. Unallocated Loss Adjustment Expenses (ULAE) represent the costs of claim handling not attributable to specific claims, indirectly affecting reserves through expense provisioning. Accurate differentiation between indemnity payments and ULAE is critical for precise financial statement reporting and regulatory compliance in insurance accounting.

Claims Process: When Indemnity and ULAE Apply

Indemnity payments represent the compensation directly paid to claimants for covered losses, while Unallocated Loss Adjustment Expense (ULAE) covers the insurer's internal costs related to managing and processing claims. During the claims process, indemnity payments are triggered once liability is established and damages are quantified, whereas ULAE applies continuously as claims are investigated, evaluated, and settled. Accurate separation of indemnity and ULAE is critical for insurers to correctly reserve funds and comply with financial reporting standards.

Importance for Insurers and Policyholders

Indemnity payments represent the direct compensation insurers provide to policyholders for covered losses, making them crucial for maintaining policyholder trust and financial security. Unallocated Loss Adjustment Expenses (ULAE) cover the insurer's overhead costs related to claims handling without being tied to specific claims, ensuring efficient claims management and operational sustainability. Understanding the distinction and impact of both elements helps insurers accurately price policies and maintain regulatory compliance, while policyholders benefit from clarity on claim settlements and service quality.

Indemnity Payment Infographic

libterm.com

libterm.com